PancakeSwap price had a strong performance in September as demand for top Decentralized Finance (DeFi) tokens rose. CAKE rose to a high of $5.088, which was the highest level since May 12. It has risen by more than 100% from the lowest level this year, giving it a market cap of more than $676 million.

CAKE had a good September

PancakeSwap is a leading player in the decentralized finance industry and is the biggest DEX in the BNB Smart Chain. It is a platform that makes it possible for people to buy and sell cryptocurrencies in a decentralized manner. According to CoinMarketCap, it handles more than $115 million on a daily basis.

Unlike Uniswap and dYdX, PancakeSwap the network makes it possible for people to swap tokens and provide liquidity and earn returns. The network has also expanded its ecosystem to include betting and predictions and even NFT trading.

In total, PancakeSwap has a total value locked (TVL) of more than $2.92 billion. In the past 24 hours, the network raised over $430k in fees leading to revenue of $51k.

CAKE price has done well in the past few months mostly because of the stability of the DeFi industry. Indeed, other DeFi tokens have done well in the past few weeks. This includes tokens like Lido, Aave, Uniswap, and Maker.

After the collapse of centralized projects like Celsius, Vauld, and Voyager Token, many analysts believe that users will continue to move to decentralized platforms. For one, they are more secure than centralized ones because of their open-source nature.

PancakeSwap price prediction

The daily chart shows that the CAKE price has been in a strong bullish trend in the past few days. It has risen by more than 100% from the lowest level in June. The coin has risen above the 25-day and 50-day moving averages. It has also moved slightly above the important resistance level at $4.6 while the Relative Strength Index (RSI) has continued rising.

Therefore, there is a likelihood that the coin will continue rising as bulls target the next key resistance level at $7.5, which is about 60% above the current level. This is an important price since it was the lowest point on April 12.

How to buy CAKE

Skilling

Skilling is a Scandinavian based cryptocurrency broker which has a desktop website as well as apps for iOS and Android devices. It supports over 50 cryptocurrencies and it has a demo account to allow users to gain familiarity with the platform. Skilling has no hidden fees, it is an officially regulated broker and it supports a wide range of payment methods.

Capital.com

Capital.com is a global broker which offers over 200 cryptocurrencies for its users. It comes with a range of features such as; great security, 24/7 support, demo accounts and a wide variety of assets. On top of that, it also has no inactivity, withdrawal or deposit fees, which makes it stand out from other crypto brands.

Buy CAKE with Capital.com today

The post CAKE price prediction: Will PancakeSwap rise in September? appeared first on CoinJournal.

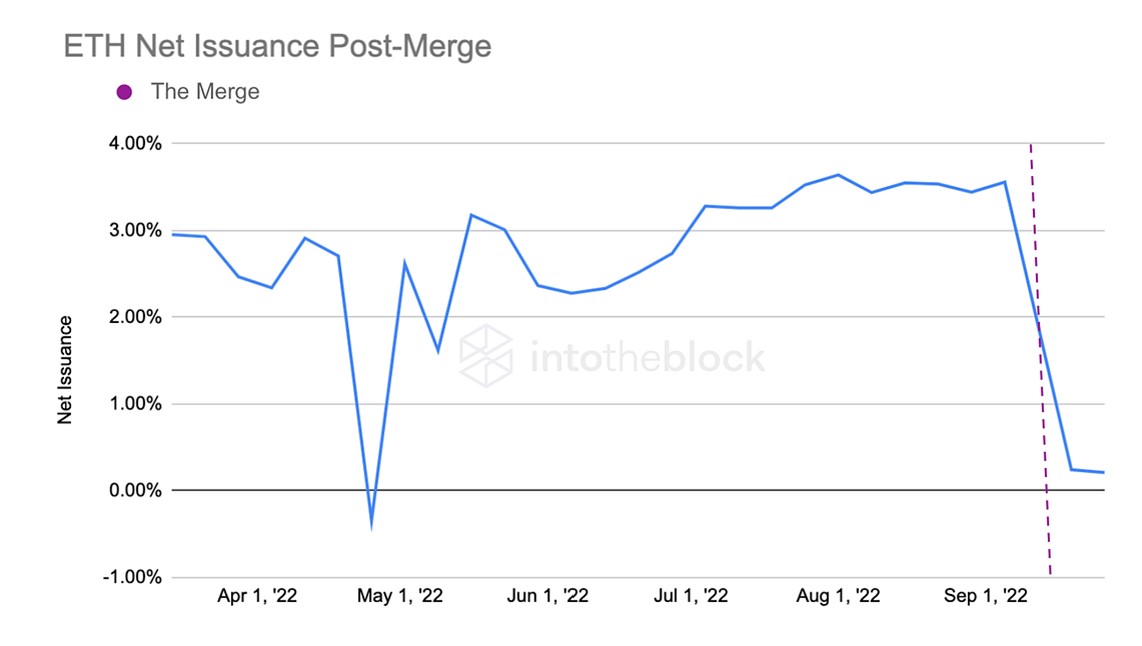

However, perhaps more sombrely is Ethereum fees dropping 80% quarter over quarter. This is for no other reason than a good old-fashioned fall in demand. The macro situation remains absolutely abhorrent and it follows that demand for the network is down (I’m likely being a little harsh as Layer 2’s are partially exacerbating this fall in fees but it is largely due to an overall fall in demand).

However, perhaps more sombrely is Ethereum fees dropping 80% quarter over quarter. This is for no other reason than a good old-fashioned fall in demand. The macro situation remains absolutely abhorrent and it follows that demand for the network is down (I’m likely being a little harsh as Layer 2’s are partially exacerbating this fall in fees but it is largely due to an overall fall in demand).

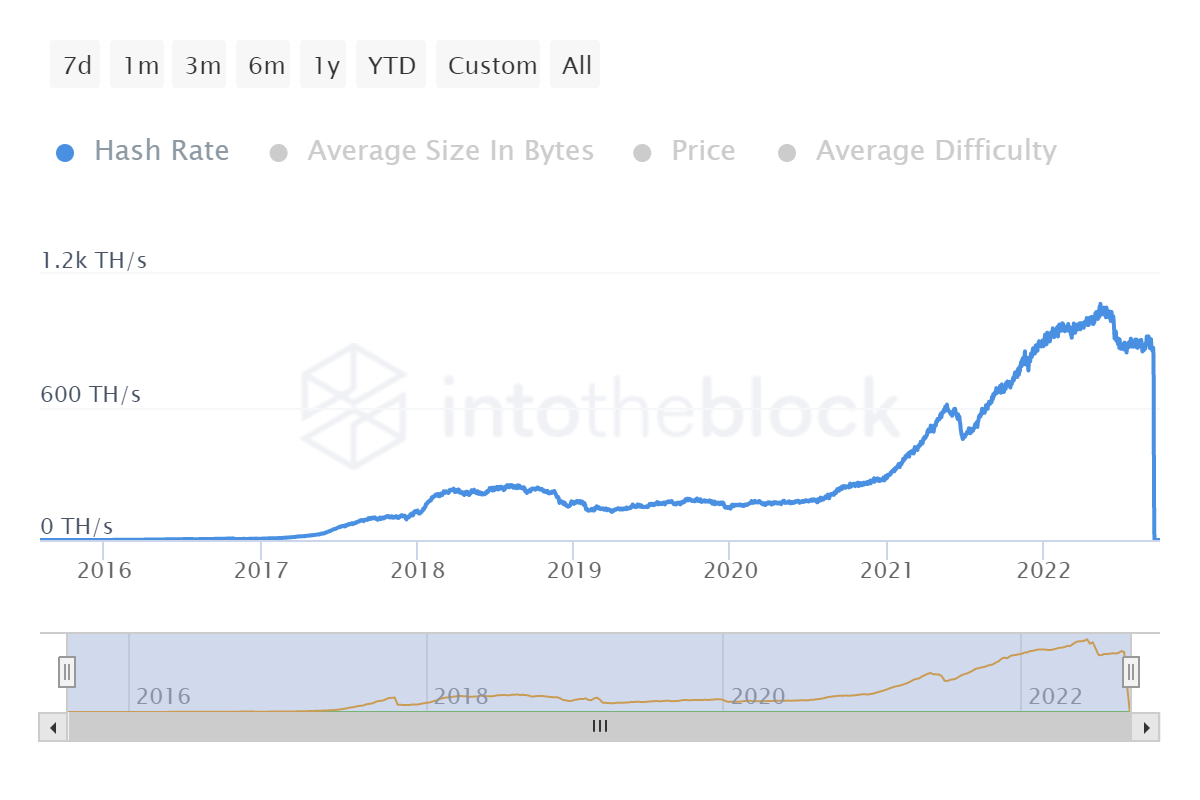

Top of that list is good old Ethereum Classic – a coin which I had largely forgotten about until I noticed its hash rate had ballooned to an all-time high on the date of the Merge, nearly 4Xing overnight.

Top of that list is good old Ethereum Classic – a coin which I had largely forgotten about until I noticed its hash rate had ballooned to an all-time high on the date of the Merge, nearly 4Xing overnight.