Spanien will sich in der Europäischen Union (EU) als Marktführer in Sachen Künstliche Intelligenz etablieren und gründet zu diesem Zweck eine eigene Behörde für die boomende Branche.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Spanien will sich in der Europäischen Union (EU) als Marktführer in Sachen Künstliche Intelligenz etablieren und gründet zu diesem Zweck eine eigene Behörde für die boomende Branche.

Nachdem das positive Urteil im Verfahren gegen die SEC zuletzt für einen Höhenflug gesorgt hat, befindet sich die Ripple-Kryptowährung wieder auf dem Rücklauf und muss nun mit neuem Verkaufsdruck rechnen.

Num Finance, a stablecoin issuer focused on the Latin America market, has launched a new stablecoin pegged to the Colombian Peso.

The new stablecoin is dubbed nCOP and will be issued on the Polygon network, Num Finance’s blockchain partner, and is designed to bring the benefits of borderless transactions to the Colombian remittances market.

“In Colombia, there exists a unique opportunity to “tokenize” remittances and offer them a yield in nCOP, based on regulated financial products. Currently, Colombia is one of the main recipients of remittances in Latin America, with nearly USD 6.5 billion flowing into the country. Num Finance aims to provide a new possibility for people to send and receive nCOP as remittances and get a yield on it,” Num Finance CEO Agustín Liserra said in a blog release.

nCOP will be an overcollateralized stablecoin pegged 1:1 to the Colombian Peso and will offer people in the region a robust, stable and secure channel to send and receive funds. The stablecoin will also enable companies to tap into real time settlements, bringing efficiency to cash management.

Num Finance will also offer a yield feature for nCOP, with token holders getting rewards from regulated financial products.

Other than the Colombian peso-pegged stablecoin, Num Finance also issued nARS and nPEN, which are pegged to the Argentine Peso and Peruvian Sol.

The company launched in 2021 and raised $1.5 million in a pre-seed funding round closed in May. The capital financing was led by crypto project Reserve and attracted several investors including H20 Scouter Fund, Ripio Ventures, and Auth0 CTO Matias Woloski.

The post Num Finance launches stablecoin pegged to Colombian Peso on Polygon appeared first on CoinJournal.

On Wednesday morning, PepeCoin (PEPE) plunged after millions of dollars worth of PEPE were transferred from the team’s wallet to various crypto exchanges.

As news of the multi-million dollar token transfers emerged on social media, the token’s market capitalization dropped by $100 million, from $444.4 million to a low of $344.7 million.

The PepeCoin team sent 16.045 trillion PEPE tokens worth $16.85 million to four exchanges including Binance, Bybit, KuCoin, and OKX from a multi-sig Ethereum address. Normally, a multi-sig wallet requires approval from many parties before any transactions can be done from the wallet.

The PepeCoin team reduced the security requirements for its multi-sig wallet from five out of eight to just two out of eight signatures needed to complete a transaction after the tokens were moved to the exchanges.

After the transfer, PepeCoin’s multi-sig Ethereum wallet address was left with 10.697 quadrillion PEPE, worth $9.61 million.

The massive transfers and a lack of clarification from PepeCoin’s official Twitter account sparked concerns about the currency and led to a panic sale, which further pilled bearish pressure on the price of PEPE.

In most cases, whales move their tokens to crypto exchanges in readiness for selling, staking, or exchanging with more valuable tokens and crypto traders/investors are already speculating that the PepeCoin team is readying itself for any of the above.

The post PEPE continues to slide: trillions of tokens sent to exchanges appeared first on CoinJournal.

Investors appear to be liquidating their positions as Ripple (XRP) struggles to maintain growth following Judge Torres’ summary finding in the US SEC v. Ripple Labs case that XRP isn’t a security. Additionally, following a recent price decrease, a whale moved over 29 million XRP, worth over $15 million, to the Bitstamp cryptocurrency exchange.

According to a Whale Alert article on August 24, the whale transferred 29,300,000 XRP worth $15.13 million to the Bitstamp.

🚨 29,300,000 #XRP (15,130,884 USD) transferred from unknown wallet to #Bitstamphttps://t.co/DhcHkKNdzc

— Whale Alert (@whale_alert) August 24, 2023

Additional information raises the probability that this whale may be angling to sell its XRP holdings because it recently transferred another 14 million XRP to Bitso.

Although Ripple (XRP) has become a centre of attention after winning the case against the SEC, the cryptocurrency is facing an uncertain future after Judge Torres allowed the U.S. Securities and Exchange Commission (SEC) to lodge an interlocutory appeal challenging the sale of XRP tokens. After the ruling, the price of XRP fell sharply and broke through important support levels of $0.6 and $0.5 even as some professionals hold that the appeal would not be a setback for Ripple.

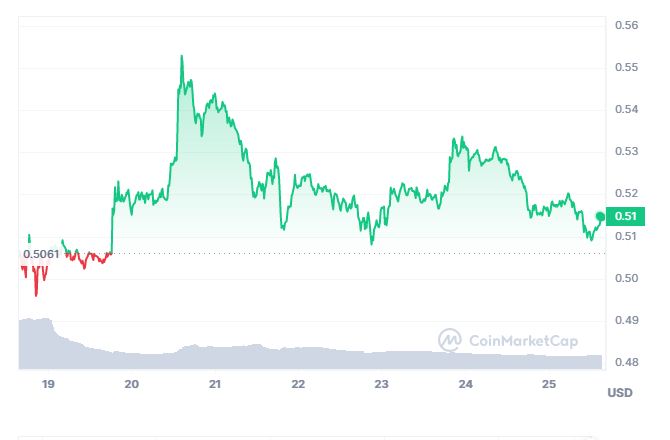

Ripple (XRP) price chart

Ripple (XRP) price chart

Although the XRP price has since slightly risen from the $0.5 support level, there is a big chance of a sharp decline if traders and whales decide to sell their holdings in fear of the outcome of the SEC appeal.

The appeal case between Ripple and the US SEC is expected to start around the middle or end of May 2024 in the interim. This timetable is consistent with the SEC and Ripple Labs court notifications, as well as those of CEO Brad Garlinghouse and executive chairman Chris Larsen, who stated that they would not be available until the second quarter of 2024.

The post Whale moves millions of XRP tokens to Bitstamp appeared first on CoinJournal.