Im besten Fall könnte für Bitcoin bei 25.000 US-Dollar Schluss sein, weshalb die Vorhersage für den Februar eher verhalten ausfällt.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Im besten Fall könnte für Bitcoin bei 25.000 US-Dollar Schluss sein, weshalb die Vorhersage für den Februar eher verhalten ausfällt.

Cryptocurrencies are looking to end January on a winning note, with most digital assets rocking huge gains in a month that saw Bitcoin break above $23,000.

On 31 July, the total crypto market capitalization was above $1 trillion, helped by Bitcoin’s market cap rising to $446 billion to account for a market dominance of 40.9%. A similar upside trend has been observed across altcoins, led by Ethereum’s breakout from lows of $1,200 at the beginning of the month.

Perhaps notable is the bullish sentiment for Syntropy that has been increasing since the team updated the token’s circulating supply schedule and as the platform edges closer to its public launch.

Less than a week until our important launch 👀

With the public network launch and revised @SyntropyStack website, we will reveal a completely new Syntropy Knowledge Hub designed for novice and experienced individuals to learn everything about #Syntropy and $NOIA in one place. pic.twitter.com/AfGS5jrfIP

— Syntropy (@Syntropynet) January 31, 2023

While tokens like Aptos and dYdX continue to outperform, crypto analyst Rekt Capital is pointing to one other coin that could benefit from the recent bull run.

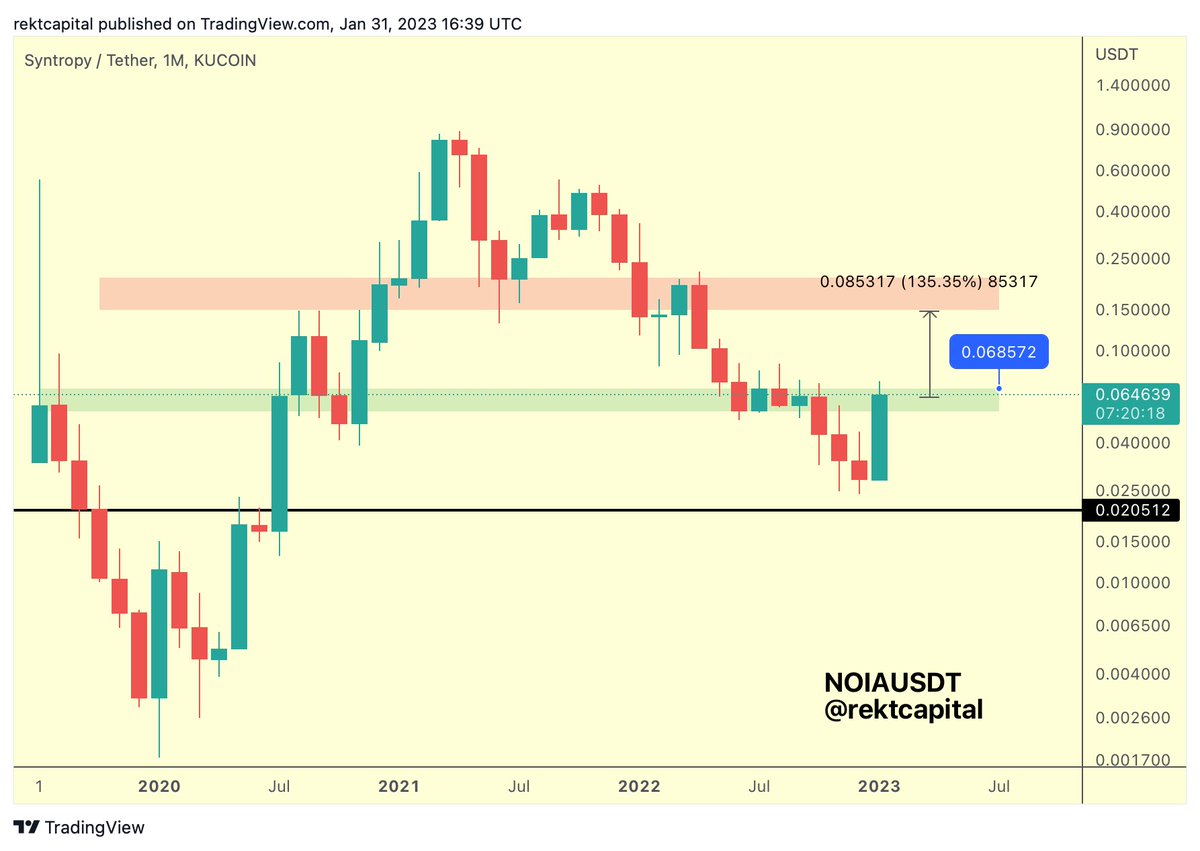

According to the crypto trader, Syntropy (NOIA) is likely to do a 2x if it holds a crucial price level on the monthly close. In a tweet early Tuesday, the highly respected analyst noted that NOIA’s 168% rally from its lows in December has the Syntropy token at a crucial area.

