- A new and promising crypto, ScapesMania, has witnessed impressive presale success.

- Ethereum is poised for growth with potential regulatory advancements like an ETF while Solana is the 5th most-traded cryptocurrency, stable and growing.

- Polygon is resilient and attracts investments, Dogecoin balances community projects amid market fluctuations, and Shiba Inu faces uncertainty due to whale transactions and a bearish outlook.

The cryptocurrency market is currently experiencing a significant upswing, with Bitcoin (BTC) crossing the $42,000 mark, signaling a broader market recovery. This resurgence is not just limited to the flagship cryptocurrency but is also evident in the performance of other players.

Today, we’ve put together our 6 top picks for investors looking to capitalize on the rising market before it’s too late: Ethereum (ETH), Solana (SOL), Polygon (MATIC), Dogecoin (DOGE), Shiba Inu (SHIB), and the emerging ScapesMania. These coins have the potential to yield significant returns and showcase substantial growth.

Let’s take a closer look at each coin.

Growth factors behind promising coins

ScapesMania: features and vision

ScapesMania is an innovative crypto project currently in the presale phase. Amidst the volatility experienced by larger cryptocurrencies, it offers a unique opportunity to diversify your portfolio.

Upon closer examination, ScapesMania reveals a range of appealing features. By embracing ScapesMania, crypto enthusiasts get a chance to engage with a unique ecosystem thriving within a multi-billion-dollar gaming industry.

Furthermore, ScapesMania has implemented mechanisms to keep holders actively involved and incentivized. By participating in DAO governance, backers have a say about ScapesMania’s future direction. Other notable perks for holders include up to $142 in bonuses for early adopters, token buyback and burn mechanisms, and staking rewards.

As for safety, the project’s smart contract has undergone a thorough audit by leading security-ranking companies. ScapesMania is backed by an award-winning team that has secured a prestigious grant from a major player in the blockchain industry.

Visit ScapesMania’s website for more information about its standout features.

Ethereum: regulatory developments and market Impact

Ethereum price chart

Ethereum price chart

Ethereum is currently experiencing a noteworthy development related to regulatory matters and market dynamics. The United States Securities and Exchange Commission (SEC) is actively engaged in discussions regarding a proposed rule change.

This change, if approved, would enable Fidelity Investments to offer shares of its spot Ethereum (ETH) exchange-traded fund (ETF).

Fidelity’s latest SEC filing outlines its ETF’s objective to monitor Ether’s performance using the Fidelity Ethereum Index. If approved, the ETF, trading as ETHF on the Cboe BZX Exchange, may mark a pivotal moment in Ethereum’s broader adoption.

Solana: climbing the ranks in the crypto market

Solana price chart

Solana price chart

Solana has recently achieved a significant milestone. As of now, it’s the 5th most-traded cryptocurrency in the world. This achievement indicates a rising trend in its adoption and a growing interest from traders and investors.

Furthermore, Solana’s blockchain has experienced positive developments. Among notable achievements are inclusion in Visa’s stablecoin trials, a rise in total value locked, and maintaining around nine months of continuous uptime.

These factors enhance Solana’s presence and credibility in the market. Ultimately, investors can expect an ongoing upward trend in SOL’s price performance.

Polygon: navigating through market volatility

Polygon price chart

Polygon price chart

MATIC underwent a significant price correction recently, drawing considerable interest from prominent investors commonly known as “whales.”

Capitalizing on the dip in Polygon’s price, these large-scale investors seized the opportunity and injected a substantial $90 million into acquiring MATIC tokens. This influx of funds suggests a strategic move by major players in response to the recent price fluctuations in the Polygon market.

Major backers continue to play a pivotal role in shaping the asset’s value amidst dynamic market conditions in the Polygon ecosystem. So, keeping an eye on the movements of these whales remains crucial.

