- Mayweather has connections to multiple rug pulls and scams

- The superstar boxer has purged his social media of reference to his promotions, but the Internet is forever

- He is an example of the opportunity that exists in crypto for those without a conscience

I love crypto.

I believe Bitcoin can make the world a better place – a digital, decentralised form of money with a hard supply cap, the likes of which the world has never seen before.

I especially think innovation within stablecoins and decentralised finance can create a fairer, more democratic and accessible financial system, compared to the current system which is too often stacked in favour of those at the top, widening the chasm of inequality that is plaguing so many countries right now.

But let us not kid ourselves here – there are dark sides to this wonderful industry too. And the aforementioned potential, possibilities and dreams of making a real difference are far from reality yet.

Regulation

Whether you’re pro or anti-regulation, the truth is that this is a $1.2 trillion industry that has been allowed to run free. It’s an overused expression in crypto, but the “wild west” remains the perfect way to describe it. Sure, this has massive positives as innovation can ramp up, creators have free rein and barriers remain minimal.

But as important as those advantages of minimal regulation are to mention, I don’t want to discuss them here. I want to talk about the negative externalities of this environment; I want to spend some time looking at the villains that can operate in the space, with salivating upside at the expense of innocent members of the public.

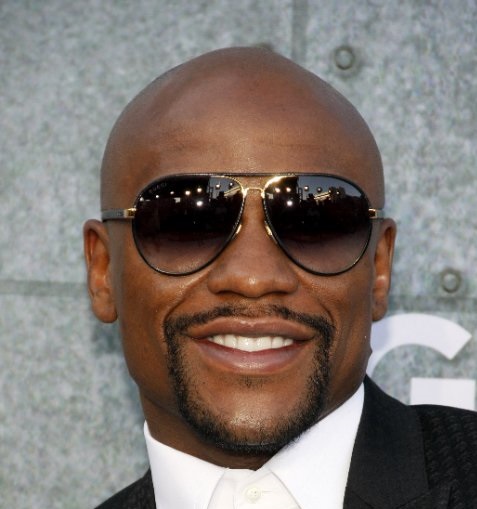

Let’s do a case study on an individual who has exploited the system and the gullible investor to their benefit, perhaps more than any other: Floyd Mayweather.

Floyd Mayweather

Floyd Mayweather is a boxer known for his exciting fighting style, humble attitude and respect for women. OK, that was a joke.

Let’s talk money because that is what this article is about, really. Mayweather was ranked sixth on the Sportico’s all-time athlete earnings list last year, with an inflation-adjusted $1.2 billion banked throughout his career. But have you seen the price of gas recently? Apparently, even $1.2 billion makes it hard to make ends meet in modern-day America, as Floyd “Money” Mayweather has turned to cryptocurrency scams to supplement his income.

Mayweather’s Metaverse Project

His Twitter bio can be seen below, promoting some kind of metaverse related project titled “mayweverse”, which if you ask me, couldn’t roll off the tongue any worse.

