- Bitcoin shows signs of a pullback after strong surge, with $100K still possible.

- XRP rallies 15% after breaking key resistance, targeting $1.35 amid regulatory hope.

- Vantard aims to offer exposure to meme coins without active trading through its native token VTARD.

As the crypto market resurges on Donald Trump’s reelection, three tokens—Bitcoin (BTC), XRP, and VTARD—are making headlines with impressive price movements and strong investor interest.

While Bitcoin is showing signs of a potential pullback after a meteoric surge, XRP is on a bullish streak following key technical breakouts. Meanwhile, Vantard, a new meme coin index fund, is gaining traction in its ongoing presale as investors look to capitalize on the “memecoin supercycle.”

Analysts project a potential Bitcoin pullback after strong surge

Bitcoin’s performance has been bullish, particularly in the wake of the US election. Bitcoin’s price surged past $93,000 before dipping to its current price of around $88,100.

Hawkish comments from Federal Reserve Chairman Jerome Powell, suggesting that rate cuts will be slower than previously anticipated, add weight to the bearish sentiment.

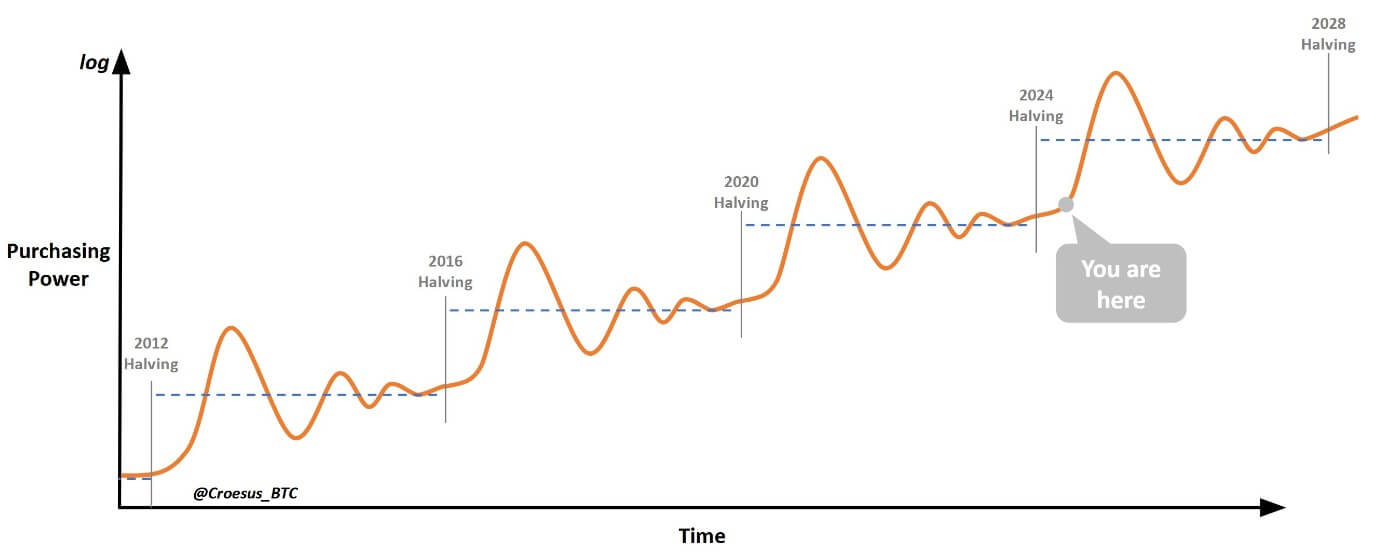

Market participants are starting to bet on a potential pullback as the overall sentiment shifts toward caution, but there remains a strong contingent of market analysts expecting Bitcoin (BTC) to break the $100,000 barrier in the long run.

Let’s be honest; no asset goes up in a straight line forever and volatility is set to stay high, so it wouldn’t be a surprise to see bitcoin take a breather at some point. Even so, it’s hard to look past the possibility of bitcoin reaching the illustrious $100,000 by year end.

— Josh Gilbert (@JoshGilbert_) November 14, 2024

The next few weeks will be crucial for Bitcoin, as the market watches how the implied volatility dynamics and broader economic factors, including interest rates, play out.

If BTC can break past its resistance levels, a surge towards the $100,000 mark could still be possible, but the increasing pressure on altcoins and BTC’s inability to secure a solid position above $90,000 points to a potential correction in the short term.

XRP breakout ignites bullish momentum

XRP has emerged as one of the top performers in the crypto market, gaining nearly 15% and reaching the $0.80 mark in a remarkable rally.

This XRP price surge comes after a long-awaited breakout from a descending triangle pattern that had constrained the token for over three years.

This $XRP breakout of the 3-yr downtrend means one thing

Massive rally incoming pic.twitter.com/RUwFuPDVM2

— Mikybull 🐂Crypto (@MikybullCrypto) November 14, 2024

On November 12, XRP broke through the $0.58 resistance level, triggering a wave of buying that saw its price surge by 40% in a short period. The rally was further bolstered by the news that SEC Chairman Gary Gensler may resign, fueling optimism that regulatory pressures on Ripple and XRP could ease.

The key resistance level at $0.7611 was also broken, with XRP managing to retest this level and continue its climb.

Currently, the next significant resistance lies at $0.9368, and if XRP surpasses this, the next target could be as high as $1.35—a potential 68% gain from its current price.

The positive technical outlook, combined with regulatory optimism, has ignited strong investor interest in XRP, making it a standout in an otherwise mixed market.

However, while the bullish momentum is undeniable, broader market conditions and regulatory shifts will continue to influence XRP’s trajectory.

If the positive news surrounding Ripple’s legal battle with the SEC continues to unfold favourably, XRP could see further gains, but volatility remains a constant factor in the crypto space.

Vantard, a Meme Coin Index Fund gains traction in presale

Vantard, the latest entrant to the meme coin market, has garnered significant attention due to its innovative concept: a Meme Index Fund that captures the top meme coins of the current cycle. The index fund is designed to give investors exposure to the explosive potential of meme coins without requiring active trading.

As it prepares to officially launch its platform, Vantard has already raised over $826,874 in its ongoing presale, with the current price of its native token, VTARD, set at $0.00014 per token.

Notably, as the presale progresses, the price is set to increase to $0.00015 in the next stage and continue rising to $0.00019 in the final presale stage.

According to Vantard’s whitepaper, it aims to allow investors to ride the “memecoin supercycle,” a term used to describe the ongoing surge in meme coin popularity. With the rise of meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB), Vantard offers a low-touch, index-like investment vehicle that aims to capitalize on this trend.

Investors holding VTARD tokens can redeem them for a share of the assets in the fund’s treasury, which includes Solana-based meme coins. This concept appeals to both seasoned crypto traders and newcomers looking to benefit from meme coin volatility without the need for constant monitoring and trading.

Vantard is positioning itself as the “ETF of meme coins,” bringing traditional finance strategies to the world of cryptocurrencies.

With global liquidity on the rise and a growing appetite for speculative assets, Vantard presents a unique opportunity for those looking to profit from the growing popularity of meme coins. Its presale success signals a strong market interest, and as the memecoin supercycle continues, VTARD’s potential for high returns could be a key attraction for investors.

For more information on Vantard and its ongoing presale, you can visit the project’s official website here.

The post Bitcoin, XRP and Vantard (VTARD) capture investors’ attention with price gains appeared first on CoinJournal.