The cryptocurrency market has continued to show resilience in the wake of trade tensions. Most majors have recorded some gains as investors beyond the current instabilities and onto the expected surge in cryptocurrency adoption rates.

Notably, more market participants are broadening their horizon to include fresh projects with great potential. iDEGEN, a revolutionary force within the AI crypto space is one such entity.

With about two weeks left for its presale, savvy investors are steadily amassing $IDGN tokens. Based on its potential, its current token price of $0.0236 is likely the lowest it will ever get to moving forward.

Bitcoin’s steady appeal to sustain it above months-long support zone

Even with the recent risk-off mood, bitcoin price has held steady above $90,000, a support zone that has been steady since mid-November 2024. As a cryptocurrency, it is categorized as a risky asset.

Nonetheless, it continues to attract more individual and institutional investors as its global adoption increases. Indeed, countries like the US and Czech Republic may soon join the growing number of nations and sovereign wealth funds that have included Bitcoin in their strategic reserves. It is this optimism, coupled with eased cryptocurrency regulations, that will support bitcoin in the short and medium-term.

A look at its daily chart shows Bitcoin price hovering around the 50-day EMA while still trading below the short-term 20-day EMA. At the same time, its RSI is at 47, slightly below the neutral level of 50. Notably, the RSI is facing upwards, indicating that the current rebounding may continue in the ensuing sessions.

At its current level, the range between the psychologically crucial zone of $100,000 and the support level of $96,005 remains worth watching. Further rebounding will have the bull eye the next target at $102,595. However, this bullish thesis will be invalid if the cryptocurrency pulls back below the lower support zone of $94,444.87.

iDEGEN’s positioning turns early adopters to rich crypto investors ahead of its listing

iDEGEN, an AI crypto project that has been making waves in the market since late November 2024, is set to hit the public shelves in about two weeks. Notably, the powerful trifactor that has captured the attention of investors is expected to catapult it to great heights upon listing.

To begin with, the AI crypto space has grown to a market cap of $29.2 billion as seen on CoinGecko. AI16z, one of iDEGEN’s rivals which was launched in October 2024, is valued at over $618 million. As a revolutionary force that has succeeded at curving its niche in the sector, iDEGEN also has the potential to have its value surge by 20x post-listing.

Besides, its positioning as a community-driven project with no guard rails has given it a competitive edge in the market. For instance, its previous ban on X on grounds of “violent content” attracted more investors; enabling it to raise an additional $1 million within 24 hours.

It has gone on to expand its reach with it the latest V3 upgrade allowing for video content. These upgrades, coupled with its integration of the viral DeepSeek, have yielded fresh waves of buying pressure.

So far, it has raised over $21 million with more than 1.7 million $IDGN tokens already sold. As it stands, investors only have a few more weeks left to get onto this highly profitable bandwagon. With returns of over 21,000%, the early adopters are already earning big even before the project’s listing. You can buy the iDegen token here.

