Key Takeaways

- The next Bitcoin halving is slated for April 2024, the fourth of Bitcoin’s existence

- Litecoin has just undergone its fourth halving, but the price effects of Litecoin halvings in the past have not been as strong

- Sample size is small meaning it is hard to conclude with confidence whether halvings have tangible price effects in the short-term

- Bitcoin is a very different proposition to Litecoin, but the price action going forward of the latter will be interesting to track as we approach Bitcoin’s next halving in April 2024

Whether Bitcoin halvings are priced in has become a fervent topic of debate among the community. We put together an analysis of this question a few weeks ago, as we now fast approach the fourth halving of Bitcoin’s young life.

Slated for April 2024, the halving will cut the Bitcoin block subsidy from 6.25 Bitcoins to 3.125 Bitcoins per block, halving the issuance rate of newly created supply.

We will not rehash (pun intended!) our aforementioned analysis of the upcoming halving here. Instead, we will focus on another coin: Litecoin. One of the world’s first altcoins, it is a derivative of Bitcoin and, intriguingly, just underwent the fourth halving of its life.

Can Litecoin therefore be seen as a guinea pig ahead of Bitcoin’s own halving next year? Well, not really, but we may be able to gain certain insights.

First, let us examine Litecoin’s performance through past halvings. Price data is quite illiquid prior to 2015, so the below chart omits the first halving.

The log scale of the chart somewhat obscures it, but the second halving in 2015 preceded strong price performance for Litecoin. On the other hand, the third halving in 2019 saw falling prices, before the trend reversed after COVID struck in 2020, when the entire crypto sector surged into the mainstream.

It is too soon to draw conclusions regarding the fourth halving, which occured just over a week ago on August 5th. Nevertheless, Litecoin’s halvings don’t offer compelling evidence of a strong relationship thus far at least. Furthermore, like most questions in crypto, the sample size is so small that even if they did precipitate aggressive price rises immediately, that would not necessarily mean there is causation.

Bitcoin is not Litecoin, but again, we may be able to derive clues from the pattern in ascertaining the effect of halvings on the former, even if we can’t be confident given the sample size issues. First, let us now look at Bitcoin’s price action while marking the halving events:

The pattern is clear. Typically, we have seen outsized volatility in the months leading up to a halving, before strong outperformance on the other side. The outperformance has also grown smaller with each halving, perhaps unsurprising given the market cap has grown so much in the four years between each event.

So, why has the effect of halvings on Bitcoin been, at least optically, larger than the same events on Litecoin? The first theory takes us to the heart of the debate on whether halvings are really priced in: while previous events have preceded steep inclines for Bitcoin, they have also lined up well with global liquidity cycles.

