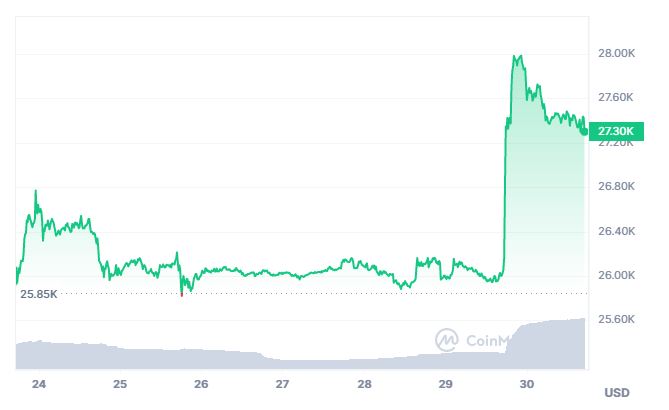

- Bitcoin price rose sharply on Tuesday, reaching highs of $28k after news of Grayscale’s win against the SEC.

- Santiment has shared data showing whales and sharks scooped over $388 million in BTC ahead of the news.

Bitcoin (BTC) whales have accumulated more and more over the past few months, with price dips providing a good buying opportunity. These large BTC holders appear to have rode the impending court decision in the Grayscale vs. US Securities and Exchange Commission (SEC) lawsuit to add to their holdings.

Bitcoin whales and sharks buy $388 million in BTC

Bitcoin price has retreated to around $27,370 at the time of writing on Wednesday, August 30, giving up some of the gains seen on Tuesday when the benchmark cryptocurrency spiked more than 6%.

But even then, market intelligence platform Santiment has highlighted a key on-chain metric involving Bitcoin whales and sharks. Per data from the platform, large holders purchased a total of over $388 million in BTC just prior to the news that Grayscale had scored another landmark win against the SEC.

As crypto reacted with upward action and BTC shot to above $28k, whales and sharks were “handsomely rewarded with a +6% price jump.”

“Whales & sharks may have known a thing or two about the outcome of the #Grayscale and #SEC lawsuit, with 10-10K $BTC wallets accumulating a collective $388.3M in $BTC the day leading up to the news. They were handsomely rewarded with a +6% price jump,” Santiment posted on X.

Was there a hint of manipulation here? Earlier, Santiment had retweeted (re-X’d) analyst Ali Martinez’ highlight of the fact that 30k BTC was sent to exchanges just before the Grayscale victory news.

📈 The exchange supply of #Bitcoin was boosted significantly just prior to #Grayscale’s win over the #SEC. It looks quite clear that the powers that be knew of the inevitable boost in #crypto market capitalization as a result of this outcome. https://t.co/ARsnt7vsRM https://t.co/jFFPwk1CHD

— Santiment (@santimentfeed) August 29, 2023

Bitcoin ETF – chances of approval up

In a decision delivered by the DC Circuit court, SEC’s order denying Grayscale’s proposal to convert its GBTC to a Bitcoin ETF was vacated. The court granted the company’s review petition and criticised the SEC for its capriciousness in the treatment of Bitcoin futures and spot ETFs.

Experts have since opined that the court’s ruling raises chances of the US market getting its first spot Bitcoin ETF. One of these is an application by asset management behemoth BlackRock.

The post Whales bought $388M of Bitcoin just before the Grayscale-SEC news appeared first on CoinJournal.