Helium’s coin HNT dipped after a recent rally, but it’s starting to gain again. There has been some positive news around it.

The Helium network unveiled new Hotspots, its 5G ecosystem grew exponentially in a year, GigSky launched the first cell plan, and Dish joined as the first major carrier.

HNT is up 16% so far today. If you want to know what HNT is, can it give you good returns, and the top places to buy HNT, you’ve come to the right place.

Top places to buy HNT now

FTX

FTX is a cryptocurrency exchange built by traders, for traders. FTX offers innovative products including industry-first derivatives, options, volatility products and leveraged tokens. We strive to develop a platform robust enough for professional trading firms and intuitive enough for first-time users.

Swapzone

Swapzone is a crypto exchange aggregator that operates as a gateway between the cryptocurrency community and exchange services. Swapzone aims to provide a convenient interface, safe user flow, and crystal-clear data for users to find the best exchange rates among the whole cryptocurrency market.

What is HNT?

HNT is the token of Helium, a decentralized blockchain-powered network for Internet of Things (IoT) devices. It enables low-powered wireless devices to communicate and transmit data across its network of nodes.

These nodes are called Hotspots, which were mentioned earlier. They are a combination of a blockchain mining device and a wireless gateway.

Helium is most interesting to device owners and people invested in the IoT space. Financial incentives provide further outreach possibilities.

The network allows nodes in a network to reach consensus even with inconsistent connection quality. This is because it runs on a new algorithm called proof-of-coverage, based on the HoneyBadger BFT protocol.

Should I buy HNT today?

HNT can be a lucrative investment, but take the time to read at least several price predictions from leading analysts and do market research before making a commitment. Take all investment advice with a grain of salt.

HNT price prediction

Digital Coin Price predicts Helium will reach $29 by the end of 2022. In 2025, they believe it will have gone all the way up to $40.17.

GOV Capital is even more bullish on HNT long-term. They predict the coin will pass $70 in November this year. In 2027, 1 HNT will be worth a staggering $860.

HNT on social media

#HNT #HNTUSDT

Yatay direnç kırılımı mevcut. 14.1$ üzeri kapanışlarda güzel prim verebilir.#Bitcoin #BTC pic.twitter.com/qFsCqmXjFH— KriptoVerse (@Kripto_V) May 2, 2022

The post Top places to buy HNT, which is back on track and climbing appeared first on Coin Journal.

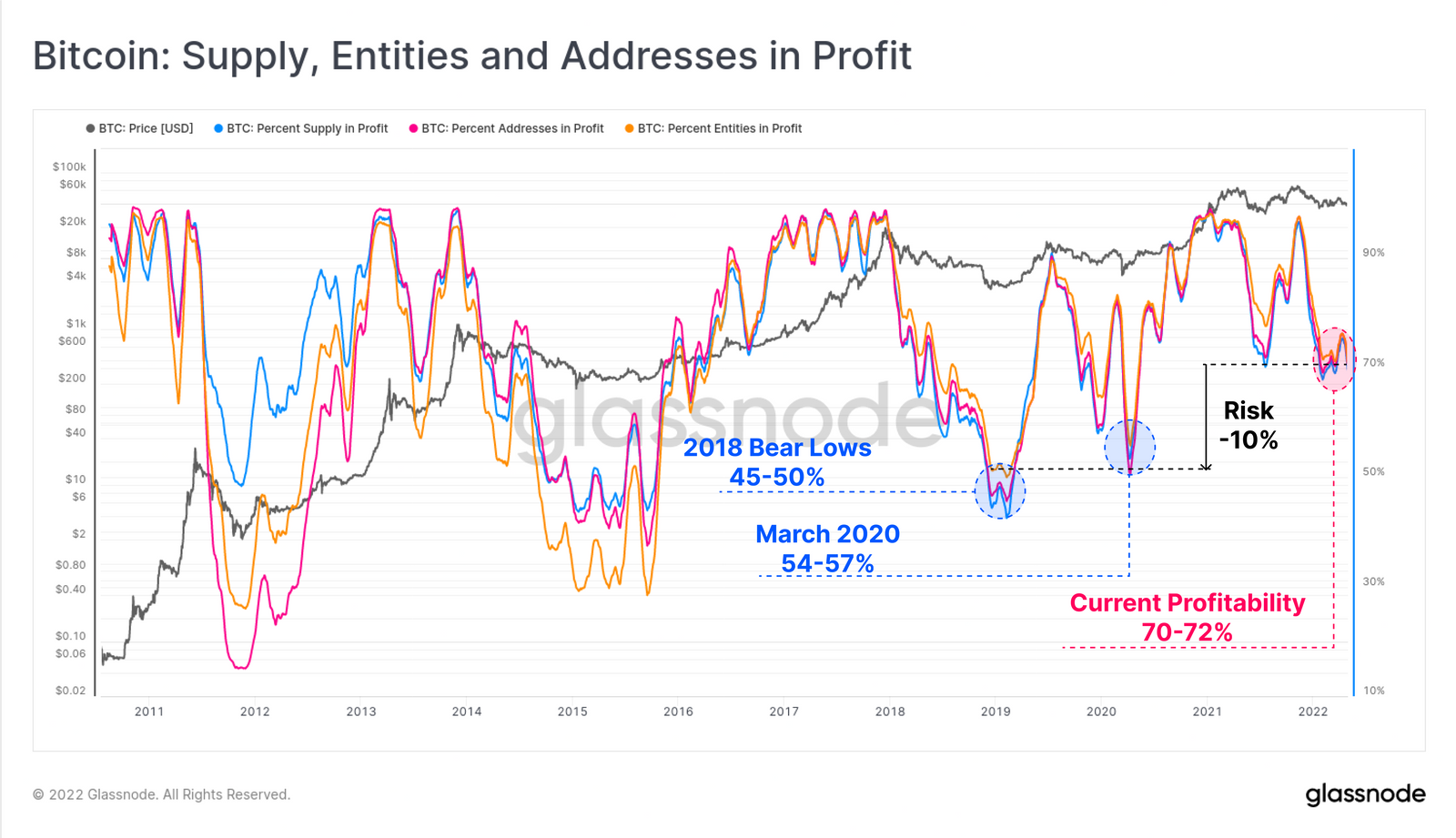

Chart showing 10% of BTC supply could fall into loss. Source: Glassnode

Chart showing 10% of BTC supply could fall into loss. Source: Glassnode