Key takeaways

- Bitcoin Dogs will launch its game by the end of the month.

- $0DOG is up 12% in the last 24 hours as it climbs above $0.010

Bitcoin Dogs to roll out its game by month-end

The Bitcoin Dogs team has revealed that it will launch its Web3 game by the end of the month. In an X post over the weekend, Bitcoin Dogs told its community to prepare to earn big.

Bitcoin Dogs’ Telegram-based Play-2-Earn (P2E) game looks to leverage the millions of users already playing several Telegram games. The Telegram game will feature an in-game currency known as Bark, which players are expected to earn by playing.

What is Bitcoin Dogs?

The cryptocurrency market performed excellently over the last seven days, with Bitcoin touching the $69k level again. This allowed new projects like Bitcoin Dogs to recover from their recent bearish move and rally higher.

Bitcoin Dogs is a new project offering products and services to users in the Bitcoin ecosystem. The project is the first BRC-20 token ICO on the Bitcoin network and seeks to add another utility layer to the blockchain.

Bitcoin Dogs raised $13 million during its presale and is now using the funds to integrate basic features of cryptocurrency, non-fungible tokens (NFTs), decentralized finance (DeFi), and Web3 culture to enable it to become a solid Bitcoin-based project.

$0DOG, Bitcoin Dogs’ native token, is live on several crypto exchanges, including MEXC, Gate.io, Uniswap, Unisat, and others. $0DOG is also live on Coinmarketcap and DEXTools.

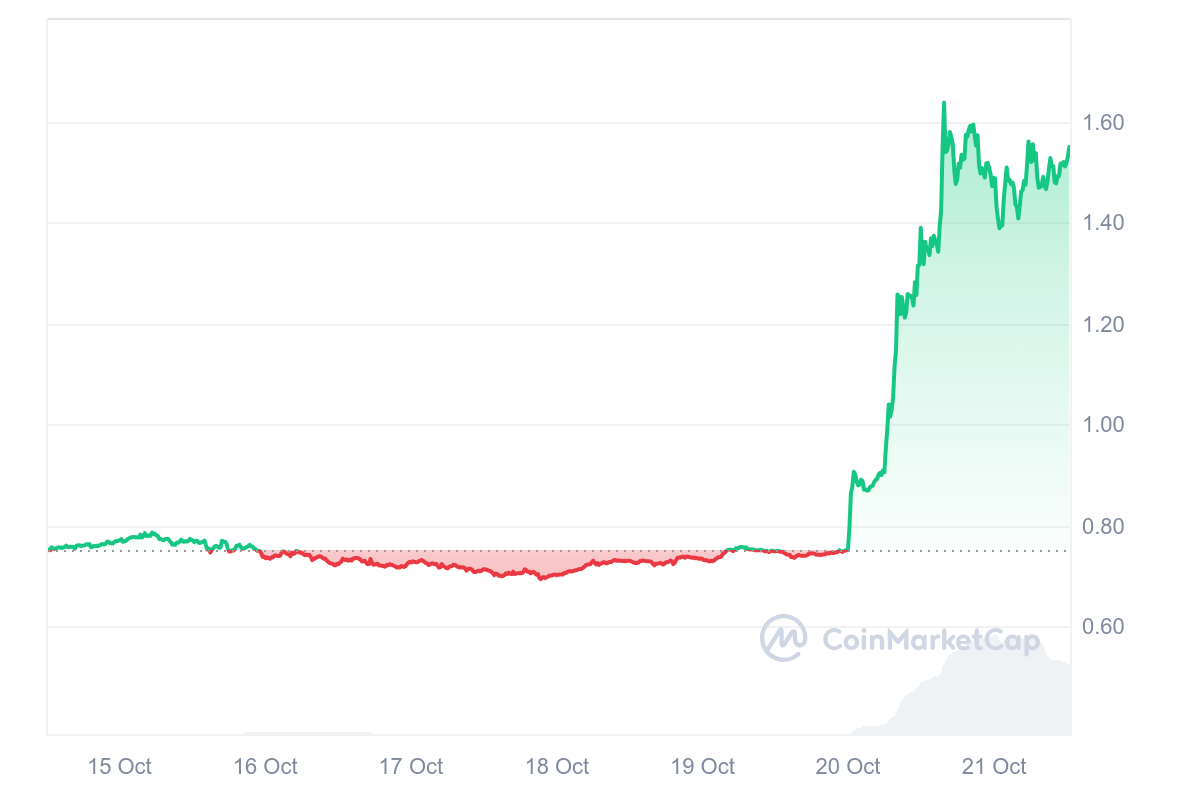

$0DOG surges by 12%

$0DOG is recovering from its recent slump and has added more than 12% to its value in the last 24 hours. Thanks to this rally, Bitcoin Dogs now trades above $0.010 per coin.

Bitcoin Dogs is up 69% from its all-time low but is still down from the $0.01792 all-time high it set two months ago. In the last seven days, $0DOG added 58% to its value, outperforming Bitcoin and the broader crypto market.

Investors are still taking advantage of the recently launched $0DOG-ETH LP Farm, as it offers an APY of 447%.

Should you buy the Bitcoin Dogs token now?

The crypto market is recovering from its recent slump and could surge higher ahead of the upcoming presidential election in the United States. $0DOG is down from the all-time high of $0.01792 it achieved two months ago.

After adding 58% to its value in the last seven days, Bitcoin Dogs could surge higher as the team rolls out new products, including its upcoming Web3 game. These developments could push $0DOG’s price higher in the medium to long term.

The post Bitcoin Dogs game to launch by month end as $0DOG adds 12% appeared first on CoinJournal.