- Firms in the travel sector, including Lufthansa, EuroWings, Hahn Air, and Sunnycars, have backed the Camino Network consortium blockchain.

- Hexens has previously audited well-known projects like Polygon Labs, Celo, and Lido.

- Camino Network is also inviting white-hat hackers for a $50,000 bounty program.

The Camino Network Foundation has announced that the Web3 travel ecosystem Camino Network has successfully completed a security audit conducted by the renowned cybersecurity company Hexens with great results.

Camino Network, which was introduced earlier this year, is a public, permissioned Web3 blockchain that anyone may build on. By enabling users to create and deploy decentralized applications backed by smart contracts, it will revolutionize the travel sector and usher in a new era of travel-related goods and services. Numerous significant firms in the travel sector, including well-known names like Lufthansa, EuroWings, Hahn Air, and Sunnycars, have backed the Camino Network consortium blockchain.

Camino Network security audit

Since Camino Network has always placed a high focus on security, it set out to locate a dependable and trustworthy partner to audit its sizable codebase and offer suggestions for patching any vulnerabilities.

The Camino Network Foundation ultimately decided to collaborate with Hexens, which has considerable experience reviewing the code for smart contracts and blockchain infrastructure, having previously worked on well-known projects like Polygon, Celo, and Lido.

Hexens is regarded as a pioneer in the creation of fresh bug-finding methods and employs the industry’s known procedures and workflows to uncover vulnerabilities and provide recommendations.

Nine minor flaws were found during Hexens’ audit of Camino Network’s L1 codebase; each was swiftly fixed by the team to maintain the network’s reliability. The adherence to excellent coding methods and emphasis on strong security is demonstrated by the absence of any significant vulnerabilities.

Camino Network bug bounty program

Following the audit, the Foundation hired Hexens to continually contribute actively to its security. Through cooperation, Camino Network can ensure the travel industry that maintaining the security of the ecosystem is one of its top goals.

To that aim, Camino Network has established a formal bug bounty program, asking white-hat hackers to evaluate the security of its network in exchange for payments of up to $50,000 for the discovery of serious flaws.

The post Web3 travel ecosystem Camino Network passes Hexens security audit appeared first on CoinJournal.

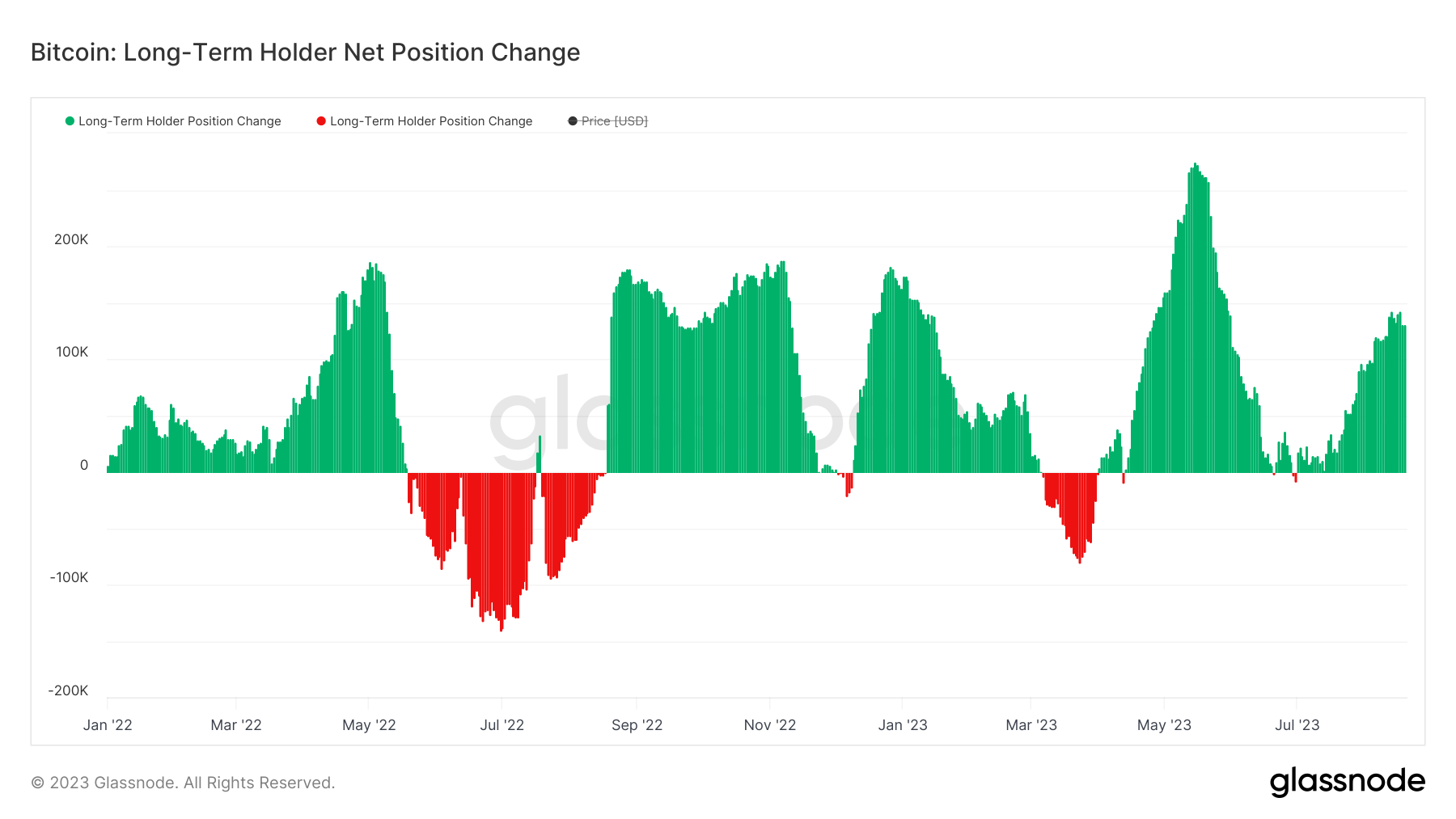

(As a note, Glassnode defines long and short-term holders via a logistic function centered at an age of 155 days and a transition width of 10 days).

(As a note, Glassnode defines long and short-term holders via a logistic function centered at an age of 155 days and a transition width of 10 days).