Key Takeaways

-

Within about a year, NFT games are now on the brink of overtaking PC games in popularity

-

Compared to conventional PC games, only 10 games are more popular than top NFT editions

-

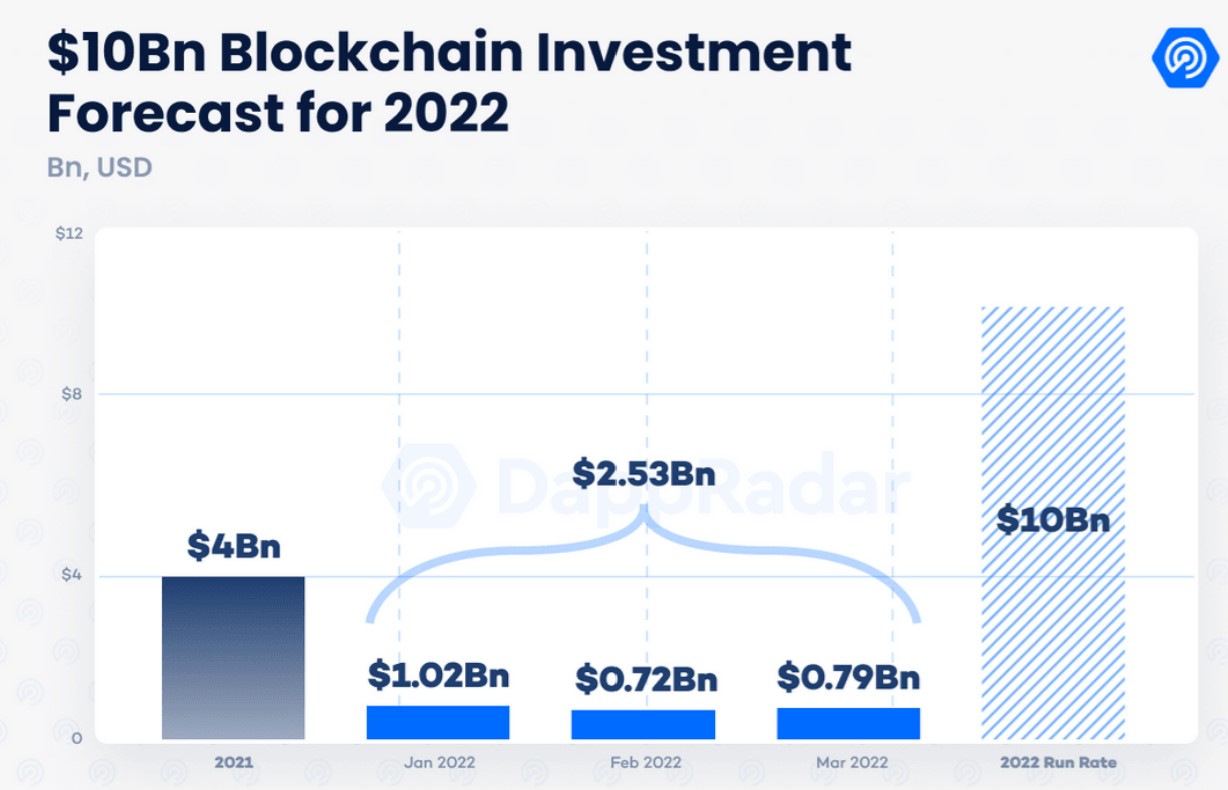

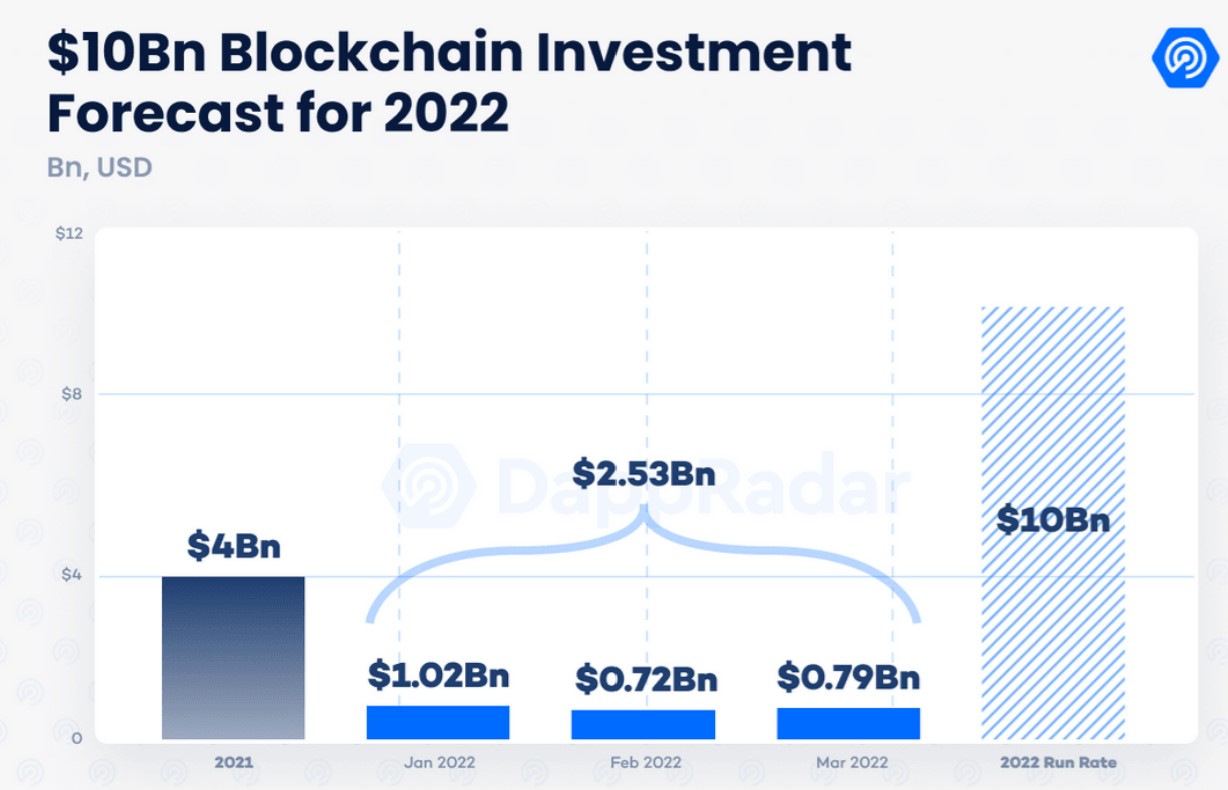

$2.5 billion raised by blockchain games in Q1 of 2022, on course for $10 billion this year compared to $4 billion for 2021

-

While prices of gaming tokens have been in freefall alongside wider market, user growth and investment has been stout

With NFTs crumbling as the market continues in full risk-off mode, I decided to dive into the statistics behind a sector I believe is one of the most intriguing use cases for this novel technology.

Sure, lots of NFTs are overpriced and can be attributed to bear market hysteria, but I have always felt that the marriage between gaming and NFTs is a natural one. Players pour so much time into playing certain games, as well as money into in-game additions, that defining ownership and maintaining a historical record on-chain seems to make sense.

So what do the numbers say about NFT gaming adoption compared to conventional gaming, and do they paint a more bullish picture than the freefalling token prices?

One year growth

In terms of active users, the growth in the last year has been meteoric for NFT games. A report from DappRadar calculated the growth in blockchain gaming as 2000% since Q1 of last year.

Also in Q1 of this year, $2.5 billion was raised for blockchain games and other metaverse projects. While this came before the ugly downturn of recent months, it’s still promising given $4 billion was raised in all of 2021, a period when the bull market was in full swing. That puts gaming and metaverse projects on course to raise $10 billion through 2022. So, even a hugely conservative 60% cut to funding would place it above 2021 levels.

NFT gaming users

The funding is stout, but so too are the users. A look at the below graph showing the top 10 NFT games confirms that the sector is starting to gain mainstream appeal and capture more and more unique users per month.

