-

The bullish price estimate for OMI is between $0.0062 and $0.0125.

-

The price of OMI may hit $0.02 this year.

-

The OMI negative market price forecast for 2022 is $0.00461.

The cryptocurrency market seems to be rapidly rebounding in recent days. After a negative run in the previous months, bulls have gradually increased in the past week. At the moment, it seems that the crypto-asset business will resume its upward trend.

Price is currently trading at the Central Pivot, price trading above P indicates that OMI uptrend may extend for some time because the final candlestick is above P.

The latter indicates that the current gain in ECOMI (OMI) value is unlikely to cease soon, as there may be stabilization and a resumption of the bullish trend which may lead us to break the previous all-time high and tap a high of 0.02 before the year ends.

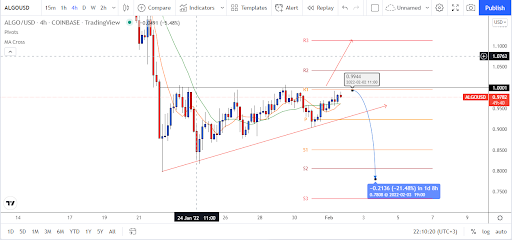

Source – TradingView

Source – TradingView

The Relative Strength Index (RSI) determines oversold or overbought equities by measuring the relative momentum in the size of recent price fluctuations. The RSI price of ECOMI (OMI) on the OMIUSDT one-day chart is 58.20.

Because it is over 50, the OMI is in a robust bullish movement. This value might spark another bullish run as additional purchasers seek to profit from the predicted price rise.

The long-term OMI price forecast for 2022

OMI is likely to trade around its current all-time high of $0.01338. Nevertheless, this will only transpire if many earlier psychological barriers are broken.

If the current upward pattern holds, ECOMI might be worth $0.02 by the conclusion of 2022. Furthermore, the first half of 2022 will see a modest increase of up to $0.0082. With planned collaborations and advances, achieving $0.03 is somewhat ambitious in terms of pricing, but it is undeniably doable in the foreseeable future.

The post Will the price of ECOMI (OMI) reach $0.02 in 2022? appeared first on Coin Journal.