- Cryptocurrencies keep growing in popularity

- Bitcoin’s price dynamics changed with institutional investors’ adoption

- Bitcoin is now correlated with assets in the traditional financial market

Since digital currencies exist, the industry evolved exponentially in a little more than a decade. Currently, more than 22,000 cryptocurrencies are part of one of the most dynamic markets in the world.

The huge number of currencies brings a few challenges to traders and investors. First, crypto exchanges find it difficult to list all cryptocurrencies; thus, investors may miss some opportunities.

Second, many projects in the crypto space failed. Statistics say that nine in ten blockchain projects will fail.

For example, in 2023 alone, 83 coins disappeared for various reasons, such as failing ICO, no purpose, scams, or they had no volume.

Therefore, to avoid being caught in projects doomed to fail or to be scammed, many investors prefer cryptocurrencies with a large market capitalization and well-established in the investing community. In other words, if a cryptocurrency becomes part of institutional investors’ portfolios, the chances are that it will still exist in the medium and long term.

Bitcoin is such a digital currency.

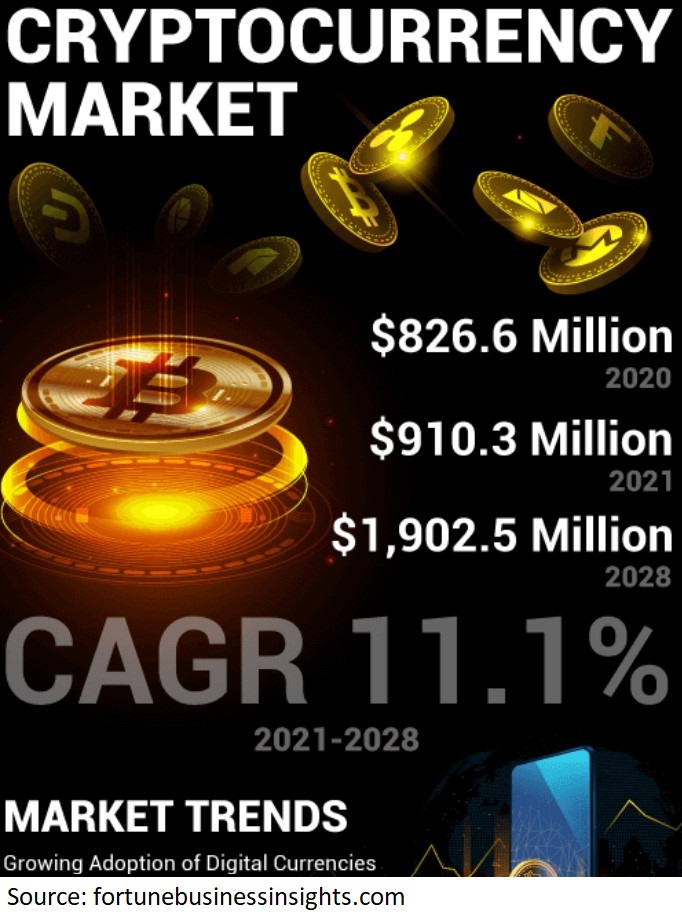

Bitcoin’s dynamics changed with the growing adoption of digital currencies

As the investing community embraced digital currencies, Bitcoin became part of more and more institutional investors’ portfolios.

But the adoption came with some costs.

Take the chart above. It shows Bitcoin’s price evolution since its inception.

When it first traded above $1,000, Bitcoin caught everyone’s attention. Then, when it reached $20,000 for the first time, everyone talked about a bubble.

So strong was the resistance level that it took Bitcoin a few years to overcome it. Respecting the interchangeability principle, resistance has become support recently.

But such ample moves are unlikely to be seen in the future. Because Bitcoin’s correlation to traditional financial markets increased, it is unlikely for the price to triple or double without similar moves elsewhere.

Summing up, Bitcoin may be a good investment for the long term, but the rising adoption of cryptocurrencies will make it more and more difficult for the price to move the way it did before.

The post Should you own Bitcoin, given the growing adoption of digital currencies? appeared first on CoinJournal.