Bitgert price has crawled back in the past few days as investors cheer its ecosystem growth. BRISE, its native token, rose to a high of $0.0000092, which was the highest level since August 7. It has surged by over 162% from the lowest level this year.

Bitgert TVL soaring

Bitgert is a relatively small but fast-growing blockchain project that seeks to become a leading player in the industry. It is an Ethereum-killer that is substantially faster and cheaper to operate. According to its developers, it is able to handle thousands of transactions per second (tps).

Bitgert is also significantly cheap to operate since it can handle millions of transactions for pennies. Some of the top applications created in Bitgert are Knit Finance, Midas NFT Marketplace, Briseswap, and Icecream Swap among others. $BRISE is the native token for Bitgert’s ecosystem.

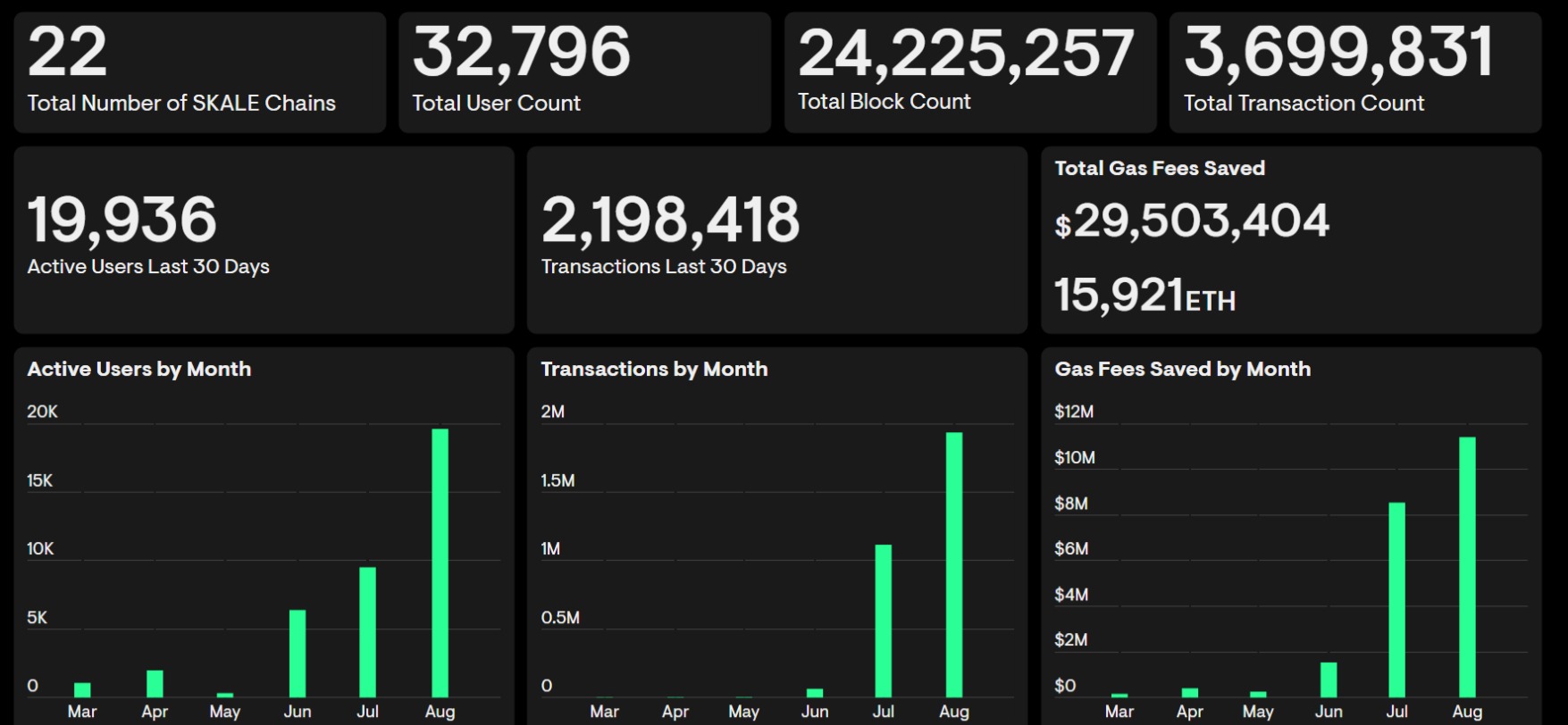

Bitgert price has risen in the past few days as investors cheer the sudden growth of its ecosystem. According to DeFi Llama, Bitget has seen its total value locked (TVL) soar from almost zero to over $9 million.

