- XRP has fallen below $2.50 while Solana has dipped under $200.

- Dogizen’s DOGIZ token currently costs $0.000086 after six presale stage gains.

- Dogizen offers stability amid XRP and Solana’s price volatility.

XRP and Solana (SOL) are navigating through turbulent waters, with both assets experiencing significant price drops. With market sentiment pointing at further potential downturns, investors are looking for safer havens.

Dogizen, a newcomer in the crypto space, is presenting itself as a potentially stable investment avenue, particularly with its unique proposition as the first Telegram ICO.

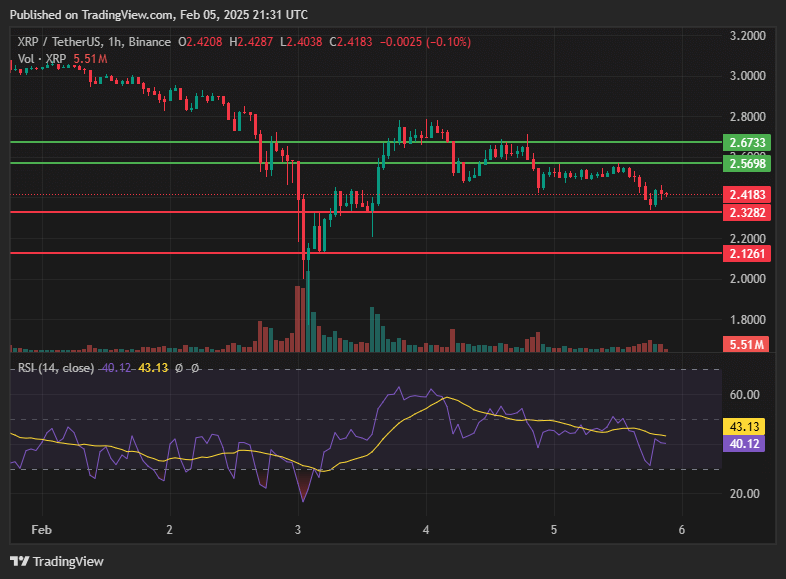

XRP price falls below $2.5

After hitting a high of $3.38 on January 16, 2025, just a few cents shy from its all-time high of $3.40, which it hit on January 7, 2018, XRP has seen a sharp decline over the past two weeks. Its price has fallen by 26% in the past two weeks, positioning it below $2.50.

The Relative Strength Index (RSI) for XRP sits at 43.12, suggesting a balanced market where neither buyers nor sellers are in clear control.

The nearest resistance level is at $2.5698 with a support at $2.3282. Investors are closely watching these levels since a surge above $2.5698 could result in a new ATH, while a fall below the $2.3282 support could lead to further declines.

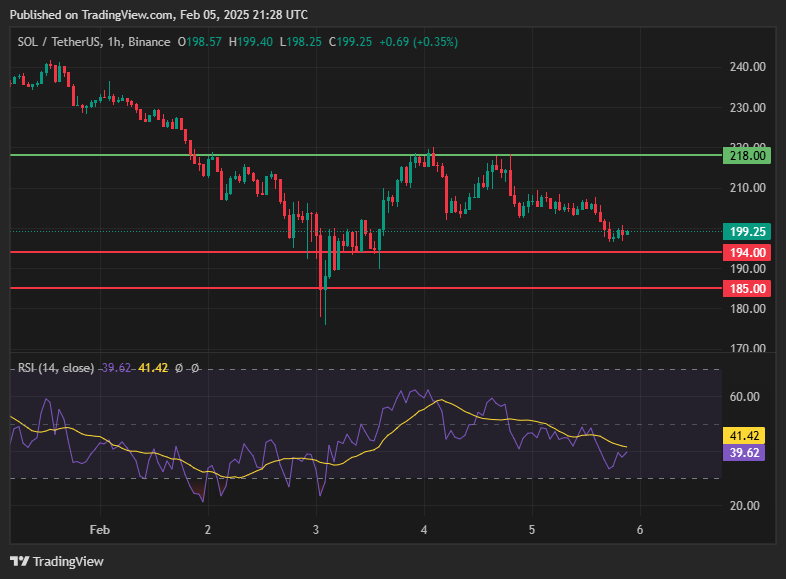

Solana (SOL) drops below $200

Similarly, Solana’s price is also grappling sharp price drop, having decreased by 26% over the last two weeks and 9.28% over the past month to trade at $198.98 at press time.

The RSI at 41.42 places Solana in a neutral zone, suggesting that the market is neither overbought nor oversold, thus providing potential for significant price movement in either direction.

With resistance at $218 and support at $194, Solana’s trajectory could go either way. Breaking above resistance would signal a bullish trend, potentially yielding a 13% increase, but a slip below support could see Solana dip to $185.

Dogizen offers a compelling alternative to investors

In contrast to the rollercoaster ride of XRP and Solana, Dogizen emerges with a different narrative. With the presale of its DOGIZ token nearing its end on February 7th, 2025, Dogizen has already raised $4,028,605 out of a $4,760,000 goal, showing significant investor interest.

The DOGIZ token is currently going for $0.000089 after steady increments with each presale stage. In the next presale stage, the token’s price is expected to jump to $0.000094.

Positioned as the first Initial Coin Offering (ICO) on Telegram, Dogizen leverages the platform’s vast user base to redefine gaming and crypto interaction. With over 1 million users already engaged, the project’s foundation is built on community involvement and innovative gaming solutions.

Dogizen’s roadmap focuses on expanding its gaming ecosystem, which could offer stability in contrast to the more volatile trends seen in XRP and Solana. The project’s tokenomics are designed with a community-centric approach, allocating 40% of its total supply to its community, which could foster a more stable token price through shared incentives.

While XRP and Solana face immediate pressures from market corrections, Dogizen’s structured growth plan and community engagement might provide a safer investment environment. It’s not immune to market volatility, but its unique position in the Telegram ecosystem and its focus on gaming could make it a compelling alternative for those looking to diversify away from traditional crypto assets showing signs of bearish trends.

With market analysts predicting further dips for established cryptocurrencies like XRP and Solana, Dogizen stands out by offering a blend of innovation, community, and a new platform for growth in the Telegram environment.

Whether it will prove to be a ‘safe-haven’ remains to be seen, but for investors wary of current market dynamics, Dogizen presents an intriguing option to consider.

The post Market analysis hint at XRP and Solana price dip, Dogizen could be a safe haven appeared first on CoinJournal.