Key points:

-

Both are undervalued and could rally as the market turns bullish.

-

Tezos has more potential due to its growth in the NFTs market.

-

Tezos is also a major player in DeFi, a fast-growing aspect of crypto.

Filecoin (FIL)

In its simplest form, Filecoin is a distributed storage system that allows users to rent unused hard drive space. The project was created by Protocol Labs and built on top of the Interplanetary File System. It allows for easy access from anywhere in the world without any additional cost or waits time during delays because it’s an open-source effort with no single point failure like other companies have had before them.

Tezos (XTZ)

Tezos is a next-generation blockchain that has been designed from the ground up to be scalable, secure, and flexible. This means it can execute peer2peer transactions with high speed while also serving as an excellent platform for deploying smart contracts – all without sacrificing any of its core features or principles.

Which one is a better buy?

Both Tezos and File coin are good investments in February. Both of them have the fundamentals to rally and test new highs in 2022.

However, on a comparative basis, Tezos has more potential. Tezos has seen its share of the NFTs market grow, and this is a big deal because NFTs are on a growth path at the moment, a factor that could help drive up the demand for platforms like Tezos.

For instance, in late 2021, Formula 1 team, McLaren Racing, introduced a non-fungible tokens (NFTs) platform where digital art collectors can buy F1 collectibles. This is built on top of the Tezos blockchain protocol which is preferred by many in this industry because it provides greater security than other similar networks.

Tezos has also been gaining traction as a DeFi platform, another growth area in crypto that could take crypto to new lengths.

All these factors make Tezos a top cryptocurrency to watch, even though file coin too has good odds of profitability.

The post Filecoin v Tezos, which one is a better buy? appeared first on Coin Journal.

Data Source: Tradingview.com

Data Source: Tradingview.com

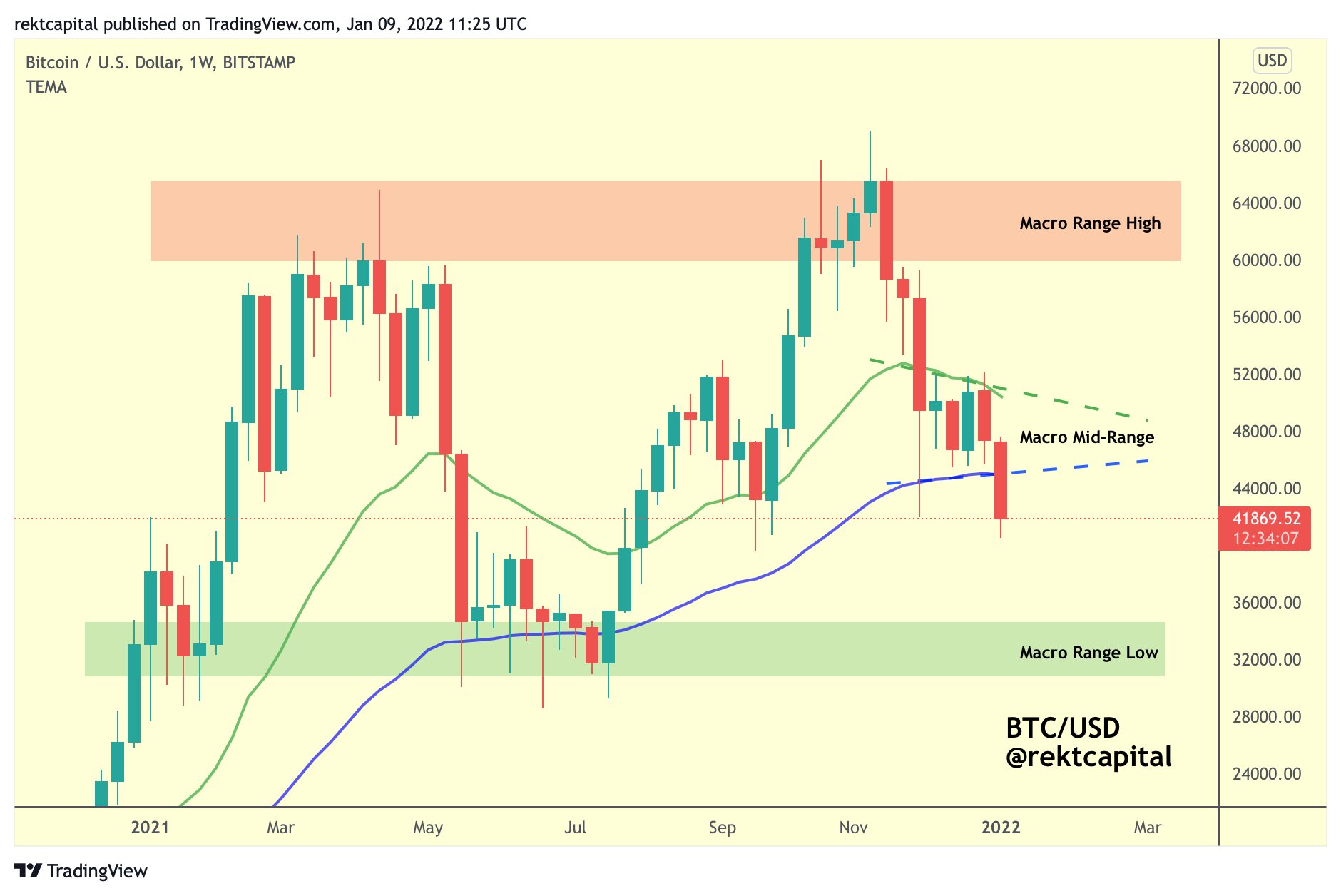

Chart showing BTC price below the two EMAs. Source: Rekt Capital on

Chart showing BTC price below the two EMAs. Source: Rekt Capital on