Dogecoin: aiming for the moon

Dogecoin price chart

Dogecoin price chart

The Dogecoin community has embarked on an ambitious mission to send a physical token to the moon, reflecting the coin’s playful and pioneering spirit. This endeavor coincides with a significant technical development in Dogecoin market behavior.

DOGE’s price recently broke out from a long-term descending resistance trend line, which had been in place for 900 days.

Furthermore, the number of total crypto wallets holding DOGE reaches 5 million. These dynamics indicate the growing adoption and increased user activity within the blossoming Dogecoin network.

Shiba Inu: whale transactions and network developments

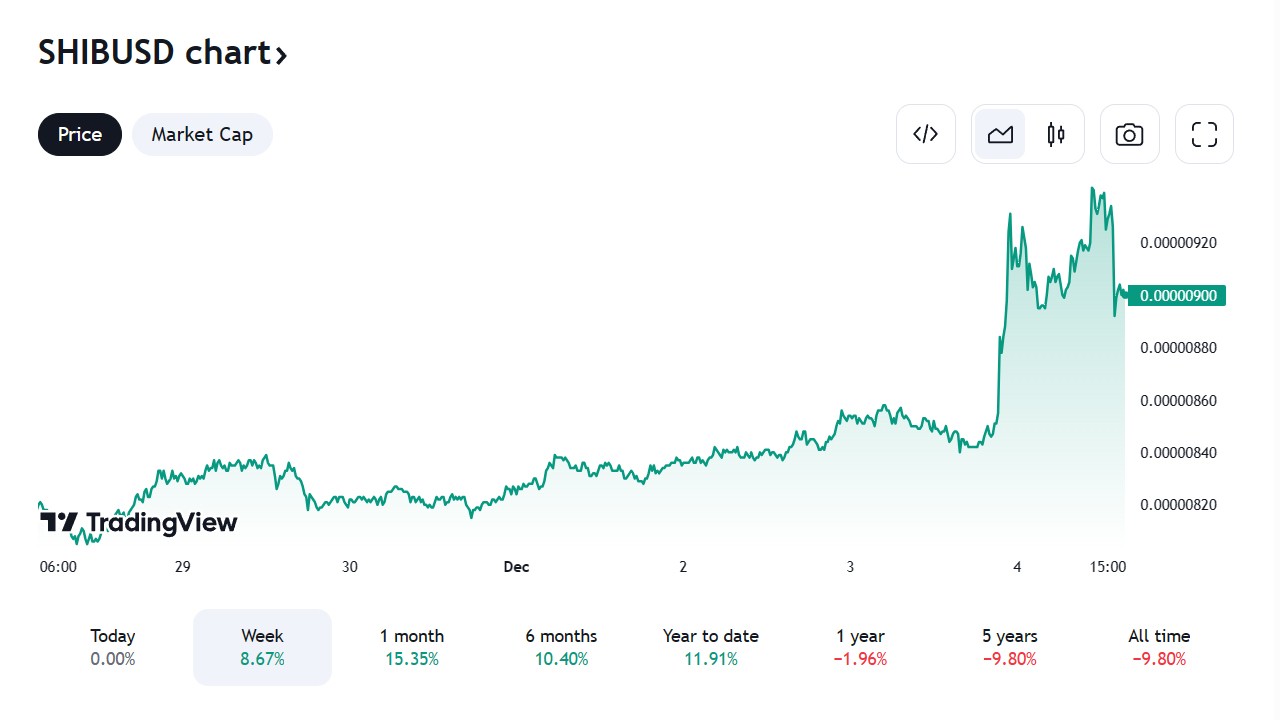

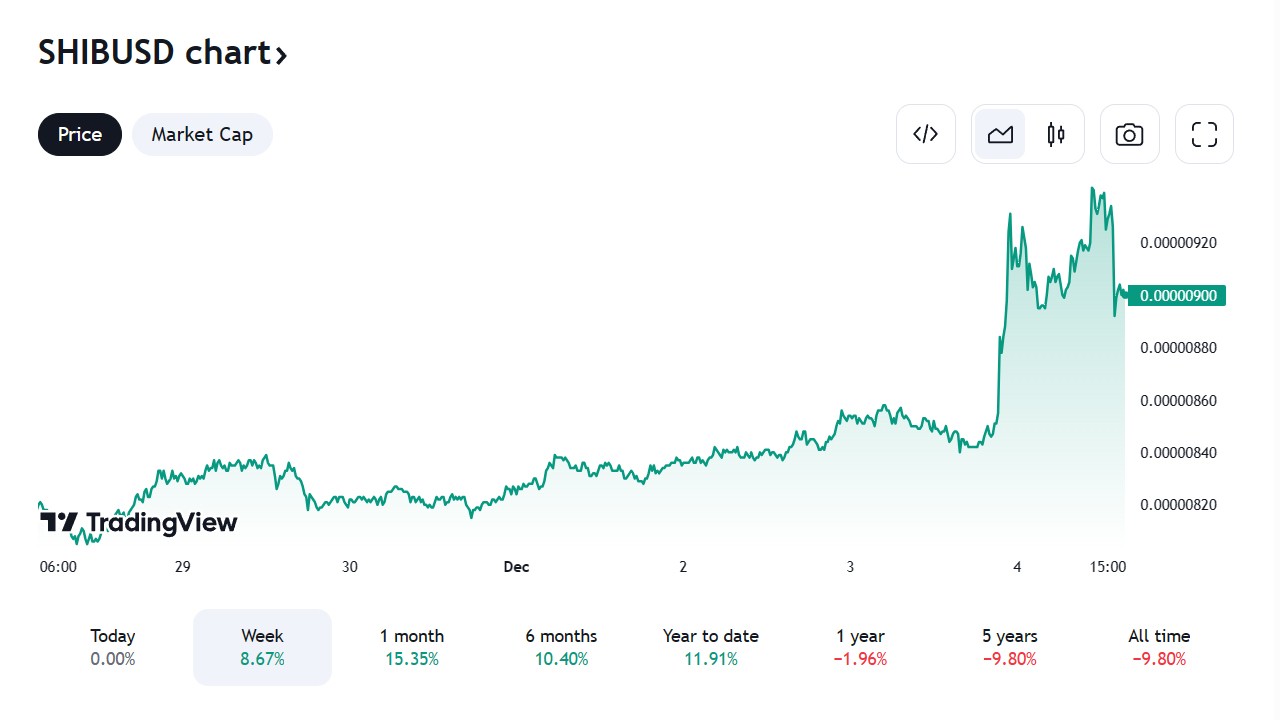

Shiba inu price chart

Shiba inu price chart

Shiba Inu recently underwent a substantial transaction involving the transfer of 300 billion SHIB tokens to an anonymous wallet. Notably, this transfer originated from the popular cryptocurrency exchange Binance.

The occurrence of this transaction has generated curiosity and speculation within the crypto community, driving investors’ interest in the token. However, it’s not the only growth factor behind Shiba Inu.

Shiba Inu’s advancements, such as the launch of Shibarium, aim to enhance transaction efficiency and reduce costs. These developments can further increase SHIB’s appeal for decentralized finance use cases.

Current state and prospects

ScapesMania: ambitious future vision

The ScapesMania presale unfolds in several rounds, with the current one presenting a substantial 70% discount on token purchases. This discounted entry point provides an attractive incentive for early adopters, offering potential ROIs of 400-500% as the post-listing price hits the $0.1 mark.

Looking ahead, ScapesMania’s ambitious vision includes listings on major exchanges and continuous improvements. The team is on a mission to develop a unique niche concept not yet explored in crypto circles. This forward-thinking approach contributes to the outstanding presale figures, positioning ScapesMania as one of the potential long-term assets for crypto enthusiasts.

With its visionary roadmap and current presale offerings, ScapesMania could be a worthy bet for those seeking a foothold in the crypto space. To dig deeper into ScapesMania’s proposition, visit its official website, Twitter account, and Telegram channel.

