- The new FTX CEO is working tirelessly to have the FTX crypto exchange launched.

- FTT token holders will not receive any distributions from the rebranded FTX exchange.

- FTX claimants will, however, own interests in the newly established offshore FTX Company.

The newly appointed CEO of FTX Trading Ltd., John J. Ray III, has unveiled a new draft strategy to “reboot” the defunct FTX cryptocurrency exchange.

In the proposal, which was unveiled on Monday, FTX.com claimants are allowed to own equity securities, tokens, or other types of interests in the newly established offshore company.

What will happen to FTT holders?

The new plan describes the debtors’ approach to grouping claimants into different categories. Users of the offshore FTX.com exchange will be referred to as “Dotcom customers,” while those using the FTX US will be called “U.S. customers.”

The Dotcom Customer Pool, the U.S. Customer Pool, and General Pool are the three main recovery pools that are suggested to be created on the new exchange. All fiat, digital, and other specified assets connected to FTX.com and FTX US will be included in these pools.

The newly created company, which was established in collaboration with outside investors, will run a “rebooted” offshore platform that won’t be available to American investors.

Each Dotcom customer will receive a pro-rata share of the proceeds from a pool of assets tied to the FTX.com exchange. However, the new plan indicates that claims from FTT holders, the collapsed exchange’s native token, “will be cancelled and extinguished as of the Effective Date and holders will not receive any distribution.”

Furthermore, claims from non-customers, like the regulatory penalties and taxes claims, will be subordinated.

The development comes a few days after FTX and Genesis agreed to an in-principle settlement to resolve claims by the two companies in the bankruptcy proceedings.

FTX 2.0 impending launch

The idea of restarting the collapsed FTX exchange was first suggested by the new FTX boss in January. The new management had targeted to relaunch in Q2, 2023.

According to a court document filed in May, Ray has been actively investigating the steps needed to restart the business and reviewing and completing the “FTX 2.0” materials to be distributed to investors.

Following the recent development and the anticipation of the FTX reboot, the FTT token has been climbing. At press time the FTT token price was trading at $1.41 up 5% in the last 24 hours.

The post FTX claimants to hold equity securities and tokens in the rebooted exchange appeared first on CoinJournal.

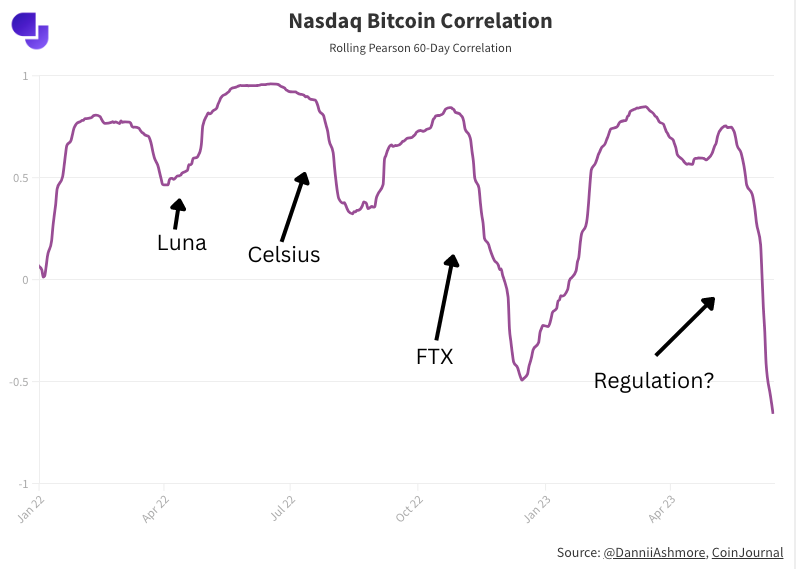

In fact, this deviation brought the Nasdaq’s correlation with Bitcoin to a five-year low. If we now re-run this chart, we see the correlation has picked back up again, rising to 0.5 and trending upwards.

In fact, this deviation brought the Nasdaq’s correlation with Bitcoin to a five-year low. If we now re-run this chart, we see the correlation has picked back up again, rising to 0.5 and trending upwards.