Key Takeaways

- Ethereum completed its long-awaited Merge upgrade in September 2022

- Stakers are currently earning approximately 4% APY from their Ether tokens

- 19% of the total Ether supply is staked, the lowest ratio of any of the leading coins

- Staking rewards are divided among stakers, meaning the APY earned decreases as more users stake

- Demand on the network increases gas fees and ultimately contributes to more APY, meaning there are several factors at play when trying to assess where the yield may land

- All in all, it remains up for debate as to where the yield is headed, despite many analysts predicting basement-level yields of 1%-2% are inevitable

The fundamentals of Ethereum were entirely transformed in September 2022 when the Merge went live, the blockchain officially becoming a proof-of-stake consensus. The implications for this are many, however one of the more fascinating aspects is that investors can now earn a yield from staking their Ether tokens.

Let’s dive into how popular staking has been, where it’s trending going forward, and speculate about where the all-important APY may land.

Ethereum stakers are increasing

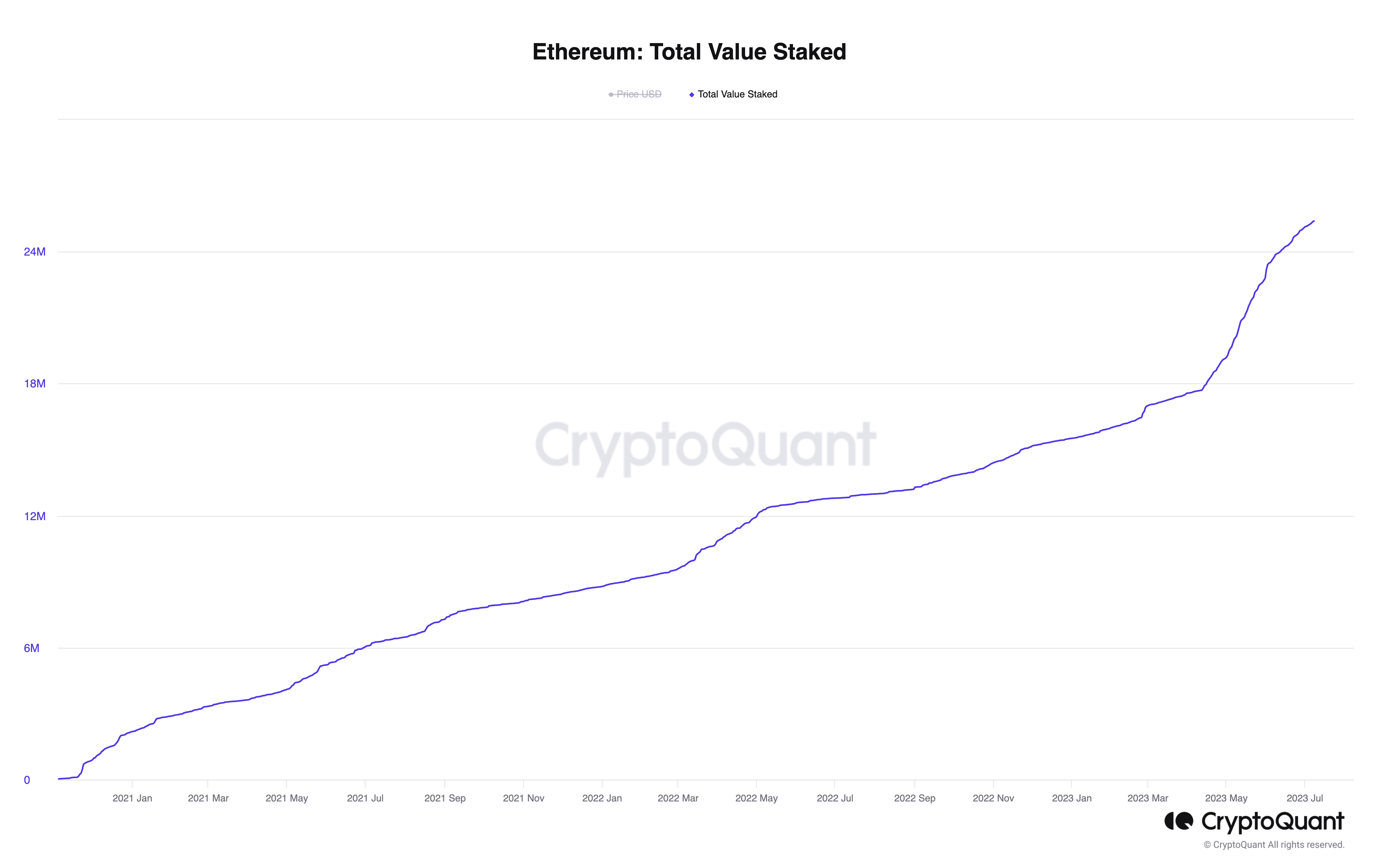

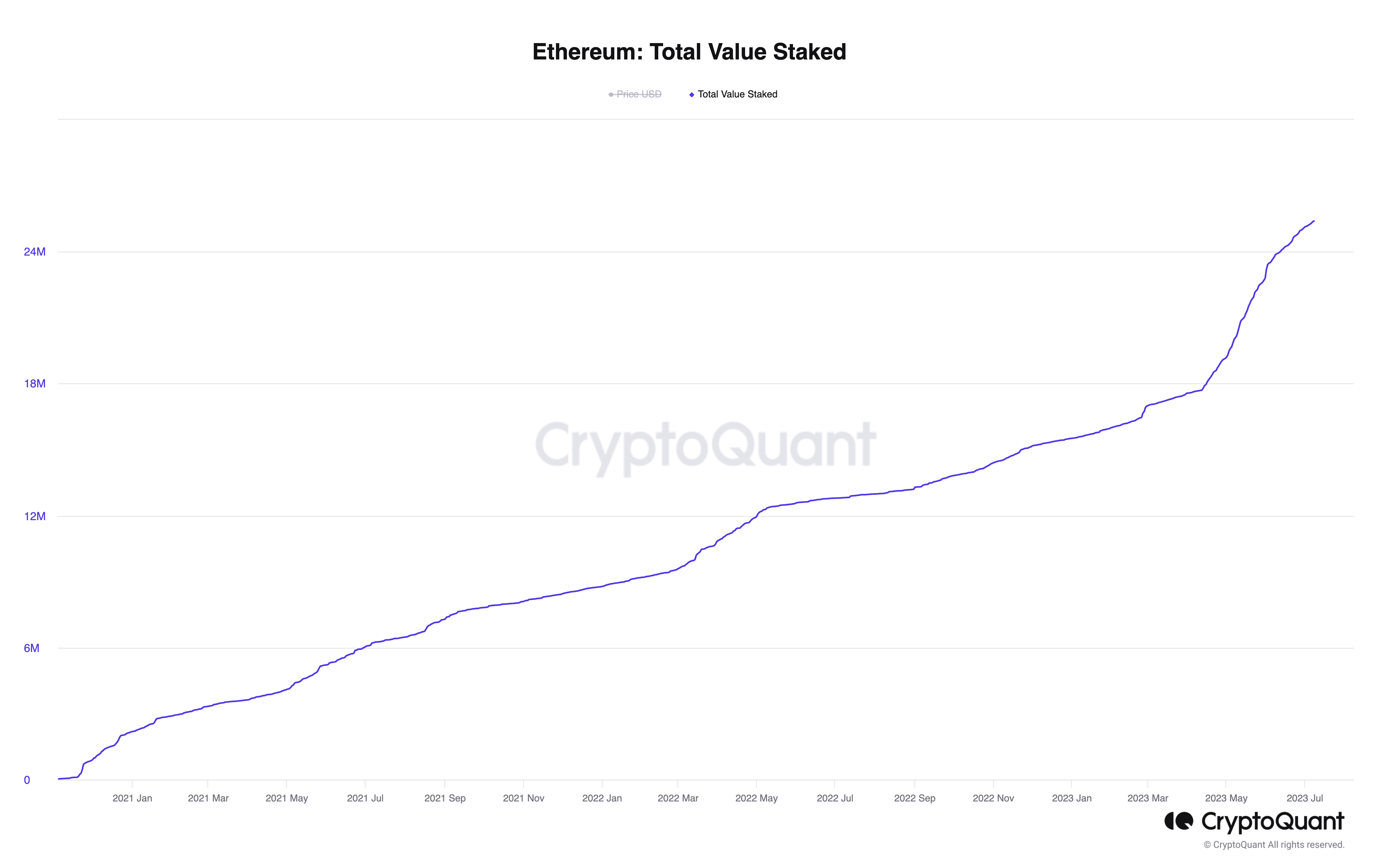

Ethereum staking has proved wildly popular. There is currently almost 18.75% of the total supply staked. The below chart from CryptoQuant shows that not only has the increase been consistent, but the rate of increase has steepened noticeably since the Shapella upgrade in April.

