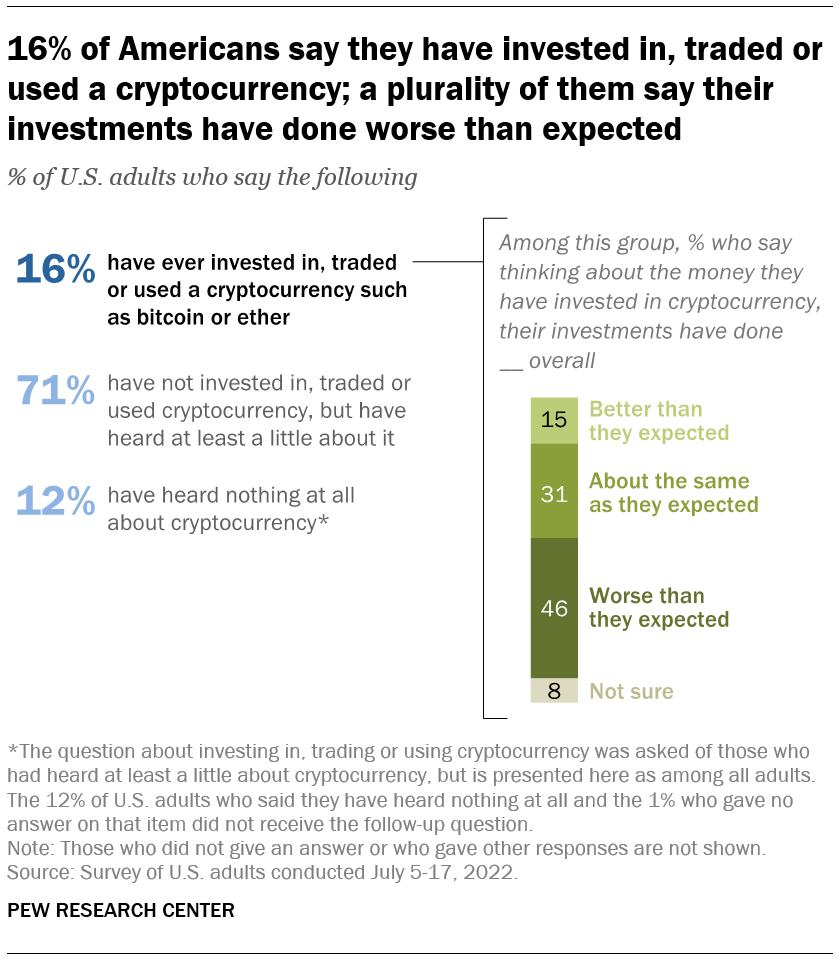

- Majority of US crypto users at 46% are unhappy with how their crypto investments performed.

- Percentage of crypto users in the country unchanged (at around 16%) since last year.

- About 50% of those surveyed know of NFTs, 2% have bought them.

Nearly half of Americans who have ever invested in crypto, including the top two by market cap Bitcoin (BTC) and Ethereum (ETH), say the assets have performed “worse” than was expected.

46% of crypto users ‘disappointed’ by returns

A new report recently published by the Pew Research Center revealed that of the 16% of US adults who say they have ever bought, traded or used cryptocurrencies, about 46% are unhappy with how their investments have turned out.

Pew Research Center survey report on US crypto users’ take on their assets’ performance.

Pew Research Center survey report on US crypto users’ take on their assets’ performance.

But while a majority expressed dissatisfaction about the overall performance of their crypto holdings, at least 15% said they had seen better-than-expected returns. Another 31% said their crypto investments had so far performed as expected.

Notably, the research found that the number of crypto users in the US has remained largely unchanged.

“While relatively few Americans overall say they have ever invested in, traded or used cryptocurrencies, the vast majority of Americans have heard about them,” Michelle Faverio and Navid Massarat wrote in the research report.

They noted that about 88%, or nearly nine out of every ten Americans had heard about crypto. 26% of this number said they have “heard a lot” about cryptocurrencies.

Almost 50% of the respondents also said they’ve heard about non-fungible tokens (NFTs). However, just 2% have bought NFTs, the report added.

Crypto bear market

The survey, conducted in July (5-17), came after the mid-June sell-off that compounded the bear market pain and saw bitcoin price fall to lows of $17,600 and ether below $1,000.

Indeed, the broader cryptocurrency market had lost over $2 trillion in total value by then, with multiple crypto companies ending up bankrupt amid contagion.

Bitcoin and Ether, currently trading around $19,930 and $1,475 respectively after another bout of sell-off pressure on Friday, hit their all-time highs above $69,000 and $4,800 in November 2021.

The post 46% of US crypto users say their investment performed ‘worse than expected’ appeared first on CoinJournal.

The user connects with the Giving Block’s expert team, sets up a widget and cryptocurrency donation page, and starts accepting donations. The platform’s widget is unique.

The user connects with the Giving Block’s expert team, sets up a widget and cryptocurrency donation page, and starts accepting donations. The platform’s widget is unique.