“NOIA enjoyed a +168% rally from December’s lows & is now approaching a crucial area. If NOIA is able to turn the green box top (~$0.068) into support on Monthly Close, Syntropy could be well-positioned for another 2x rally,” he suggested.

Syntropy (NOIA) price prediction chart. Source: Rekt Capital on Twitter.If bulls hold the highlighted price zone ($0.068), Rekt Capital sees a 135% or more rally towards $0.15. That could open up the NOIA price for a potential retest of its all-time high price near $0.20. However, a negative flip could see bears push for $0.030 or even target $0.020.

Syntropy (NOIA) price prediction chart. Source: Rekt Capital on Twitter.If bulls hold the highlighted price zone ($0.068), Rekt Capital sees a 135% or more rally towards $0.15. That could open up the NOIA price for a potential retest of its all-time high price near $0.20. However, a negative flip could see bears push for $0.030 or even target $0.020.

The Syntropy token was changing hands around $0.065 early afternoon on Tuesday, up 2.3% in the past 24 hours and 32% higher this past week.

The post Syntropy (NOIA) price: Analyst shares outlook after token gains 168% appeared first on CoinJournal.

Obwohl Tesla im Jahr 2022 durch Bitcoin-Verkäufe 64 Mio. US-Dollar einnehmen konnte, schlägt ein Wertminderungsaufwand von 204 Mio. US-Dollar zu Buche.

Core Scientific, a Bitcoin mining firm that filed for Chapter 11 bankruptcy orotection in December last year, says it’s agreed to a $70 million financing facility from B. Riley Commercial Capital, LLC.

Court documents the Bitcoin miner filed on Tuesday reveal that the crypto company seeks to use the loan facility from the investment bank to pay off an existing debtor-in-possession (DIP) facility.

The miner seeks an emergency relief from the bankruptcy court, which it says is needed no later than 11:30 am CET on Wednesday, 1 February, 2023. As noted in the filing, the crypto miner would be in default under the terms of the original DIP facility.

The Core Scientific team says if approved, the first part of the facility will be $35 million before the rest follow. Securing the new credit facility from B. Riley is key to the miner continuing its operations as it navigates its bankruptcy process.

The past year proved to be particularly brutal for crypto mining companies, with the crash in Bitcoin prices and surging energy costs combining to hurt business. Core Scientific was one of the largest miners to seek bankruptcy protection as Bitcoin price collapsed once more following crypto exchange FTX’s implosion.

At the time of its bankruptcy filing, Core Scientific revealed liabilities of $1 billion to $10 billion.

The post Core Scientific agrees $70 million loan from B. Riley appeared first on CoinJournal.

Ethereum Foundation developer Parithosh Jayanthi has confirmed via a Twitter post that the “Zhejiang” public testnet will be going live tomorrow (February 1, 15:00 UTC, 2023). The “Zhejiang” testnet will then be followed by the much-awaited Shanghai and Capella testnets.

Both the Shanghai and Capella testnets are scheduled to be triggered at epoch 1350.

Jayanthi was replying to another post by one, Barnabas Busa, who besides saying the testnet will go live tomorrow, said:

“Shanghai+Capella will be triggered 6 days later (at epoch 1350). You will be able to deposit validators, practice BLS change and exit without risk.”

In follow-up tweets, Jayanthi said:

“This is also a great opportunity for all tools to test out how they want to collect, display and use the withdrawal information. You can attempt to convert 0x00 credentials to 0x01 and set a withdrawal address. You can test partial withdrawals and full withdrawals by exiting your validator.”

The Shanghai and Capella upgrade testnets are expected to go live six days after the “Zhejiang” testnet, which will also feature all Ethereum Improvement Protocols (EIPs) like timestamp-based forking that will come with the Shanghai upgrade.

The Shanghai upgrade is designed to allow ETH users to withdraw their Ether tokens plus rewards. Ether holders have been able to stake ETH since the Merge upgrade that moved the Ethereum blockchain from a proof-of-work (PoW) to a Proof-of-Stake (PoS) blockchain. However, the staked funds remain locked, pending a new upgrade the Shanghai.

Ethereum Foundation is targeting March 2023 for the Shanghai upgrade. After the Shanghai upgrade, Ethereum developers will turn their eyes to the EIP-4844 upgrade which is scheduled for May or June this year.

The EIP-4844 upgrade aims at increasing the scalability of layer-2 rollups on Ethereum by more than 100 times and also lower transaction fees.

The post Ethereum to launch “Zhejiang” public withdrawal testnet on Feb. 1 appeared first on CoinJournal.