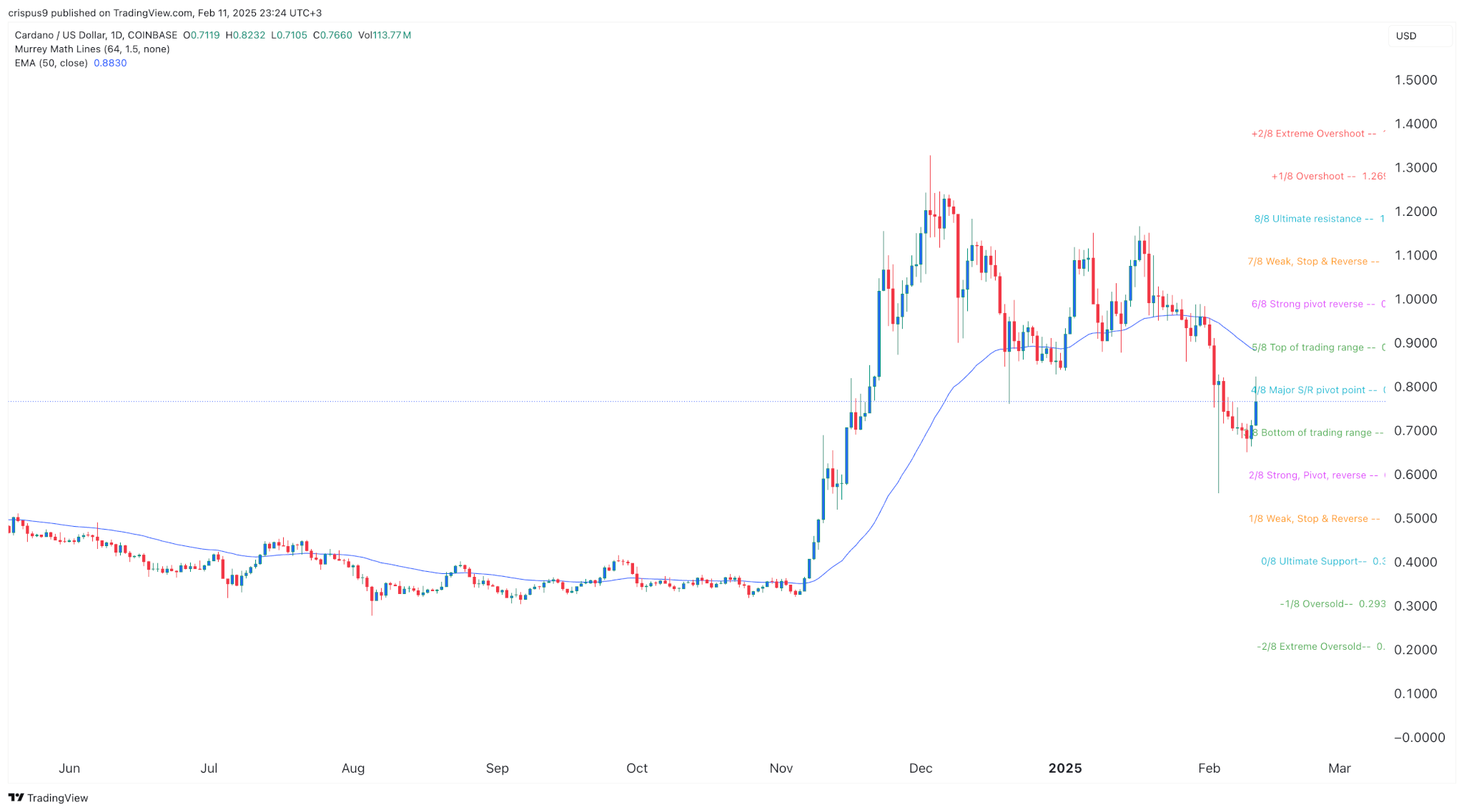

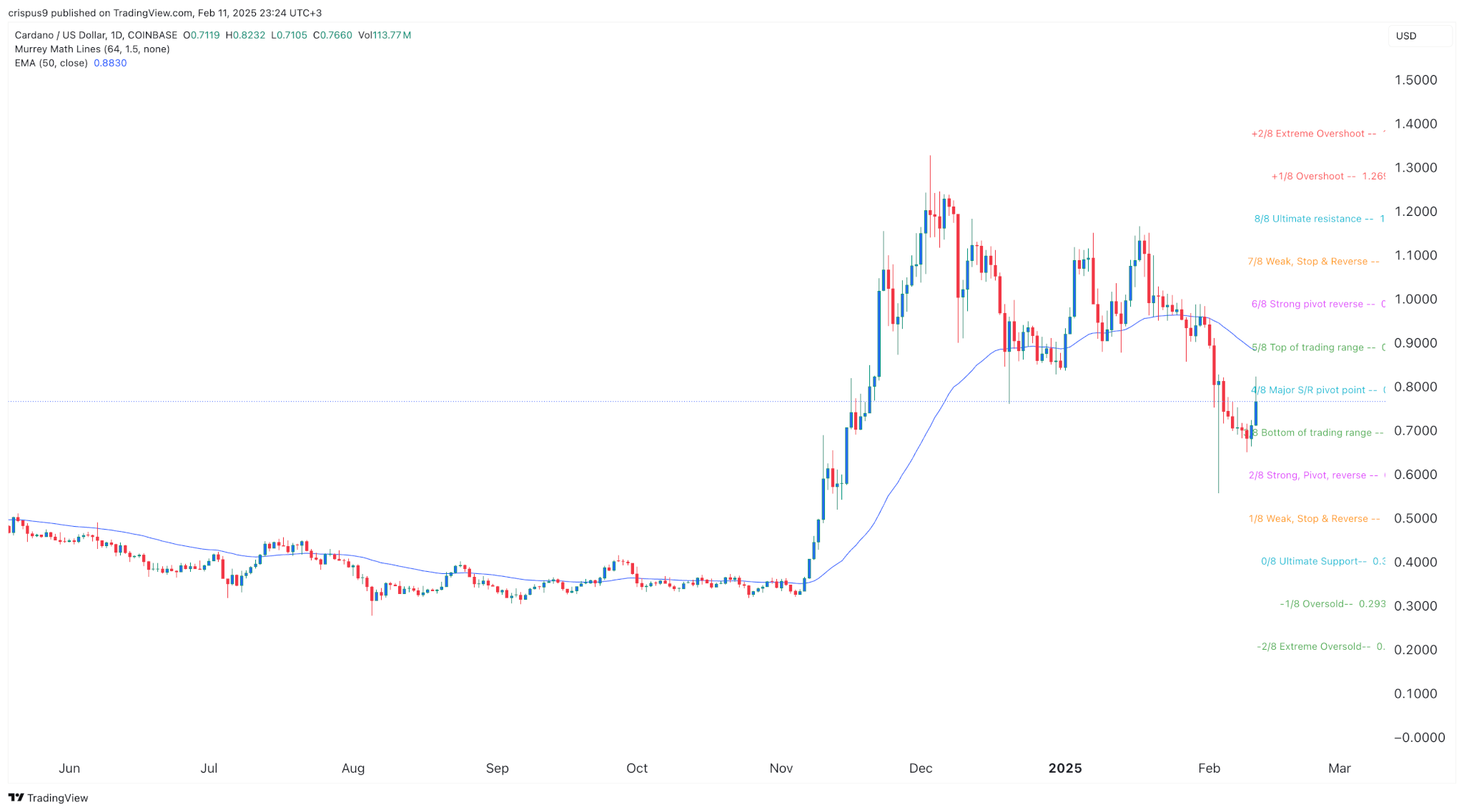

Cardano price to rebound within a range amid competition from smart contract projects

Cardano price appears set for a week of gains after being in the red over the past three weeks. On the one hand, new projects in the smart contract space have exerted pressure on Cardano. However, its healthy adoption rate and blockchain infrastructure continues to support the altcoin.

On its daily chart, cardano price remains below the 25 and 50-day EMAs. At an RSI of 39, it has some room for a rebound. However, while the rebounding will likely continue in the ensuing sessions, it may be range-bound in the short term.

At its current level, the range between the support zone of $0.7005 and the 20-day EMA at $0.8185 is worth watching. With additional bullish momentum, the bulls will be eyeing the next resistance level at $0.8875.

The post iDEGEN’s value skyrockets with its listing in the horizon appeared first on CoinJournal.