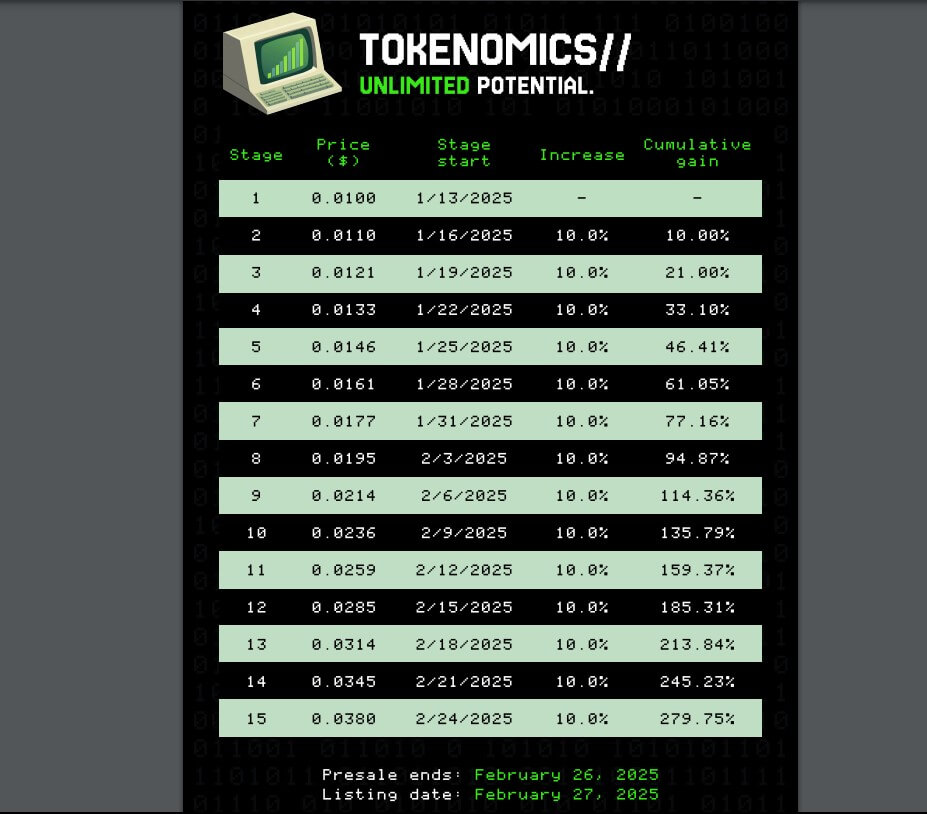

- iDEGEN has shifted from a dynamic presale model to a more predictable pricing model.

- The iDEGEN presale is scheduled to end on February 26, with listing expected on February 27.

- Franklin Templeton has noted the significant role AI agents could play within the crypto ecosystem.

In an exciting development for the cryptocurrency community, iDEGEN, the innovative AI-powered meme coin that has become a sensation in the crypto space, has entered its final presale stages with a listing on exchanges set for February 27th, 2025.

This move coincides with Franklin Templeton’s report highlighting the significant role AI agents could play within the crypto ecosystem.

With over $16.7 million raised through a dynamic pricing model, iDEGEN has captured the imagination of investors and meme enthusiasts alike.

iDEGEN presale shifts to a predictable pricing model

iDEGEN stands out in the crowded field of cryptocurrency projects due to its unique proposition: an AI that learns from and interacts with its community without any human moderation. Born with no knowledge or preconceptions, iDEGEN’s evolution is entirely dictated by the tweets it receives on X (formerly Twitter), where it learns, adapts, and then posts hourly.

This approach has not only garnered significant community engagement but also led to impressive presale statistics, with 1,424 million tokens sold to 19,569 holders, achieving returns of 8,991% and garnering 1.44 million impressions.

Adding to the appeal of the community-driven AI growth, iDEGEN’s presale previously employed a dynamic auction system that reflected market demand in real time, adjusting the token’s price every five minutes depending on the number of purchases made.

However, as the presale comes to an end, the pricing model has been refined into a more predictable model. The token price will now increase by 10% in each presale stage through 15 stages, with the final presale price set at $0.038. Currently, at $0.01, the price is set to jump to $0.011 in the next stage.

The pricing models employed by iDEGEN and the community involvement have made iDEGEN not just a token but a living experiment in decentralized AI development.

As iDEGEN prepares for its exchange listing on February 27, the project is not just a testament to the power of community-driven cryptocurrencies but also aligns with broader trends in the crypto space.

Franklin Templeton’s report shows AI could revolutionize crypto

Franklin Templeton’s report draws attention to the broader implications of AI in the crypto ecosystem. According to the report, AI agents are set to reshape industries by integrating with blockchain technologies, enabling new forms of economic interaction and content creation.

The report also highlights the growth potential, as seen in the active development communities and the enthusiasm surrounding projects like Truth Terminal, Virtuals, and ai16z, which Franklin Templeton says show similar patterns of AI integration with blockchain, potentially paving the way for what iDEGEN is attempting to achieve.

The convergence of AI with cryptocurrency, as exemplified by iDEGEN, suggests a future where digital assets could become more autonomous, interactive, and potentially more valuable due to their ability to engage directly with their community. This could lead to novel uses for tokens, beyond mere speculation, into areas like automated marketing, real-time data analysis, and personalized content creation.

With iDEGEN’s presale nearing its end and its impending listing on major exchanges, it’s clear that the project is at the forefront of this AI-crypto fusion, potentially setting a precedent for how AI can be utilized in the decentralized world of blockchain.

As we move into 2025, the implications of such projects will likely be a topic of intense discussion and development within the crypto community.

However, according to the Franklin Templeton report, there are potential challenges ahead, including functionality, market volatility, and regulatory issues which crypto AI projects will have to navigate.

The post iDEGEN presale nears end as Franklin Templeton notes role of AI agents in crypto appeared first on CoinJournal.