Looking for a good cryptocurrency exchange where you can invest in cryptocurrencies, especially in Europe, can be quite a challenge. There are many scams now claiming to offer crypto exchange platforms while in actual sense they are after stealing your hard-earned money.

We have done a comprehensive review of the Coinmate exchange to find out if it is legit or not. To find out more about Coinmate’s pros and cons and how it works, please continue reading.

How Coinmate works

Coinmate is a cryptocurrency exchange that was founded in 2014. It is registered in London and focuses its operations in Europe, especially Eastern Europe.

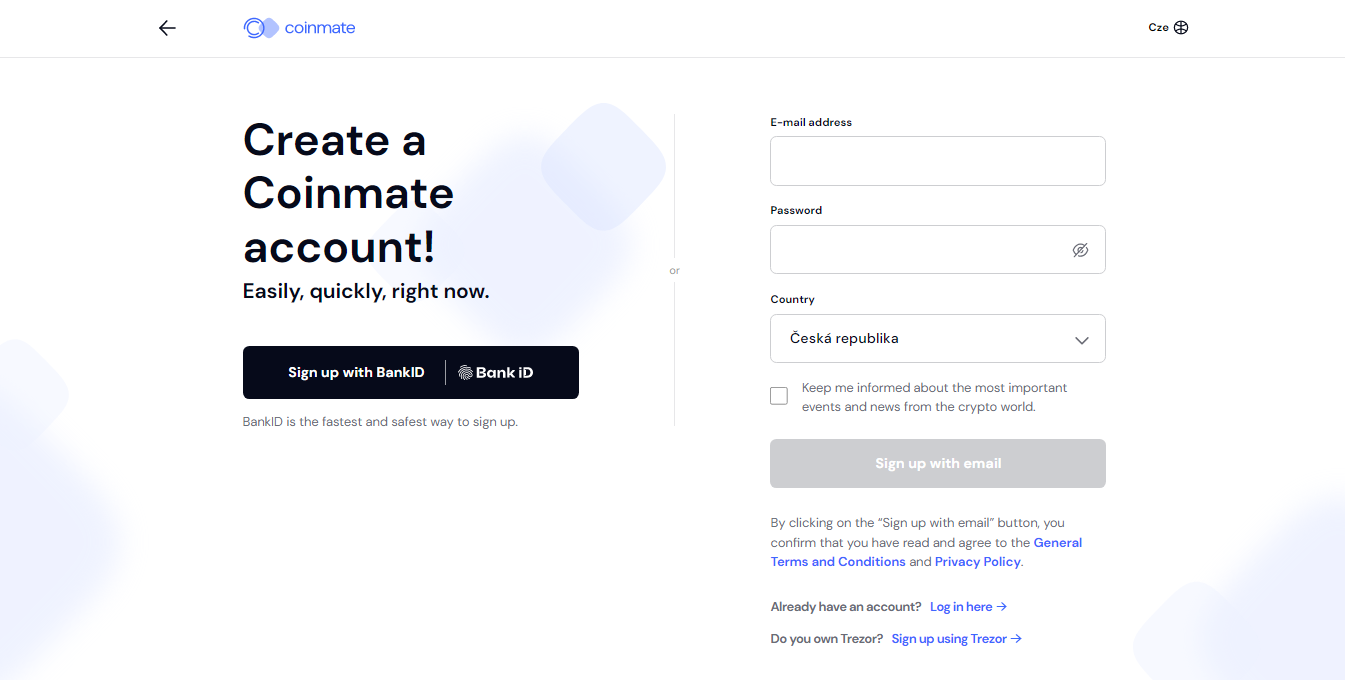

To start out, you have to first open an account with Coinmate. You can choose to use BankID which is the fastest and safest way to sign up or choose to manually input your personal details.

Once you have an account, you can choose between “Trade” and “Quick Buy” or “Quick Sell” options.

The “Trade’ option allows you to trade various cryptocurrencies. You can access an order book, and charting containing crypto prices, the history of their transactions and an area where you can create new orders.

On the other hand, the “Quick Buy” option allows you to make easy and quick purchases of various cryptocurrencies at their market price while the “Quick Sell” option allows you to make easily and quickly sell cryptocurrencies.

