-

Bitcoin and other cryptocurrencies plunged hard last week.

-

This decline happened amid a sense of fear in the financial market.

-

Shiba Memu token sale has gained steam as the developers raised over $2.1 million.

Cryptocurrency prices had their worst performance this year as Bitcoin plunged from $29,000 to below $26,000. Most coins and tokens were deeply in the red as demand waned and a sense of fear spread in the market. Despite this retreat, Shiba Memu’s token sale continued, with the developers raising over $2.18 billion.

Why did cryptocurrencies slip?

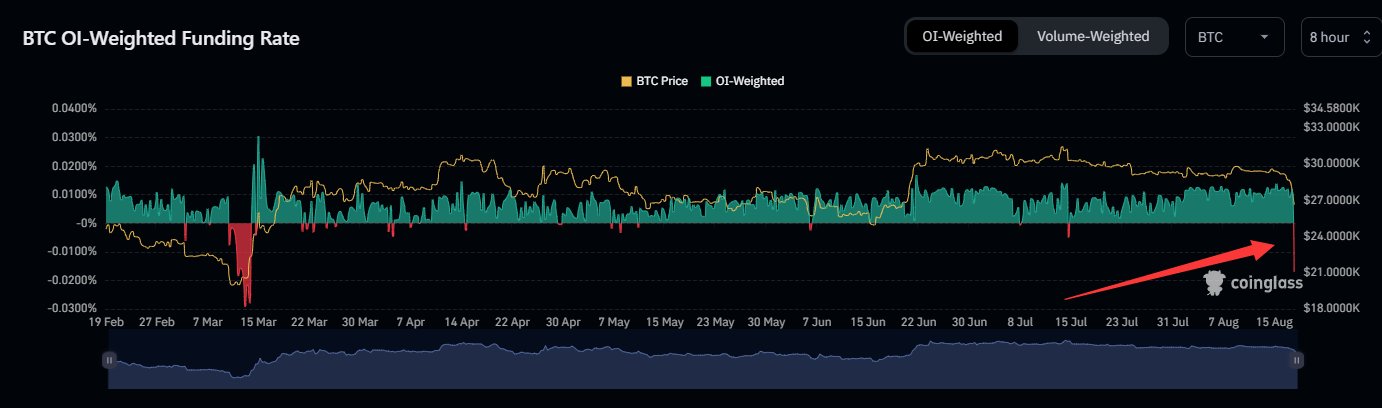

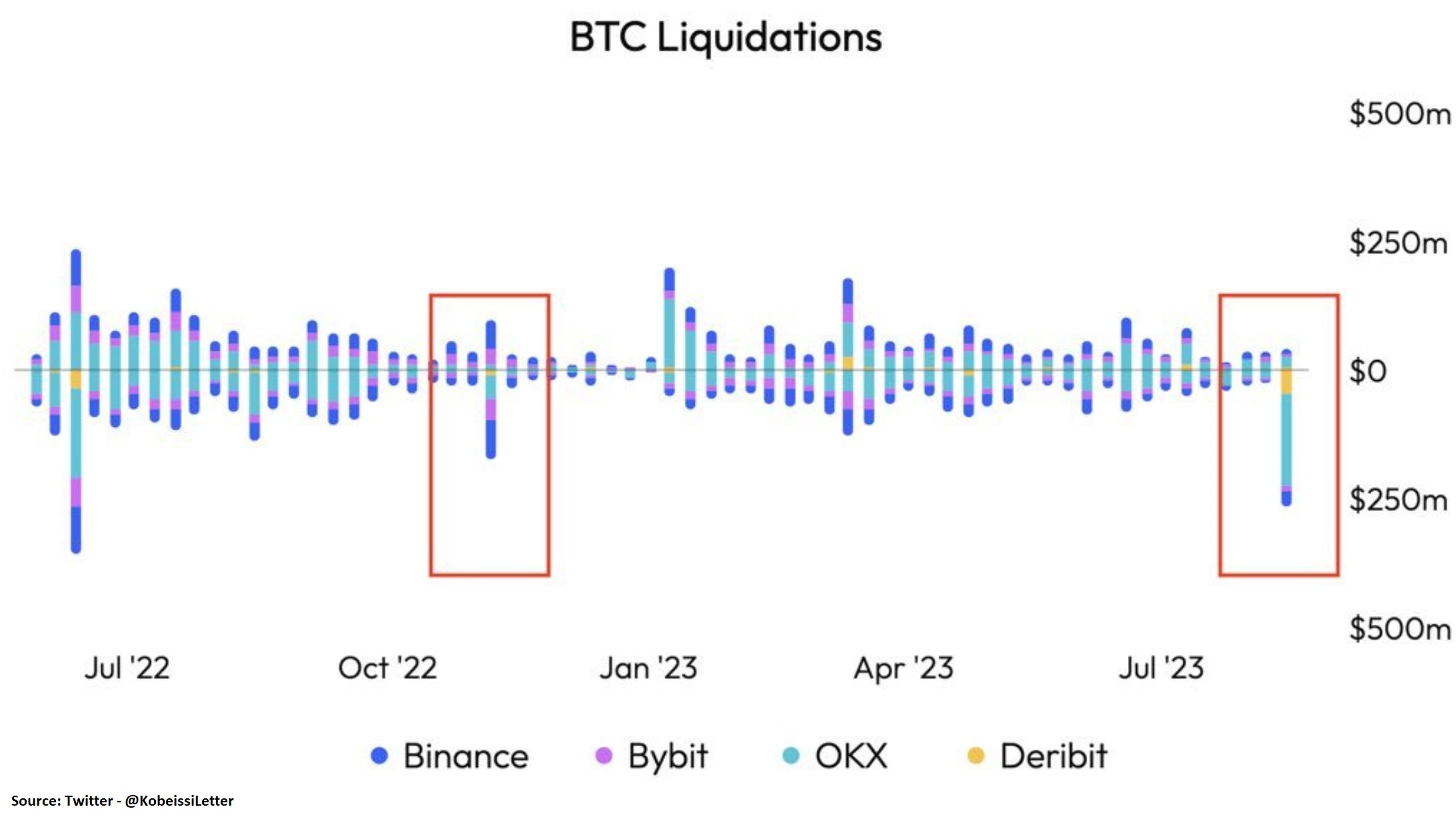

There are several reasons why most cryptocurrencies plunged last week. First, the coins dropped because of a potential shakeout. A shakeout refers to a situation where a financuial asset dips sharply and then resumes the bullish trend.

The most recent shakeout happened when Bitcoin fell from $25,000 to $19,000 and then resumed the bullish comeback to the year-to-date high of $32,000. It is still unclear whether the current decline was a shakeout or the start of a new bear run.

Second, Bitcoin dropped because of technical reasons. Bitcoin formed a double-top pattern at $32,000. In price action analysis, this pattern is usually a bearish sign. Therefore, from these technicals, there is a likelihood that the coin will continue falling.

Third, a sense of fear spread in the market as evidenced by the stock and bond market sell-off. Bond yields in most developed countries jumped, with US 10-year rising to 2012 highs and the 30-year reaching the 2007 highs. Bond yields move inversely to prices.

Further, cryptocurrency prices dropped because of the Chinese economy, which is going through the deepest slowdown in years. Data published last week showed that most parts of the economy like retail, industrial production, and fixed asset investments are slowing at a fast pace. China is still an integral part in the crypto industry, accounting for 20% of Binance volume.

Shiba Memu is still thriving

Shiba Memu, an upcoming cryptocurrency that combines aspects of meme coins and artificial intelligence, is thriving. Data available in its website shows that the developers have raised over $2.1 million from investors around the world. They have done that by raising over 68.1 million tokens in the past two months.

Shiba Memu’s token sale is unique because the price of the token is raised every days. This means that investors who bought the token on the first day have seen their value jump sharply even without doing anything.

Shiba Memu is thriving because of the industries that the developers are targeting. AI has become the fastest-growing industry this year, helping to push Nvidia’s market cap to over $1 trillion. Similarly, meme coins have thrived, with some tokens like Pepe transforming some people into instant millionaires.

With the rising hype, there is a likelihood that the Shiba Memu price will also jump when it debuts in centralized and decentralized exchanges soon. You can buy the Shiba Memu token here.

The post Shiba Memu token is thriving despite the painful crypto sell-off appeared first on CoinJournal.