Circle kündigte an, es werde bald eine Base-Version seines Stablecoins USDC angeboten. Damit wird die Bridged-Version USDbC überflüssig.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Circle kündigte an, es werde bald eine Base-Version seines Stablecoins USDC angeboten. Damit wird die Bridged-Version USDbC überflüssig.

Laut John Reed Stark, einem ehemaligen SEC-Beamten, will das US-Justizministerium möglicherweise Binance anklagen oder hat das bereits getan.

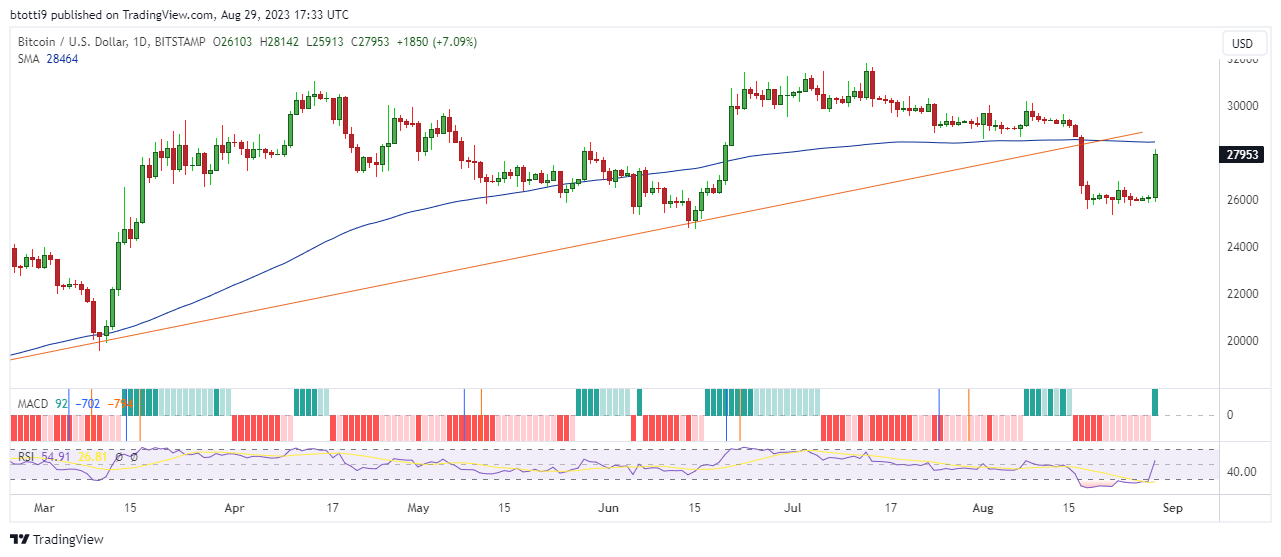

Bitcoin price saw a huge spike in volatility on Tuesday afternoon as prices across the crypto market rose. The world’s largest cryptocurrency by market cap jumped 7% to trade to highs of $28,142 at 1:05 pm ET, with the crypto market cap rising 6% to $1.15 trillion.

Elsewhere in the market, Ethereum traded to highs of $1,740, with its value up 5% in the past 24 hours. All the top 10 altcoins were in the green on the day at the time of writing, with BNB up 4%, XRP +3.8%, Cardano +4% and Dogecoin +6%.

Bitcoin’s sharp price action to the new multi-week high came as the market reacted to news that Grayscale Investments had won in its lawsuit against the US Securities and Exchange Commission (SEC).

As CoinJournal reported earlier today, the DC Circuit court ruled that the SEC had wrongfully denied Grayscale’s proposal to convert its Bitcoin Trust fund (GBTC) to a spot Bitcoin ETF.

The court vacated the SEC’s order disapproving the application and granted the petition to have SEC review the proposal.

The post BREAKING: Bitcoin hits $28k after Grayscale win against SEC appeared first on CoinJournal.

The U.S. Court of Appeals for the DC Circuit just ruled in favour of Grayscale in its long-running lawsuit against the Securities & Exchange Commission.

SEC had blocked the asset manager’s effort to convert its flagship Grayscale Bitcoin Trust to an exchange-traded fund last year.

But the ruling this morning paves the way for a Bitcoin ETF not just for Grayscale but also for others that have applied for one, including BlackRock and Fidelity. A Grayscale spokeswoman said today:

[Ruling] is a monumental step forward for investors, Bitcoin ecosystem, and those who have been advocating for Bitcoin exposure through added protections of ETF wrapper.

Bitcoin as well as Ethereum jumped more than 5.0% following the announcement on Tuesday.

Note that a Spot Bitcoin ETF is a big deal as several experts are convinced that it would help boost institutional interest in the cryptocurrency and potentially unlock its next leg up.

Shares of Coinbase Global – the listed custodian partner in a bunch of applications for such an exchange-traded fund are also up nearly 15% at writing. According to Dave Weisberger – the Chie Executive of CoinRoutes:

It virtually guarantees they will approve BlackRock and Fidelity. Grayscale may need to refile, but they will almost certainty be approved as well.

The Grayscale Bitcoin Trust currently manages assets worth about $16 billion. The aforementioned lawsuit against the U.S. Securities & Exchange Commission started in June of 2022.

The post Grayscale secures a big win against SEC in Bitcoin ETF case appeared first on CoinJournal.

The EOS Network Foundation has announced that the Japan Virtual and Crypto Asset Exchange Association (JVCEA) has approved the EOS cryptocurrency for inclusion on its whitelist. The accomplishment opens the door for EOS to be traded in Japan on authorized cryptocurrency exchanges against the yen.

By giving the EOS Network more exposure and accessibility to a wider spectrum of Japanese end users, developers, and investors, the JVCEA’s approval represents a significant advancement for EOS. Midway through September, EOS will start trading on BitTrade, a renowned cryptocurrency exchange authorized and governed by the nation’s Financial Services Agency (FSA).

Japan’s strict regulatory regime controlling digital tokens is well known for its thoroughness and sturdiness. The Payment Services Act mandates a detailed pre-screening procedure for new digital assets, and the JVCEA and FSA closely monitor and regulate crypto-asset providers. The EOS Network’s adherence to these strict rules demonstrates its dedication to openness, security, and innovation.

With the successful extension of Upland, built on EOS and one of the largest metaverses in the business, to encompass Tokyo, the network is already experiencing a rise in popularity and usage in the Japanese market.

EOS has a solid reputation among blockchain fans and developers thanks to its five years of uninterrupted mainnet operation and its top-tier Ethereum Virtual Machine, which offers unrivalled performance.

This endorsement shows that the EOS Network’s dependability and performance have been acknowledged, opening the door for further development and acceptance in East Asian markets. As one of the top blockchains globally, EOS is well-positioned for ongoing progress in the area thanks to strong collaborations and a successful track record.

The post EOS expands into East Asia markets with regulatory approval in Japan appeared first on CoinJournal.