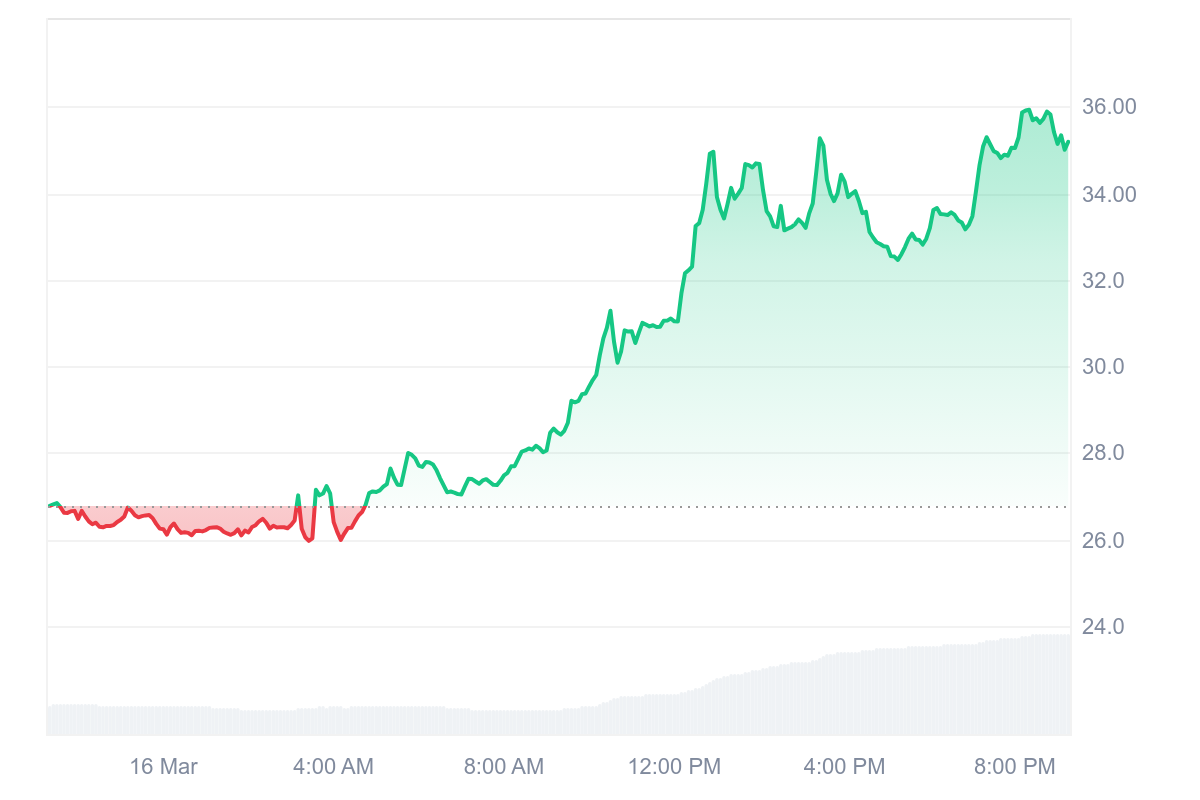

- Bounce Token soared more than 36% on Sunday, gaining to an intraday high of $36.17.

- Analysts predict a breakout for AUCTION price.

Bounce Token (AUCTION) has surged by an impressive 36% over the past 24 hours, emerging as among top gainers in the 500 largest coins by market cap. Only Ancient8 (AB) with a staggering 109% in 24 hours and BinaryX (BNX) with 40% as surged by more.

Notably, this price spike comes as most altcoins look to hold onto gains as Bitcoin hovers near $84k.

Bounce Token price recap: A 36% surge in 24 hours

According to CoinMarketCap data on March 16, 2025, Bounce Token (AUCTION) climbed 36% to reach an intraday high of $36.17. While the altcoin, native to the decentralised auction platform, remains about 49% from it’s all-time high of $70.56, it has seen significant gains in recent weeks.

Per CoinMarketCap, AUCTION price has jumped by about 107% over the past seven days and 204% in the past month. These gains have pushed Bounce Token’s market capitalization to around $232 million.

Meanwhile, trading volume has also skyrocketed, up 230% in 24 hours to hover at $590 million at the time of writing.

Why is the AUCTION price up today?

Bounce Token’s price rally builds on AUCTION’s longer-term momentum. Part of this has to do with the growth in the ecosystem and new project launches.

One of these is Auction Intelligence, an artificial intelligence (AI) agent launchpad by Bounce Finance, which went live on the BNB Chain.

Although the market is largely negative, Bounce Token bucks the trend with notable impetus from its traction in the DeFi space. There’s also huge anticipation around real-world collectibles.

As noted above, an innovative auction mechanism and adoption are key to the current upward trajectory.

Can AUCTION bounce to a new ATH?

If the bulls hold key support levels, such as the $30, its possible they could target the $60 mark seen in November 2021. From here, with supportive market conditions, it would be a new ATH for buyers.

Crypto insights provider Crypto Sat shared an outlook for AUCTION price on March 12.

$AUCTION BREAKOUT ALERT! 🚀

After months of consolidation inside this classic bullish pattern, #AUCTION has finally broken out in a spectacular way! The price has surged past key resistance levels, showing massive momentum.

💡 Key Takeaways:

✅ Pattern: Falling Wedge (Bullish… pic.twitter.com/hNhDYrdDUP— Crypto Sat (@cryptosatred) March 12, 2025

On the flipside, profit taking deals could allow bears to target $20 and then $10 – previous demand reload zones.

The post Bounce Token (AUCTION) spikes 36% to lead top gainers appeared first on CoinJournal.