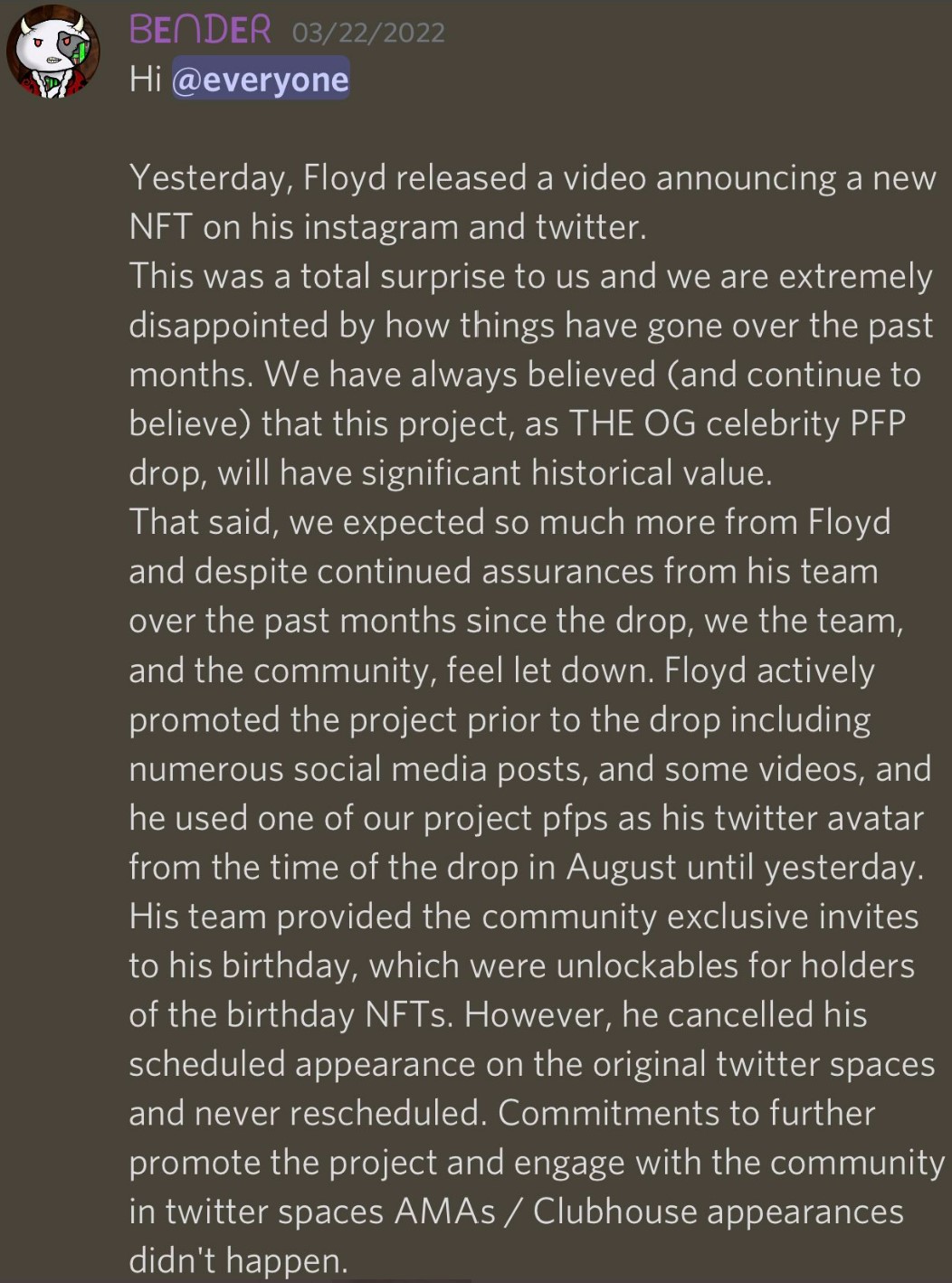

The funny thing is that when this project was announced, he completely abandoned the Floyd NFT project which he previously had incessantly promoted. He also deleted all tweets and public social media posts relating to the post.

Luckily, things live forever on the Internet, so you can see an example below of Mayweather, typically humble as he chats to the camera from the swimming pool of one of his mansions.

Floyd Mayweather – Floyds World NFT pic.twitter.com/tdI6tKSME5

— CT Caught In 4k 🎥 (@bestvideosofct) April 10, 2022

Even worse, he didn’t even inform the team (or investors) behind FloydNFT that he was launching another project nor abandoning the previous one. Classy move, Floyd.

Oh, and what happened to the Mayweverse? Yeah, it was a rug, with holders losing everything. The team behind it was anonymous and so were able to withdraw without connsequences. As for Floyd, there appear to be no repercutions, which is unfortunate but also not surprising in the slightest. On the bright side, God bless the Twitter account @bestvideosofct, because they have the below gem from one of Mayweather’s many promotions.

“And of course, I’m the Money man, but guess what? Be a part of history, own a piece of my legacy, and you can make money too” – Floyd Mayweather

Floyd Mayweather – Mayweverse Pt 1 pic.twitter.com/gUzsxeazNV

— CT Caught In 4k 🎥 (@bestvideosofct) May 5, 2022

Ethereum Max

Ethereum Max is a token which sponsored Mayweather’s “fight” with YouTube personality Logan Paul. Heavily promoted by Mayweather, he showed up to the weigh-in with an Ethereum Max t-shirt, while the official fight card advertised the token, and tickets could be bought with the currency.

Just for fun, I charted the price action of the token below since the fight.

<div class=”flourish-embed flourish-chart” data-src=”visualisation/10265542″><script src=”https://public.flourish.studio/resources/embed.js”></script></div>

Bored Bunny and Moonshot were similarly promoted rugs, but in truth, I can’t be bothered going into the detail behind them. There is also a host of older projects from the previous crypto cycle, most notably ICOs which went to zero, that Mayweather has promoted.

In almost all cases, his Twitter account has been purged of the promotions.

Take Care, People

I don’t think I need to clarify that Mayweather is not a good cookie. He has been to jail multiple times for beating his girlfriends, with a laundry list of cases from battery, assault and harassment levelled against him. Given his status as an incredibly gifted fighter, the repeated physical abuse is even more disgusting and cowardly.

But it is these kinds of morally bankrupt people that can excel in the cryptocurrency space, given the lack of regulation and easy ability of anyone to fork a coin or mint an NFT collection and sell it to the masses.

It’s a keen reminder that while due diligence is vital when investing in any asset class, it’s even more crucial in crypto where anyone can scam anyone, as long as they have a WiFi connection and lack a proper conscience.

The post Floyd Mayweather sums up everything that is wrong with crypto appeared first on CoinJournal.

Source – TradingView

Source – TradingView