This growth has been mostly because of Spynx, which has a TVL of over $6 million. IcecreamSwap has a TVL of over $2.1 million. Therefore, analysts believe that the TVL will continue growing in the coming months.

The next key catalyst for the Bitget price will be the upcoming Jackson Hole Symposium event in the United States. In it, Jerome Powell, the Fed Chair, will have an opportunity to talk about interest rates now that inflation has started falling.

Bitgert price prediction

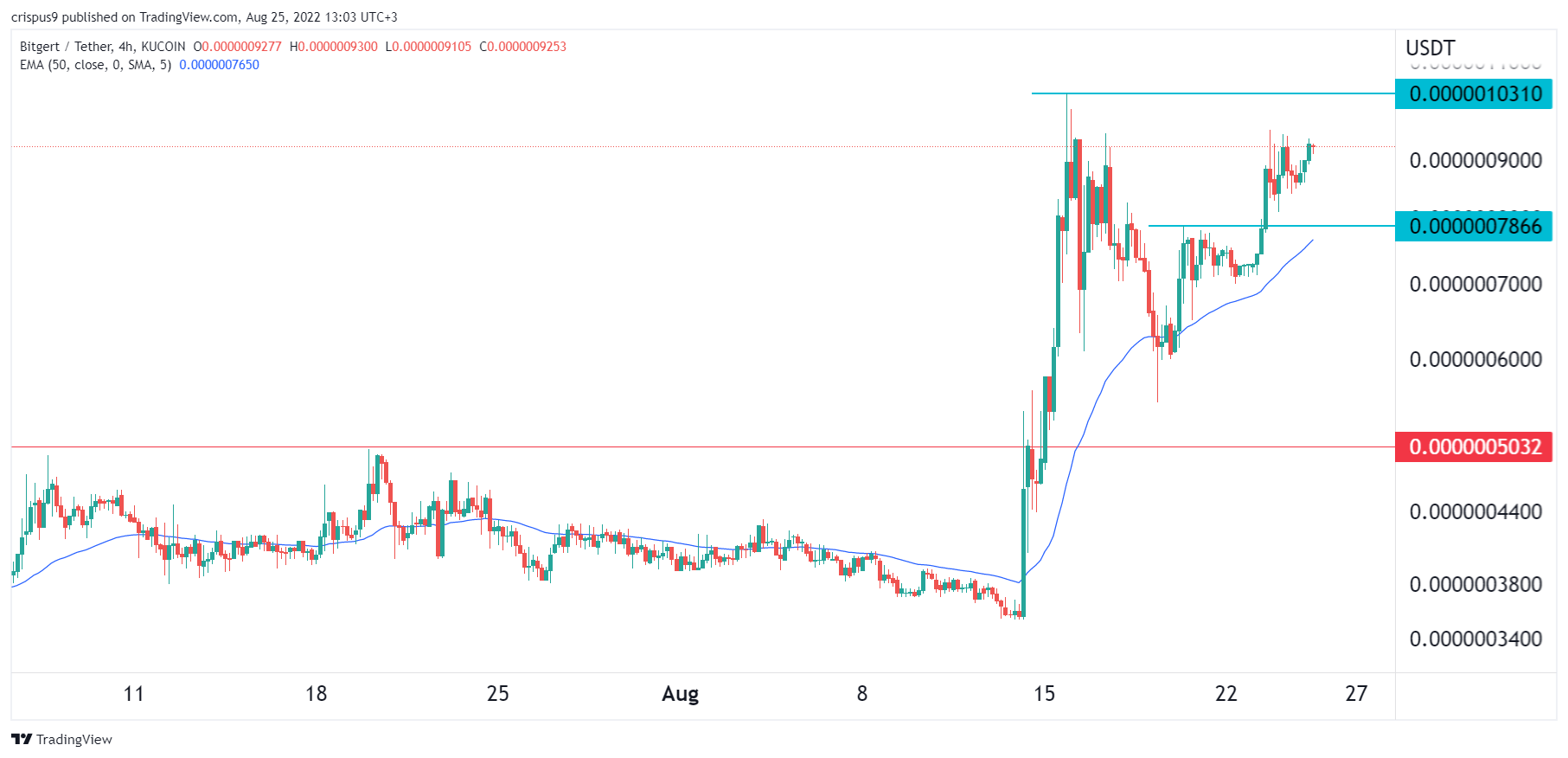

The four-hour chart shows that the BRISE price has been in a strong bullish trend in the past few weeks. As a result, the coin has become one of the best performing in the market. It has rallied above the 25-day and 50-day moving averages.

