I ate a healthy dose of humble pie today, so maybe this article can serve as a form of therapy.

I’m talking about Terra, its native token Luna, and its UST stablecoin. To quickly summarise, UST is an algorithmic stablecoin that is technically backed by nothing (bear with me, Luna bulls). Every time 1 UST is minted, 1 LUNA is burned, and vice versa.

This maintains the peg to $1, but what happens when there is so much selling pressure that UST dips below the peg? That scares people.

And when people are scared, they sell UST, for fear of the peg breaking.

That triggers more fear, which triggers more selling, which triggers more fear and so on and on and on. If I was on a stricter word count, I could merely have called it a run on the bank. We saw this today, with the UST de-pegging, trading down as low as 88 cents about thirty minutes ago (currently at 90 cents).

I Capitulated

I was one of those scared people. In fact, I sold my UST for 95 cents on the dollar, swallowing a rather uncomfortable 5% loss, as detailed in the Twitter thread below, which I typed as the tears flowed down my face and fell onto my keyboard.

A couple of reasons why, before you throw abuse at my already-egg-covered face.

As I write this, Do Kwon has not tweeted in five hours and counting, when he said “deploying more capital – steady lads”. While his tone was questionable at best amid the greatest crisis in Luna’s history, the lack of further elaboration on the defense mechanism is a real problem. We know Terra, via the Luna Foundation Guard, hold Bitcoin in reserve to collaterise the peg in such cases. But when will this be deployed, what has already been spent and is any additional capital available?

I did my best to track the Bitcoin reserves via the below address tweeted out by LFG, but it’s unclear what has been spent of the 37,000 bitcoins withdrawn (circa $1 billion) as much of it was sent to various exchange wallets.

Aside from that one tweet from Do Kwon, it has been radio silence.

Why Sell?

I ran the numbers and decided that selling was the best decision for me. The final two words in that sentence are essential – “for me”. Everyone has their own risk tolerances, and each investment decision should always be taken in the context of one’s own portfolio.

For me, I had been using an “arbitrage” strategy of earning the Anchor 19.5% yield (which was recently reduced to 18%) while paying a lower interest rate on a loan. The fact these were borrowed funds was key, and in compiling a scenario analysis, was ultimately the deciding factor in whether to sell.

In holding, I was implicitly betting my entire UST reserve (the majority of which was borrowed) that the peg would hold at 1/20 odds. I was borrowing money to bet that this peg would hold. I didn’t like those odds.

Another way to look at it is the following: at 18% yield, a 5% haircut equates to 5%/18%*365 = 101 days worth of interest in the Anchor protocol. I can live with sacrificing that, but a loss of my entire UST holdings would have caused severe damage to my portfolio.

With the UST trading at 95 cents to the dollar, while I ate my stale leftover salad for lunch a couple of hours ago, I hit the sell button.

Risk Management

This is the part where you say I messed up, that my risk management was off, and that this was always a possibility. And you’re right.

The funny part is that I was in the process of doing due diligence on other protocols, as I was in the process of moving these borrowed funds. I was growing increasingly uncomfortable with the rhetoric out of Do Kwon and Terra and, coupled with the fact Anchor has been made dynamic and the rate is now falling (already to 18% and projected to 16.5% next month) made me want to diversify out and move a bulk of my holdings elsewhere.

So if this madness hit a week later, I would have been laughing.

But that’s crypto. That’s life.

It definitely feels painful that I had assessed Anchor as a higher risk and yet still am coming out on the wrong end.

What Happens Next?

My gut feel is that the peg holds. I think the market hopefully finds its foot a little and stabilises, at least in the short term. I’m not sure what it means for the long-term confidence in the peg, but I don’t think I wake up tomorrow to see UST is no more.

And that isn’t a contradictory statement to make. I feel like it holds; I’d still be very surprised to see it break down. But I wasn’t willing to risk it, as I didn’t like the odds that were being offered.

If it has rained 95 of the last 100 days, you’d gladly accept a $10 bet that it would rain again tomorrow. But would you bet half your net worth? Would you take out a loan to leverage up? Exactly – it depends on your financial circumstances and risk tolerance. For me, today at lunchtime, UST no longer was worth it for me on a risk-reward basis.