To put the above numbers in context, a neat current benchmark for NFT games is that of PC games. The below graph shows the top 10 most played PC games on the Steam platform. While the data for total users in a month is more challenging to obtain, the below graph presents the average number of concurrent players over the last 30 days (rather than total unique users per month as per the above graph).

Assuming that 5% of active players are online at any given time, the below graph then compares how NFT games stack up to the most popular PC games, with NFT games in blue and conventional PC games in orange.

This shows that while NFT games are yet to overtake PC games, it is extremely close to occurring. Only the top 10 PC games are capturing more users than the top NFT game, Alien Worlds, and the margin is very narrow, with Alien Worlds only about 1,000 users off.

Yet despite the bullish growth in numbers, these games are being brandished as fads due to the overall pullback in crypto markets. Additionally, the below graph for two of the biggest tokens – Alien Worlds and Axie Infinity – show that the freefall has been stark after explosive run-ups last year.

But in looking past the prices of such tokens (a large part of which would have been due to speculation) and instead digging into user growth and the investment being put into these platforms, the future still appears bright.

It’s a reminder that despite the bearish sentiment in the markets, there is very real technology here that is making a difference and disrupting industries. To be on the brink of the top 10 PC games already is quite the achievement, given the nascent nature of the space.

As for whether these tokens are good investments at current prices? Well, that’s an issue for another day.

Sources

https://dappradar.com/blog/dappradar-x-bga-games-report-q1-2022

https://www.statista.com/statistics/1266486/blockchain-games-user-number/

The post NFT games on brink of overtaking PC games in popularity appeared first on CoinJournal.

Source – TradingView

Source – TradingView

Source – TradingView

Source – TradingView