Notably, this rally happened after the coin dropped to a low of $0.00000055, which was the lowest point on August 19. At the same time, it seems like it is forming a double-top pattern, which is usually a bearish sign.

Therefore, while the Bitgert price has some upside, there is a likelihood that it will soon pull back because of the double-top pattern. If this happens, the next key support to watch will be at $0.00000078.

The post Bitgert Price Has Recovered But Beware of a Bearish Pattern appeared first on CoinJournal.

Source – TradingvIEW

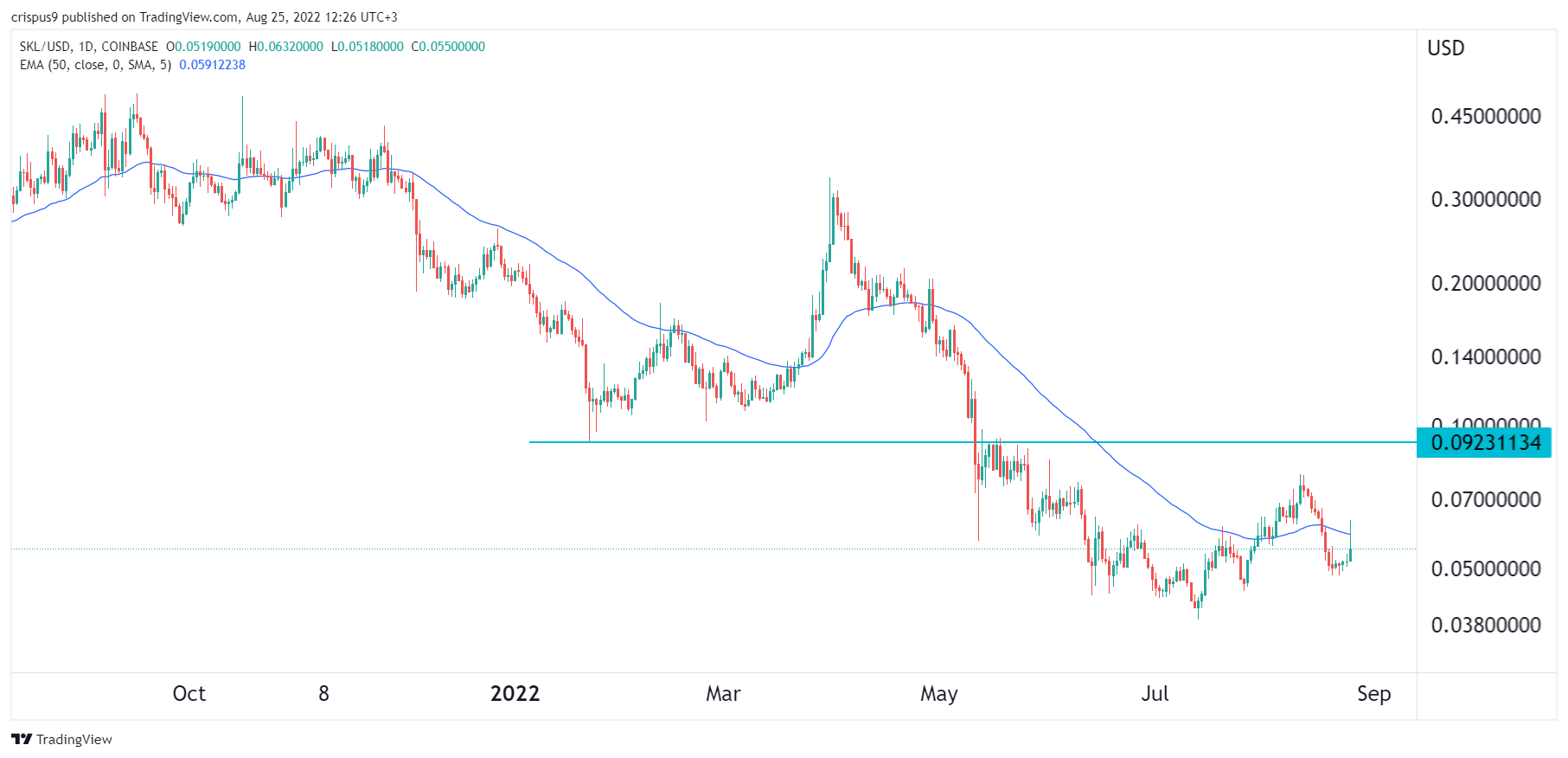

Source – TradingvIEW