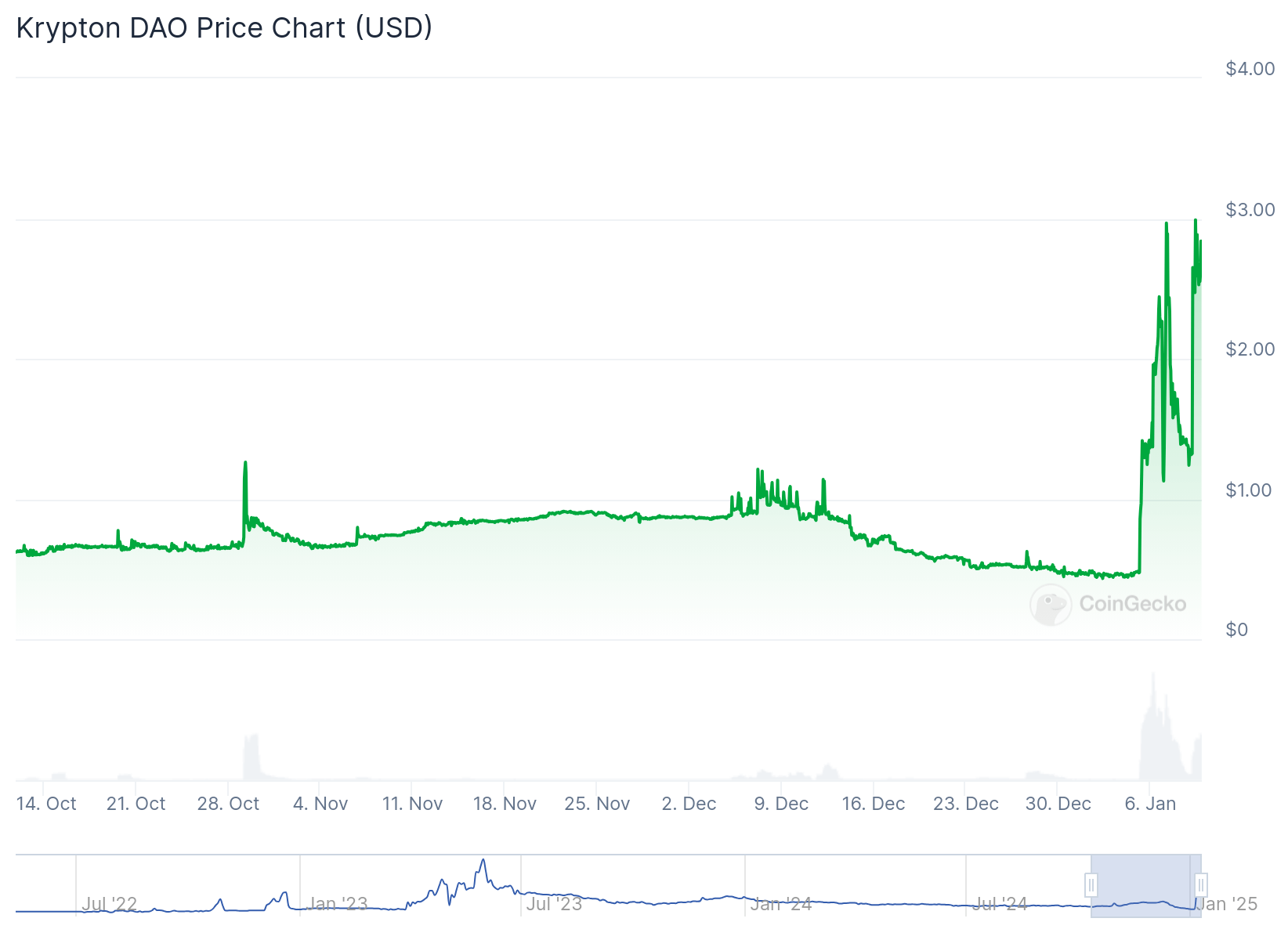

- Krypton DAO (KRD) price is up 513% in a week to $2.69.

- The token has risen by over 100% today alone.

- There are no major developments within the Krypton DAO leaving investors worried if it will sustain the gains.

In a remarkable surge that has caught the eye of the crypto community, Krypton DAO (KRD) has witnessed an astonishing 513% price increase over the last week, currently trading at $2.69.

This spike elevates the token from a modest $0.442 to a peak of $2.99 within a week, showcasing an unprecedented level of investor enthusiasm or speculative trading. While KRD’s price remains below its all-time high of $4.04 achieved on May 31, 2023, the current surge brings it closer to that mark.

What are the chances of Krypton DAO (KRD) price rising further?

The fervour around KRD’s price action has been notable on social platforms like X, where the token’s performance has been the subject of numerous discussions. Several posts have highlighted KRD’s ascent, with some posts noting even higher short-term gains, such as today’s 100% surge.

This kind of volatility is characteristic of the cryptocurrency market, especially for tokens like KRD, which is currently ranked at position 295 by market cap, suggesting it is still in the eyes of many a speculative asset rather than a mainstream investment.

However, despite the impressive growth, the question on everyone’s mind is whether KRD can maintain these gains.

Historically, such rapid ascents can be followed by equally swift declines, as seen with many cryptocurrencies that experience similar speculative bubbles.

The market cap of KRD now stands at $280,880,823, with a fully diluted valuation hinting at a much larger potential market if all tokens were in circulation. This discrepancy between current and potential valuation can be both a beacon for growth and a warning sign for volatility.

The trading volume of $322,177 over the last 24 hours further illustrates the intense interest but also the speculative nature of such investments.

While the community buzzes with optimism, seasoned crypto analysts caution against jumping in blindly. They recommend watching for further developments in Krypton DAO’s ecosystem, like partnerships or platform upgrades, which could provide a more stable foundation for its price.

However, without such catalysts, the sustainability of this surge remains uncertain, leaving investors to ponder if KRD’s current valuation is a bubble waiting to pop or the start of a new chapter in its journey.

The post Krypton DAO (KRD) price soars 513% over the week: will it hold the gains? appeared first on CoinJournal.