-

Ethereum Classic token rose 22% after a Fed rate hike

-

Investors see ETC benefiting from Ethereum shift to Proof-of-Stake

-

ETC has met resistance, but bullish momentum is strong

Ethereum Classic ETC/USD is one of the top gainer coins on Thursday. The token added more than 22% in 24 hours after the Federal Reserve hiked the interest rate by 75%. The gains were across the crypto sector, with the mother Ethereum token gaining by 11%.

The gains in ETC and other cryptocurrencies reflected a softer stance by the Fed. Markets feared a 100-basis point hike. A lower hike was welcome, adding a bullish impetus that saw tokens such as ETC gain.

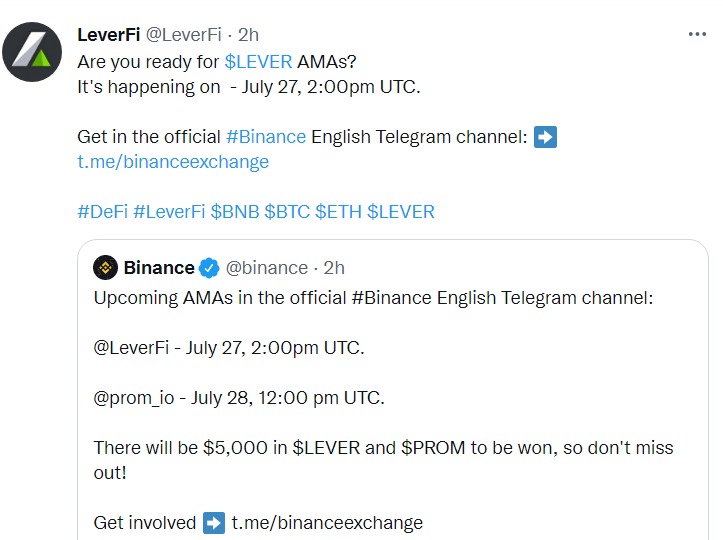

The above-market gains in Ethereum Classic could also be a result of another development. On July 27, news emerged that AntPool had invested $10 million in the cryptocurrency. AntPool already ranks as the third largest BTC mining pool.

Investors such as AntPool see Ethereum Classic benefiting immensely once Ethereum shifts to PoS. Once the merge is complete, PoW mining on Ethereum will become redundant. That will allow miners to migrate to PoW chains such as Ethereum Classic.

Ethereum meets resistance after a 24-hour surge.

Source – TradingView

Source – TradingView

Technically, Ethereum Classic has met resistance at $34.5 after robust 24-hour gains. However, the crypto sentiment and token fundamentals remain strong. We believe ETC will continue gaining as Ethereum merges approaches. However, the resistance could send the price lower in a market correction.

Investors should consider a potential retracement of ETC as an opportunity to buy. The token could slide back towards the $26 support. The token’s next resistance is at $46.

Summary

Ethereum Classic is bullish after the Fed’s rate hike. An expected boom after the Ethereum upgrade is boosting the Ethereum Classic token. Investors should buy the dip since ETC has hit a resistance.

The post Ethereum Classic shoots 22% after Fed decision – Will we see more upsurge? appeared first on CoinJournal.