Ethereum: potential impact of US ETF

The prospect of an Ethereum ETF in the U.S. market could lead to increased institutional interest and investment in Ethereum. The anticipation of such developments could create a bullish sentiment among investors, potentially driving up the price of ETH.

Crypto enthusiasts eagerly await SEC approval for ETFs, given the SEC’s historical reluctance, often citing market manipulation concerns. Optimists believe that ETFs holding major cryptocurrencies could significantly transform the market by facilitating mainstream investors’ entry into digital assets.

The future of Ethereum looks promising with the potential approval of an ETF. However, the SEC’s history of caution in approving spot cryptocurrency ETFs suggests that the road ahead may not be smooth.

Solana: stable growth amid volatility

The price situation of SOL is currently stable, showing signs of steady growth. The stability in its price, despite the volatile nature of the cryptocurrency market, is a positive sign for investors looking for a relatively less volatile asset.

Looking ahead, the future of Solana appears bright, with its rising adoption and stable price situation. The increasing interest from traders and its position as one of the most-traded cryptocurrencies could lead to further growth in its value.

Solana’s price surged by approximately 550% this year, emphasizing its strong network. Given Solana’s remarkable performance and robust infrastructure, it holds the potential to extend its ascent.

Polygon: resilience and whales’ interest

The price of MATIC has shown resilience in the face of volatility. After a retracement from its peak, MATIC has managed to rebound from its recent lows, retaining a substantial portion of its monthly gains with an overall 20% increase within the evaluated period.

At the same time, Polygon is seeing a rise in the MATIC exchange reserve. This signal indicates increased net deposits possibly driven by profit-taking motives.

The future of Polygon appears to be on a recovery path. The network’s heightened activity and continued interest from influential whales contribute to the optimism surrounding Polygon MATIC

Dogecoin: fluctuations and bullish signals

The price of Dogecoin DOGE has seen fluctuations since reaching a high of $0.087 on November 17. The decrease caused a deviation above the $0.082 horizontal resistance area.

The future of Dogecoin seems to be a blend of optimism and caution. The weekly timeframe suggests a bullish trend, while the daily timeframe indicates the potential for a retracement before a possible increase.

Considering the high levels of adoption and usage, the odds are certainly looking in favor of the bulls. Still, if DOGE manages to close above the $0.082 resistance area, it could signal a bullish takeover, potentially leading to a significant price increase.

Shiba Inu: a rebound potential

The technical analysis of the SHIB price chart shows a descending triangle formation, with a recent break below the lower trendline, suggesting a bearish outlook. However, the price is hovering above a crucial support level, with the 50-day moving average potentially acting as a springboard for a rebound.

The future of Shiba Inu is shrouded in uncertainty. If the wallet’s accumulation strategy positively influences market sentiment, we could see an upward price correction. However, the bearish indicators and unpredictability of large-scale transactions make it challenging to forecast SHIB’s prospects.

Investors are keenly anticipating Shiba Inu to surpass the $0.01 mark, aiming for the significant milestone of $1. Despite this optimistic outlook, reaching the price of $1 doesn’t look realistic. The Shibarium layer-2 network’s lack of burning trillions of SHIB adds complexity to the token’s growth.

Bottom line

In this dynamic phase of the cryptocurrency market, these six coins represent a blend of established reliability and exciting potential. Ethereum and Solana continue to demonstrate stability and growth, Polygon and Dogecoin offer a mix of stability and innovation, while Shiba Inu presents an opportunity for those willing to navigate its uncertain waters.

Meanwhile, ScapesMania emerges as a dark horse, offering potentially high returns and an opportunity to save big for early adopters. This affordability opens doors for investors with varying budget sizes to explore ScapesMania without significant financial commitments.

Discover more details about ScapesMania on the official site.

The post Top crypto picks to buy at rising market before it’s too late appeared first on CoinJournal.