- Chancer has seen nearly $1.6 million raised in its presale.

- Interest in the prediction markets crypto project has increased despite recent crypto sell-off.

Is the current crypto market landscape a good time to invest? Experts opine the correction offers yet another opportunity to buy low. The same could apply to new gems in the market – and the Chancer presale suggests investors see value in blockchain-based betting.

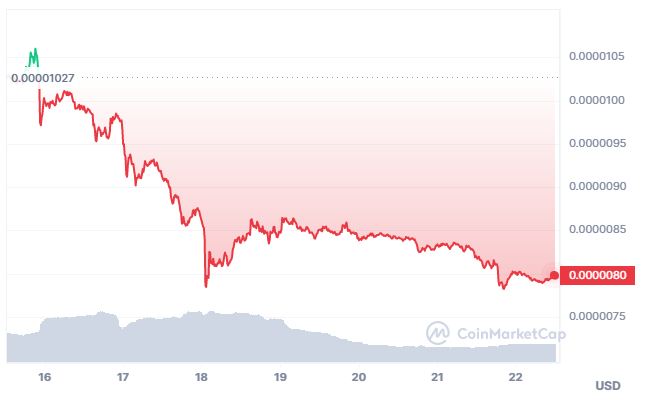

Crypto correction sees altcoins slide further

Bitcoin and Ether prices are trading at critical levels after last week’s sell-off pushed BTC to under $25k and ETH to below $1.6k. Bitcoin is currently 11% down this past week, while Ether has shed nearly 10%.

Despite resilience creeping back into the outlook for the top two coins by market cap, the broader altcoin market is showing fresh weakness across many prices.

Double-digit losses for XRP, BNB, Polygon, Solana and Cardano over the weekly time frame threatens a strengthening of the short term bearish perspective. Analysts point to regulatory and macro headwinds are key factors in coming months.

However, despite the overall weakness, experts see a flip towards a bull market early next year. Potential upside catalysts include spot ETFs and regulatory clarity. The downswings could thus be opportunities for portfolio buffing.

What is Chancer?

Chancer is a new crypto project that could revolutionise not just the betting market but the entire gambling sector. The project offers a decentralised predictions market that takes control from the traditional, centralised bookmaker and hands it to individual bettors.

Chancer’s innovative social betting project is thus seen as a potential game-changer for the entire industry, particularly when it comes to removing the limitations created by traditional platforms’ central “house” approach.

With Chancer, you can create bets on anything, including sports, elections and local community events.

$CHANCER token and fast-selling presale

The Chancer ecosystem will be powered by $CHANCER, a utility token to be launched on the Binance Smart Chain.

A presale for the token, which launched to a lot of buzz recently, has already attracted nearly $1.6 million from investors. Currently, the price of $CHANCER is $0.011 and will increase throughout the offer period to $0.021.

The Chancer team has made it easier for investors to buy $CHANCER by adding support for BNB, ETH, USDT and BUSD

Why buy $CHANCER amid the current market downturn?

While you cannot predict what happens in the markets down the road, possible scenarios for market outlook can be drawn from possible tailwinds and headwinds. The pain witnessed during the crypto winter is not fully dissipated, but as noted above, analysts are increasingly bullish on crypto.

Also, Chancer’s roadmap suggests the platform’s launch might slot in nicely with the uptick in crypto market returns.

It is a case scenario that sees investors eye the opportunity in a blockchain technology project that promises to bring transparency to the global sports betting industry.

Per a recent forecast report for the industry, significant growth is expected over the next decade. Experts also contend that decentralised sports betting is gearing for a major adoption curve. Chancer could spearhead the P2P betting revolution.

In terms of what Chancer actually offers, the whitepaper outlines more than just a currency to creating bets, playing and winning payouts.

Holders will also have passive income opportunities, including via staking and a Share2Earn feature that allows them to promote their bets to the global community. The more one shares with friends and family, the greater the rewards in $CHANCER tokens.

Are you interested in learning more about this project? Visit Chancer.com.

The post Chancer pulls in $1.6M from global investors. Buy amid the crypto correction? appeared first on CoinJournal.