So yeah, I sold a big chunk of my UST at 95 cents on the dollar, taking a hit to my pride and ego in the process. But that’s the world of investing, and if you don’t like it, well you can always go hold cash.

Win some, lose some.

The post Luna: Why I sold my UST for 95 cents on the dollar today appeared first on Coin Journal.

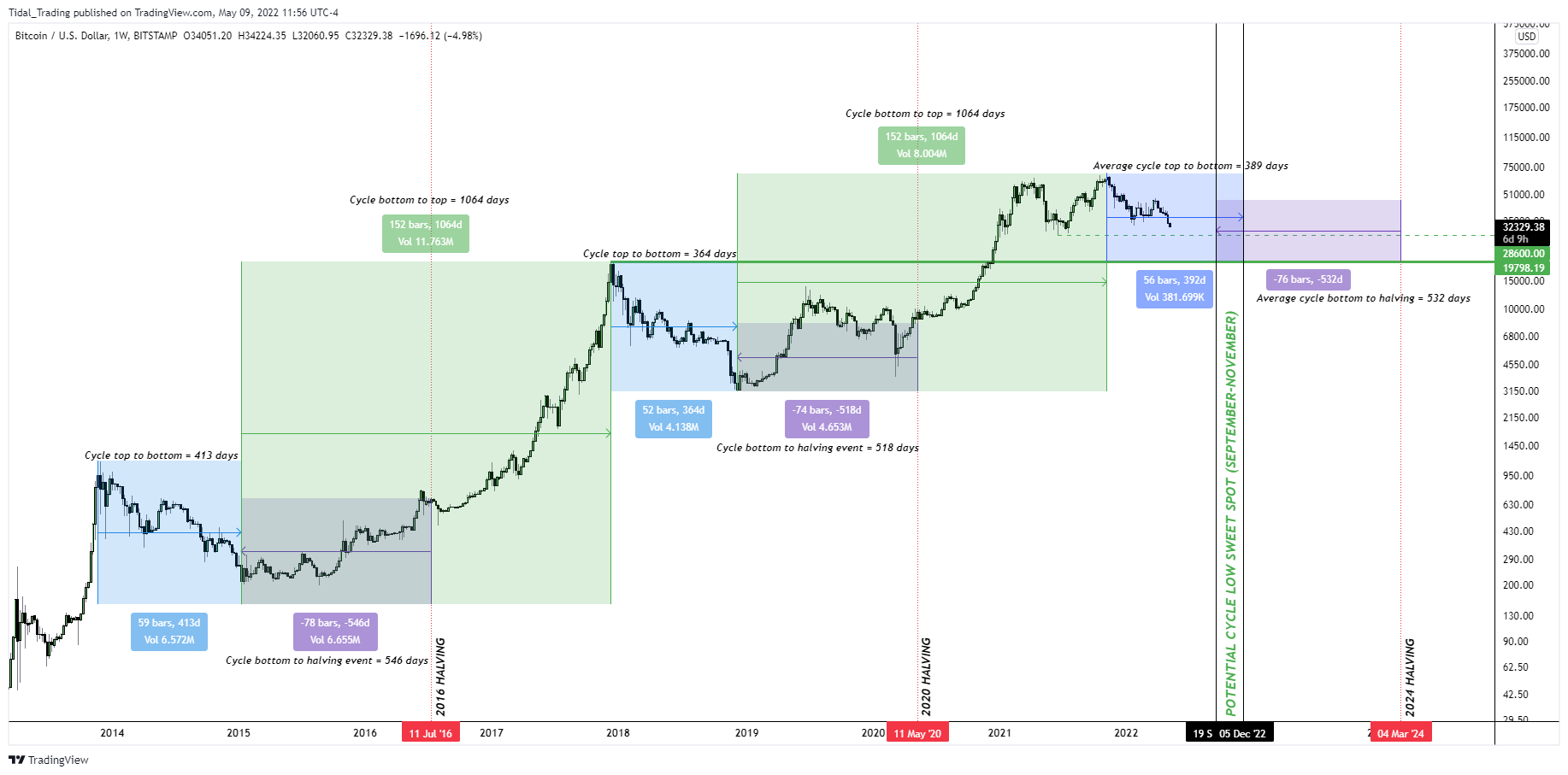

Chart showing historical price movement for BTC. Source:

Chart showing historical price movement for BTC. Source: