Chingari has announced it is launching its new beta testnet of its native token GARI. The token comes as the Indian-based social network gets ready to launch a new Mainnet this week. Chingari has over 100 million users. So, how will this token perform in the future? Here are some highlights:

-

The new GARI token is expected to help revolutionise the creator economy on the Chingari platform.

-

Chingari is also launching a matching crypto wallet as well, both of which will run on Solana (SOL).

-

Chingari has over 35 million active monthly users, one of the highest in India and in the world.

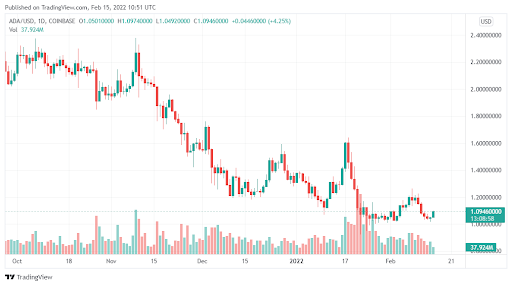

Data Source: Tradingview

Data Source: Tradingview

GARI Token – The tokenomics to know about

The move to create more value for users by Chingari has been steamrolling for the last few months. In fact, the platform has acquired several capital investments in this endeavour with a $19 million Series A funding last year.

The launch of the GARI token is the biggest move yet. Although we are seeing a beta test first, there is no doubt that this is big news.

It’s also worth noting that a Mainnet is expected to launch soon to coincide with the token. With India seen as one of the key crypto markets in the world, this is a good move for Chingari.

Should you buy the GARI token?

Right now, the GARI token is well and truly in its infancy. But based on the underlying fundamentals, it could become huge. India remains a key market for crypto growth. We have seen many innovative products come out of there.

While Chingari is not really expected to be the top driver of crypto adoption, its native GARI token could play a key role in cementing India as the world leader in crypto over the coming years.

The post Chingari announces the launch of a brand-new native token – Everything you need to know? appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview