-

Ethereum Classic is up 18% in the week

-

The network has witnessed an increased hash rate

-

Ethereum Classic still faces bear pressure at $19

Ethereum Classic (ETC/USD) has been of bull interest in the last two days. Despite losing by an intraday 1% on Friday, it was still up 18% in the week. A majority of these gains happened on January 04, 2023. The gains pushed the cryptocurrency above a crucial descending trendline that has contained ETC for a while. But how far can ETC gains continue?

Ethereum Classic was tipped for success when Ethereum shifted to the Proof of Stake protocol. Ethereum Classic is itself a Proof of Work protocol. Thus, Ethereum’s shift, also known as the Merge, was expected to push PoW miners to Ethereum Classic. Although initially boosting the price, ETC later crashed as the speculations waned.

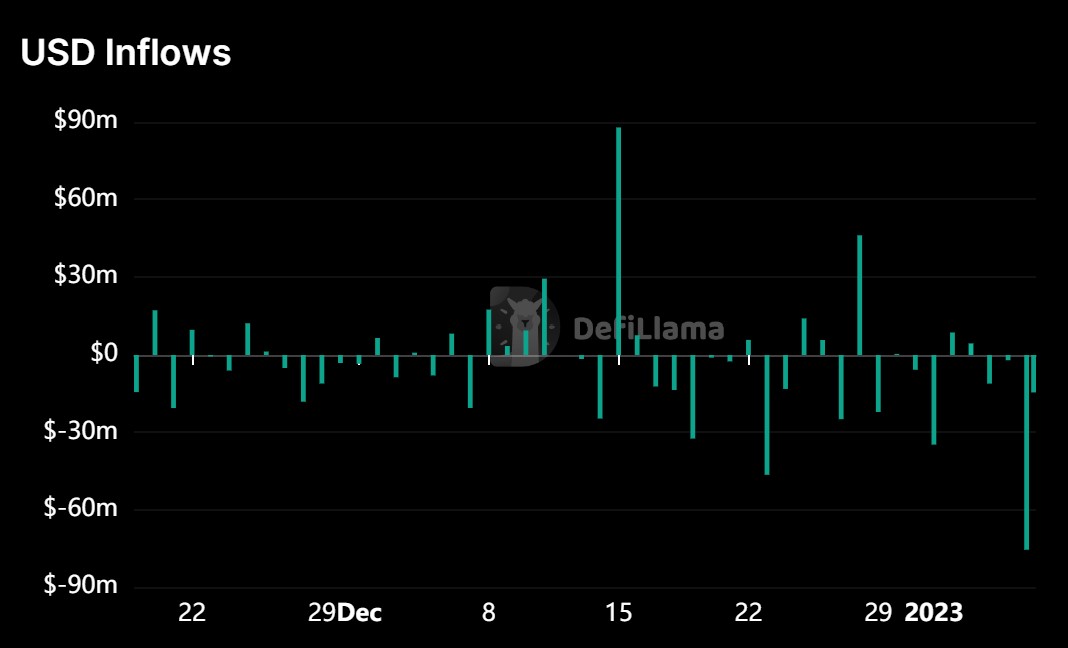

The latest ETC gains reignite hopes of miner activity on Ethereum Classic. While the hash rate went downward in December 2022, it started to gain momentum toward the new year. The hash rate improved from 97.5975 TH/s on December 27 to 111.7497 TH/s on December 30, according to CoinWarz data. That could indicate increased miner activity and ETC transactions which boosted prices after the new year. But buyers may need to exercise caution at the current price level.

Bullish ETC still facing bearish pressure despite breakout

A technical outlook shows momentum has increased strongly for ETC. The MACD indicator is attempting to break above the neutral zone. However, bears are trying to force a correction after ETC reached resistance at $19.

What to do with ETC?

Despite breaking above the descending trendline, ETC is facing a correction. The price is yet to trade above the previous high.

A break above the $19 resistance is the needed validation to consider further upsides. Investors should only buy ETC if it recovers above $19 with a confirmed bullish momentum. At the current price, ETC still faces a slump back to the $14 bottom price.

Where to buy ETC

eToro

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

OKX

OKX is a top cryptocurrency exchange which offers over 140 cryptocurrencies to invest in. OKX takes customer security very seriously, they store almost all of their clients‘ funds in cold storage, and the exchange is yet to be hacked. On top of this, the exchange offers very low fees and customers can even use their crypto as collateral for loans on the platform.

The post Ethereum Classic breaks above descending trendline but exercise caution appeared first on CoinJournal.