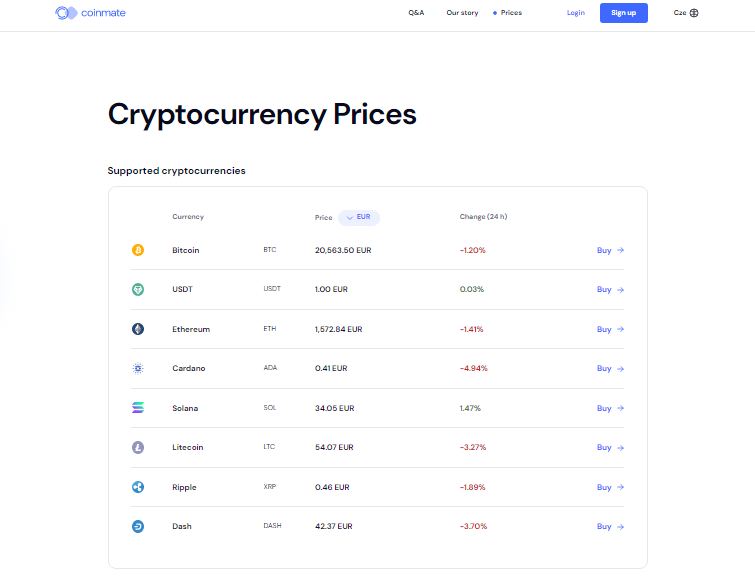

Coinmate currently supports about eight cryptocurrencies. It supports Bitcoin, USDT, Ethereum, Cardano, Solana, Litecoin, Ripple, and Dash. It also allows the use of three main currencies to purchase cryptocurrencies which are EUR, CZK, and BTC.

Key features

Types of accounts: Coinmate offers three types of accounts: basic account, verified account, and VIP account.

Trading Fees: Coinmate uses the Maker/Taker model. The maker’s fee is 0.05% while the taker’s fee is 0.35%.

Withdrawal fees: The deposit and withdrawal fees depend on the payment method you choose to use. Depositing using vouchers or domestic Czech and Poland currencies is however free.

Deposits and Withdrawals: the available methods to fund your account depending on your account verification level. The first level, which is for the basic account allows the use of OkCoin, MoneyPolo, and Vouchers. For verified and VIP accounts, you can use OkCoin, MoneyPolo, Vouchers, SEPA, Sofort and standard wires.

Withdrawal limit: For the basic account, the daily withdrawal limit is €1,000. For the verified account, the limit is €5,000 while for the VIP account the limit is €12,500. You can however adjust the limit for the VIP account higher by requesting.

Customer support: Coinmate only offers one customer support method which is through email.

Security: Coinmate is quite secure since it has a three-tiered verification for all types of accounts. Depending on your verification level, Coinmate will require users to do a video call showing the authorities clicking the pictures of the necessary documents by themselves.

Coinmate Pros and Cons

Pros

It allows users to directly purchase cryptocurrencies using the EUR and CZK fiat currencies which is a great plus especially if you are from Eastern Europe.

Its trading fees are relatively low compared to some of the popular cryptocurrency exchanges.

Although it has focused more on Europe, Coinmate also allows people from other parts of the world to sign up and use its services.

It supports a wide selection of payment methods.

Coinmate’s user interface is simple to use making it a good choice even for beginners.

Cons

While Coinmate offers a great crypto trading experience, it offers a very limited list of cryptocurrencies.

The exchange does not have a dedicated mobile platform that can allow you to easily buy, sell, and trade cryptocurrencies while on the go. Its website is mobile-friendly and seamlessly fits the smaller screen of smartphones and tablets.

While Coinmate generally allows clients from any part of the world to register with them, the exchange does not accept customers from the US.

The only form of customer support on Coinmate is email, which takes about a day to get a reply. This can be quite demoralizing especially if you have an urgent issue.

Coinmate does not offer a wide selection of crypto investment options. It only allows for purchasing, selling and trading. It does not have services like staking or liquidity mining.

Why you should use Coinmate to trade crypto

If you are in Europe and want a simple crypto exchange that you can use to start investing in cryptocurrencies, then Coinmate could be a great choice. Besides, its user-friendly user interface, the exchange also offers a lot of useful information about cryptocurrencies through its blog.

You can also be able to purchase cryptocurrencies using the EUR or the CZK.

Final Verdict

Selecting a good crypto exchange can be quite challenging, especially in a market as volatile as the crypto market.

We however hope the above Coinmate review gives you some insight to help determine if Coinmate is a good fit for you.

The post Coinmate review: what you should know appeared first on CoinJournal.

Source – TradingView

Source – TradingView