Shapella finally allowed staked Ether to be withdrawn, with some early stakers having had tokens locked up since Q4 of 2020. There was hence some concern that Ether would be withdrawn en masse once the Shapella upgrade went live, the subsequent sell pressure bound to dent the price. Not only has this happened, but staking has only become more popular since the upgrade.

Despite the popularity of Ethereum staking, and the lack of withdrawals sparked by Shapella, the network’s staked tokens as a percent of the total supply still pale in comparison to other proof-of-stake blockchains.

Despite the popularity of Ethereum staking, and the lack of withdrawals sparked by Shapella, the network’s staked tokens as a percent of the total supply still pale in comparison to other proof-of-stake blockchains.

The chart below highlights Ethereum in yellow, its 19% ratio far below the other major proof-of-stake coins. Assessing the rest of the top 10 by staked market cap, these coins average a 53% stake ratio, with only BNB Chain remotely close to Ethereum, sitting at 15%.

If we then shift the chart to assess the total market cap of the staked portion of coins, Ethereum’s dominance is clear. Its 19% staked tokens carry a value of $43 billion – more than the other nine cryptos’ staked market caps combined.

Ethereum’s low staked ratio implies that it should have more, at least if other coins can be used as a benchmark. This is especially true when considering recent bullish developments on the Ethereum network which suggest it may be solidifying its place as the market-leading smart contract platform. Most notable of these could be discussion around potential Ether futures ETFs, as well as the announcement that PayPal is launching a stablecoin on the network this week.

So, what happens to the staking yield if the amount of staked Ether does indeed continue to increase? Remember, the total annual yield paid out to stakers is calculated as follows:

[(gross annual ETH issuance + annual fees*(1-% of fees burned)]

These total staking rewards are then divided by the average ETH staked over the year to commute the APY.

In other words: The amount of ether staked is in the denominator of the fraction. So as the amount staked gets bigger, the APY shrinks. This effect can already be seen in what has happened to date. Analysts had predicted a yield of 10%-12% ahead of the Merge, however today it is closer to 4%. And that is 4% with its staking ratio completely out of whack compared to other proof-of-stake coins, as mentioned above.

What happens next?

With the amount of Ether staked increasing incessantly, is the yield therefore primed to collapse?

Some analysts believe it is headed towards 1%-2%; some even think less. The reality is that nobody really knows because, as always, demand relies on a variety of factors.

We need to remember, as we often say in these columns, that speculating on the future of crypto is so difficult because we have such little data to work with. This is true for Ethereum as a whole, which only launched in 2015, but especially so regarding the yield, as the Merge has only been live since September (or since April if you count the “true” completion date as post-Shapella).

Hence, it is a challenge to forecast the staking yield going forward. We have focused on the impressive growth of staking thus far, and while this will drive the yield down, demand on the network will increase the numerator of the aforementioned formula and kick the yield up.

