- Haven Protocol suffered a mint exploit, with over 500 million XHV tokens minted illicitly,

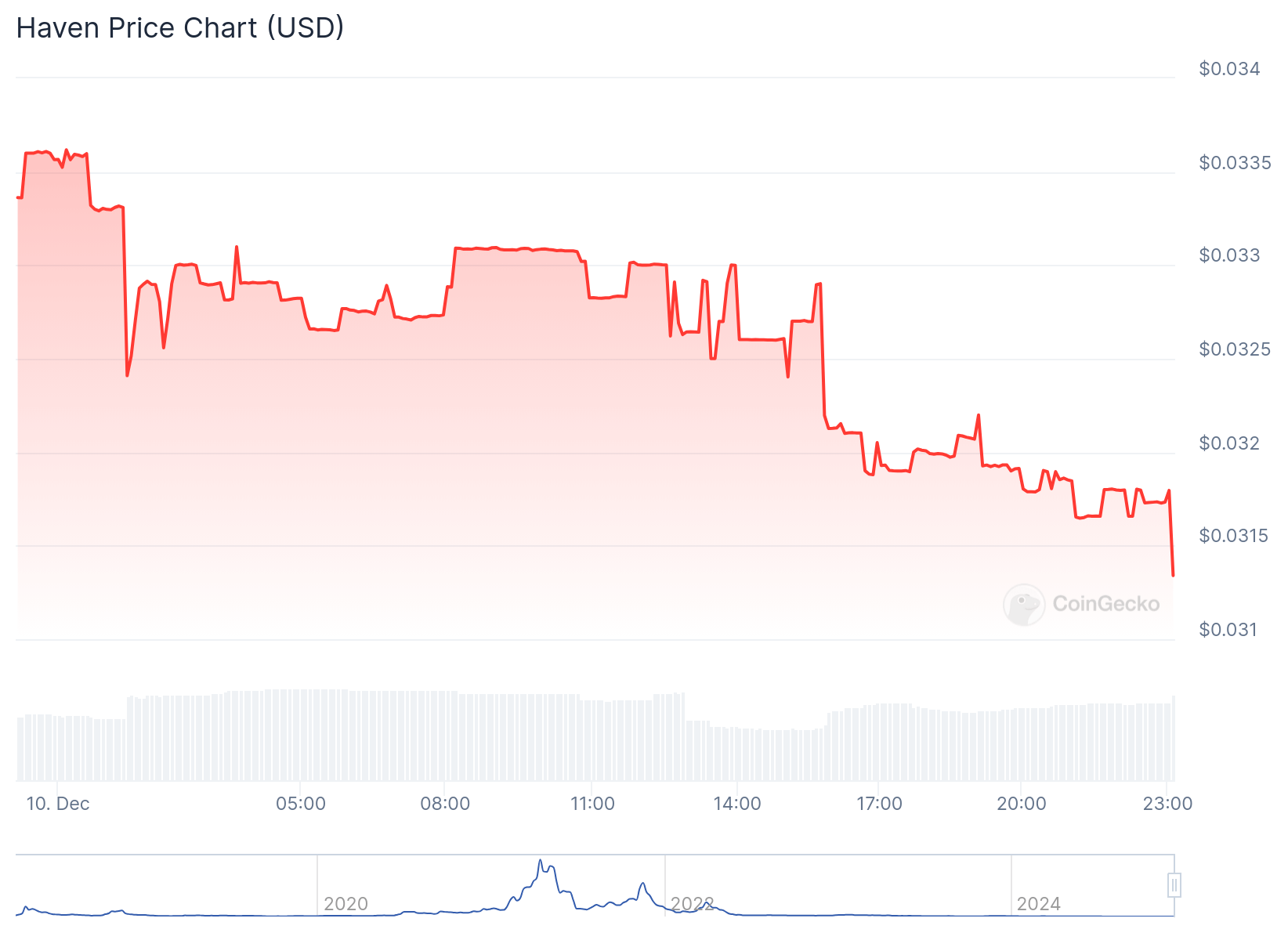

- The hack has sent the price of the XHV token down by over 60%.

- Hacker(s) exploited a vulnerability in the range proof validation code, introduced during the Haven 3.2 rebase to Monero.

Haven Protocol, a blockchain project known for its mint-and-burn mechanism, has suffered a mint exploit, leading to a dramatic plunge in its token price.

The exploit allowed a hacker to mint a vast number of XHV tokens, driving the supply to unmanageable levels. Following the hack, the price of the Haven token (XHV) nosedived by over 60%, falling from $0.0003594 to $0.0001341.

What happened to the Haven Protocol?

The Haven Protocol team disclosed the exploit via their social media account, revealing that over 500 million XHV tokens were illicitly created.

⚠️ Haven Mint Exploit ⚠️

Unfortunately we’ve been hit by an exploit.

This was identified when querying the amount of XHV on exchanges.

The number reported to us is in excess of 500 million XHV.$XHV

🧵👇🏼— Haven Protocol (@HavenXHV) December 10, 2024

This discrepancy was detected during an exchange supply query, contrasting sharply with the audited supply of 263 million tokens. Developers attributed the breach to a vulnerability in the “range proof validation” code, introduced during the Haven 3.2 rebase to Monero.

This flaw enabled the creation of XHV tokens without detection, as the minting occurred after auditing processes.

Notably, the surplus tokens were not accounted for in the audited supply figures, exposing a critical gap in the protocol’s security measures.

The exploit has significantly impacted the market standing of XHV, a project that once saw its token peak at $28.99 in April 2021. The incident has compounded its decline, with the current price reflecting the erosion of trust in the protocol.

In response, Haven Protocol urged its community to avoid purchasing XHV on exchanges, citing ongoing efforts to assess the situation. The team acknowledged the gravity of the breach, expressing regret and promising further updates as discussions within their Haven Operations Committee (HOC) progress.

The post Haven Protocol Token (XHV) crashes after mint exploit appeared first on CoinJournal.