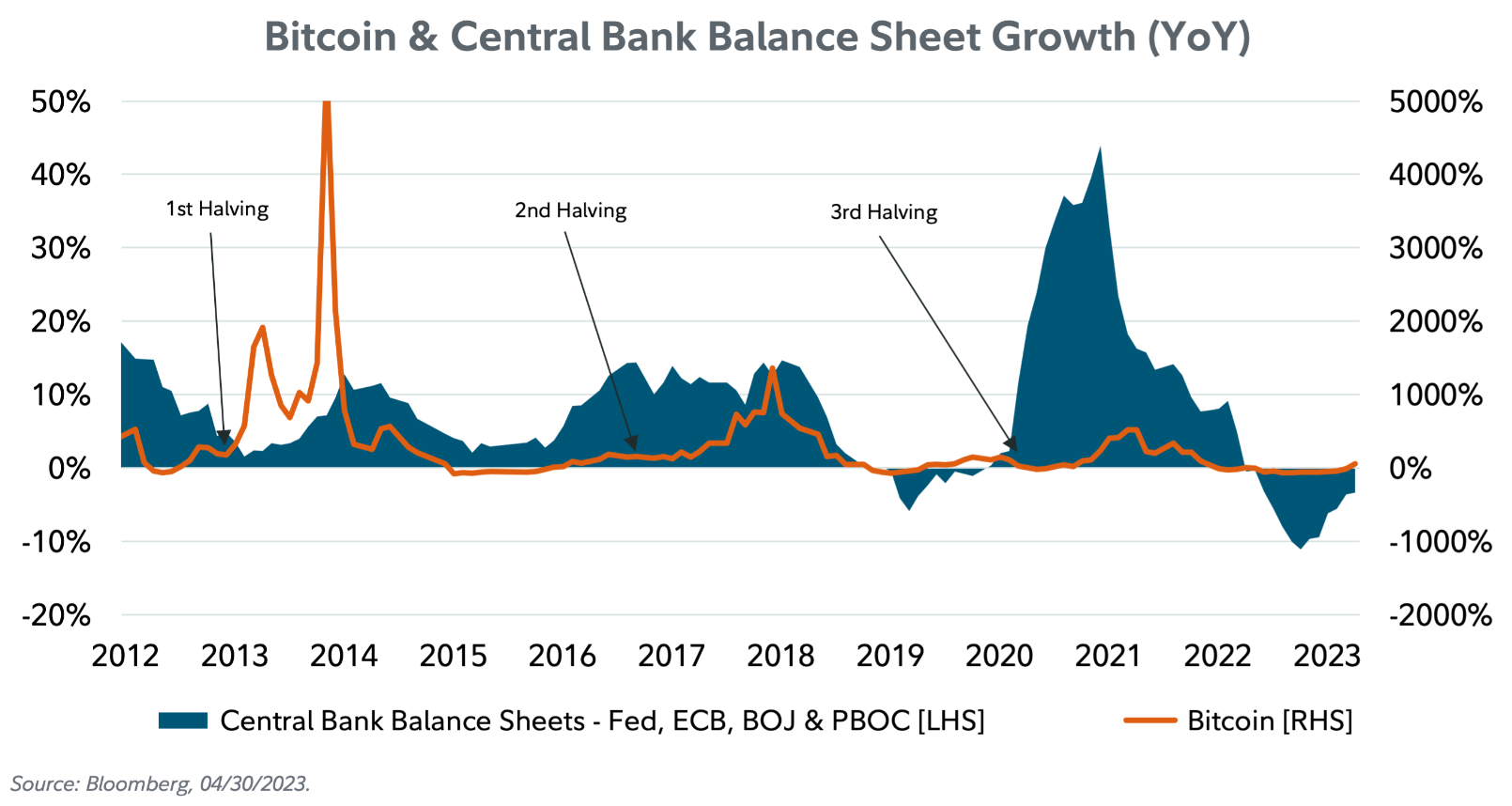

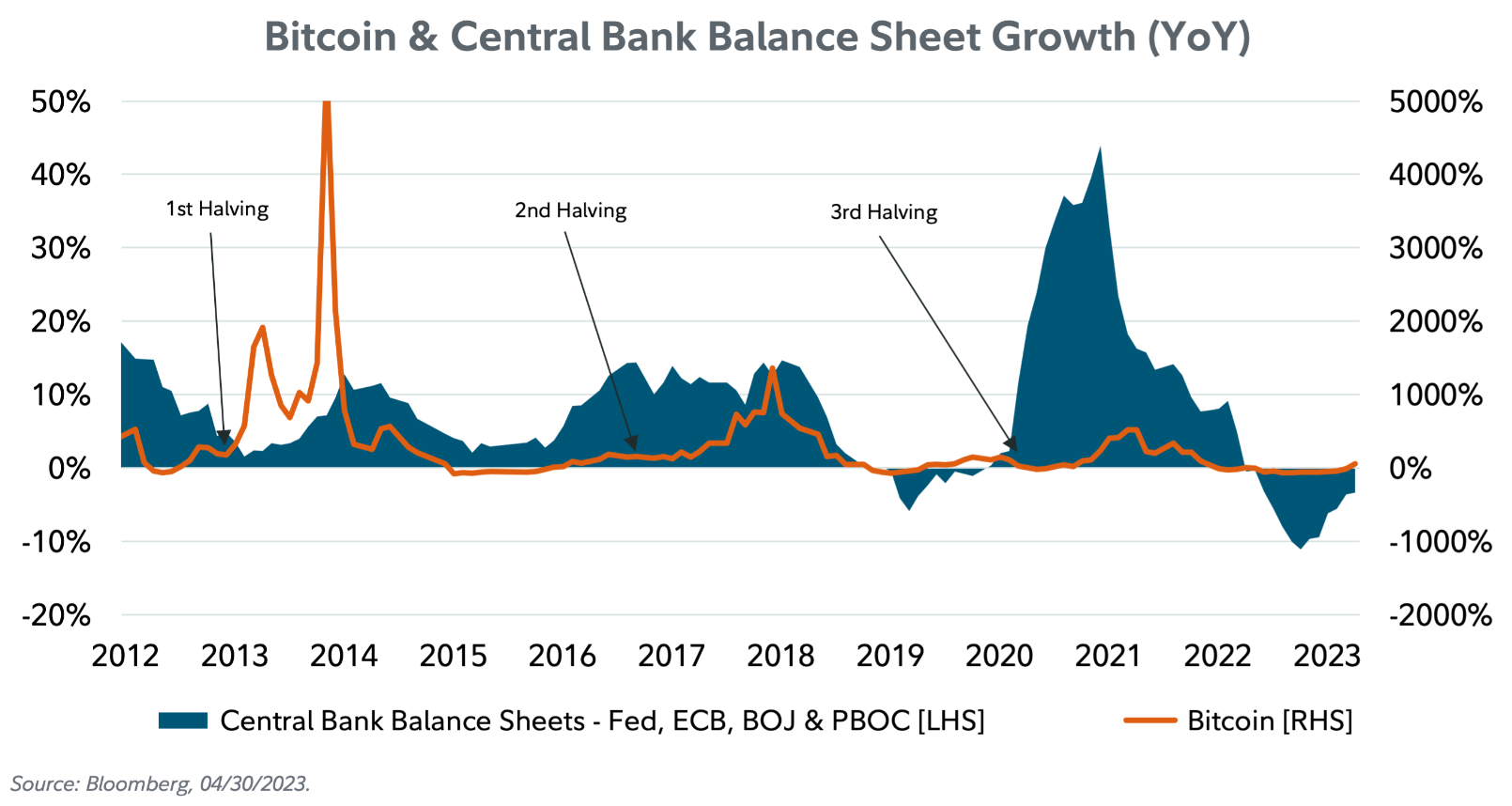

The below chart from Fidelity shows this well. There is perhaps no greater influence on the valuations of risk assets than central bank balance sheets, and the halvings have lined up incredibly well with the expansion of those same balance sheets.

The thing is, the next halving could well line up with an expansion in liquidity again. The previous eighteen months have seen one of the fastest rate-hiking cycles in recent history, with the Fed funds rate now above 5%. Now, looking at probabilities implied by the futures market, the market is anticipating that the hikes are coming to a close (if they haven’t done so already).

Looking further forward towards the time period around the halving (April), futures imply that rate cuts could come into play. Not to mention, when we look at the yield curve, it is currently at the deepest level of inversion since the early 80s. The bottom line is this: the fourth halving, through sheer chance, could again line up miraculously well with global liquidity cycles.

Of course, the macro situation has been changing incessantly, and there is every chance that forecasts around the liquidity cycle could flip, and the halving won’t line up as well as it has done in the past.

This is where Litecoin may come in. With its halvings landing at different dates to Bitcoin in the past, yet not boosting prices as much as the orange coin saw, perhaps it is just a timing thing, whether macro-related or other? Looking at Litecoin’s price action compared to Bitcoin, the duo are tightly correlated, like many altcoins in the space. If Litecoin’s halving does not cause a slight outperformance this time compared to Bitcoin or other coins, what would be the explanation?

Ultimately, like we keep saying, the sample size is small. Bitcoin has only experienced three halvings, and one could even argue that it was only the recent event in 2020 that occurred while the asset was trading with sufficient liquidity.

Litecoin’s less explosive price action after its own halvings do perhaps throw further doubt on the theory that a 50% cut to the new supply issuance will inevitably kick up the price. And yet, Litecoin is not Bitcoin, so the debate will rage on.

Either way, revisiting Litecoin’s price performance around the time of Bitcoin halving will be interesting, because by then it will have had around eight months post-halving and may present a more relevant reference point.

The post Does Litecoin’s halving provide clues ahead of Bitcoin’s next April? appeared first on CoinJournal.

XRP price chart. Source: TradingView

XRP price chart. Source: TradingView