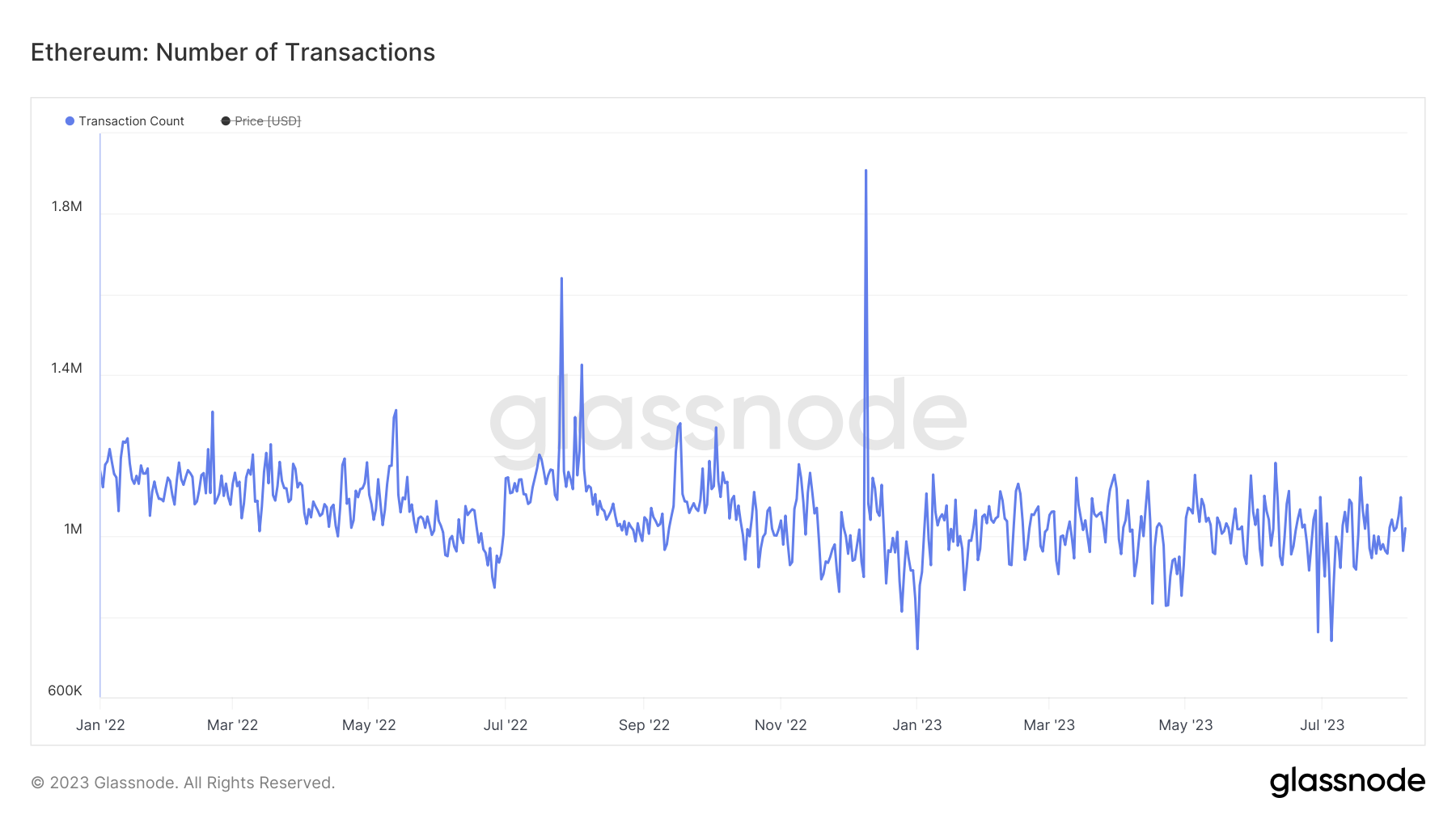

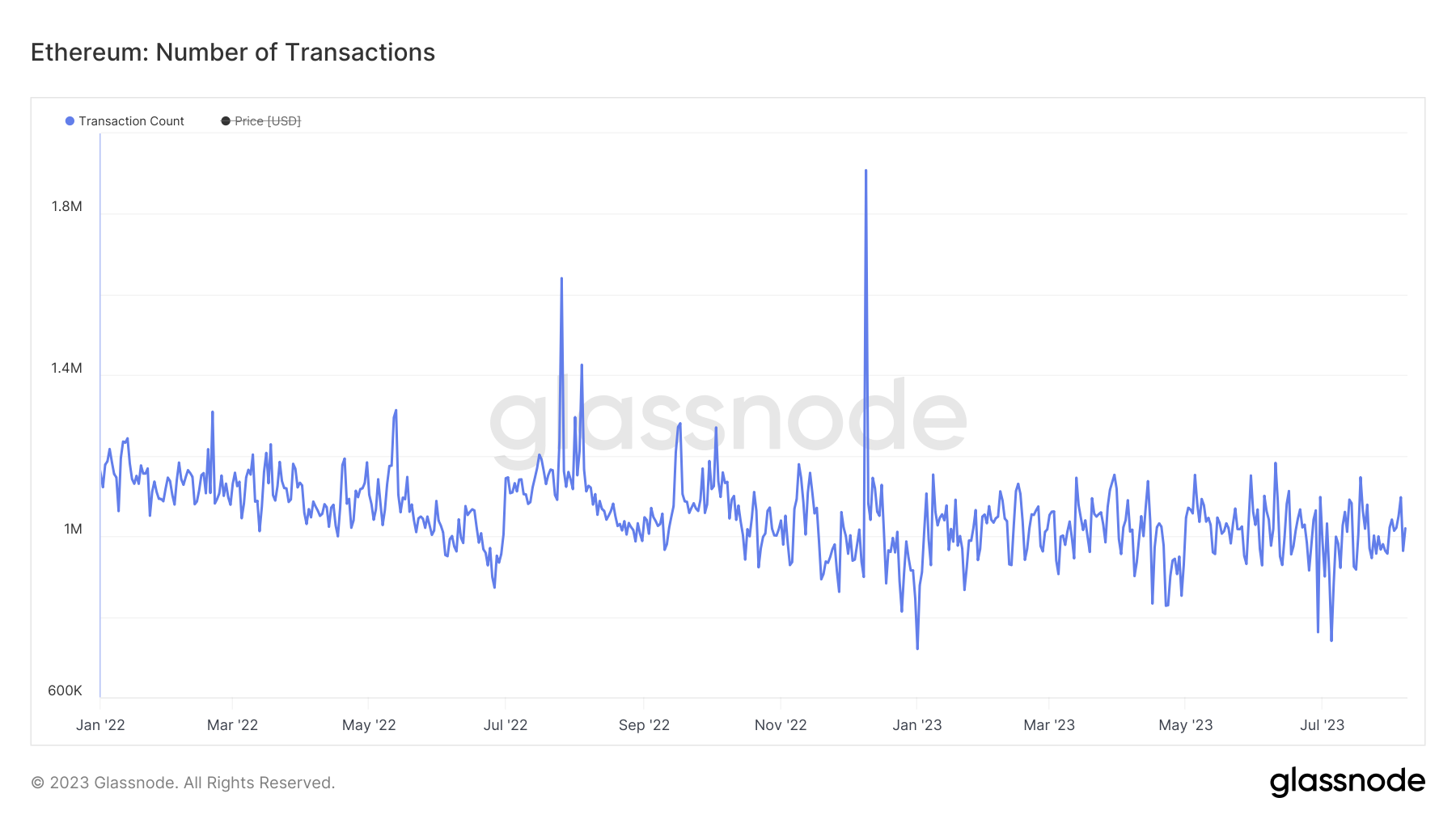

Indeed, looking at total transactions, the rate has been quite resilient throughout the last eighteen months, despite the bloodbath in the sector last year.

Then again, crypto is changing quickly. It remains difficult to foresee how regulation, infrastructural development (restaking and Eigeanlayer spring to mind as an example) and the macro landscape, just to name a few factors, will affect the climate going forward.

Speaking of macro, there is also the matter of trad-fi yields. Currently, the Fed funds rate is 5.25%-5.5%, having been near-zero prior to March 2022. Backing out probabilities from Fed futures implies the market is expecting the end of the cycle is near. Not to mention, with the mammoth amount of debt in the current system, rates cannot stay high forever.

Could falling trad-fi yields affect demand for staking yield? Perhaps – while it is hard to separate the overall liquidity drain and suppressing of risk assets that occurs out of hiked rates, the superior (and risk-free) return is definitely a key reason why capital has flooded out of DeFi in the last year. While previously-dizzying DeFi yields have collapsed, trad-fi yields have rocketed as the Federal Reserve has scrambled to rein in rampant inflation.

Furthermore, if yield does fall down towards 1%-2%, stakers could begin to pull out and search elsewhere for income. This would therefore create a reflexive relationship with regard to the yield.

All in all, it remains too early to speculate about where the Ethereum staking yield is ultimately headed, at least with any degree of confidence; it depends on too many factors and the sample space is too brief to date. It does seem likely, if not inevitable, that the yield will decline to some degree, but the question of how much is a difficult one to answer. While many are adamant the APY will cascade downwards to uber-thin levels – and for the avoidance of doubt, it may do – we have presented here at least some points of consideration as to why the situation may not be as clear cut.

The post What will happen to Ethereum’s staking yield? appeared first on CoinJournal.

Despite the popularity of Ethereum staking, and the lack of withdrawals sparked by Shapella, the network’s staked tokens as a percent of the total supply still pale in comparison to other proof-of-stake blockchains.

Despite the popularity of Ethereum staking, and the lack of withdrawals sparked by Shapella, the network’s staked tokens as a percent of the total supply still pale in comparison to other proof-of-stake blockchains.