- Buffet’s Hathaway Berkshire acquired $1 billion worth of shares of a company whose business model supports Bitcoin.

- The veteran investor’s firm also sold $1.8 billion and $1.3 billion in Visa and Mastercard stocks respectively.

Warren Buffett’s Berkshire Hathaway has invested in a Bitcoin-related business, shelling $1 billion in investment to acquire stocks of Brazil-based fintech Nubank.

Details disclosed in a securities filing on 14 February show that Buffet’s company purchased shares of Brazil’s digital bank in the fourth quarter, putting down $1 billion to get the fintech’s Class A stock.

The filing also showed that Berkshire’s firm sold over a billion dollars worth of each of Visa and Mastercard’s stocks. Per details in the firm’s Q4 2021 filing, the investment giant dumped $1.8 billion worth of its holdings in Visa shares and $1.3 billion worth of Mastercard stock.

Nubank is a New York Stock Exchange (NYSE)- listed company, debuting on the US exchange on 9 December 2021. At its IPO launch, the company was $45 billion to rank then as the largest digital neobank by market valuation.

The NU shares make up about 0.3% of the Berkshire Hathaway portfolio.

The „Oracle of Omaha,“ as the investment guru is fondly known, has never shied from criticizing Bitcoin and the broader crypto sector, previously calling Bitcoin “rat poison squared.”

He’s yet to invest directly in Bitcoin, but he holds stocks worth billions in companies that are increasingly leaning into the cryptocurrency space.

These include American banks such as Bank of America, US Bancorp and BNY Mellon. Berkshire also bought nearly $1 billion worth of shares of Activision Blizzard, a company recently acquired by Microsoft Corp.

The post Warren Buffett invests $1B in Bitcoin-friendly neobank appeared first on Coin Journal.

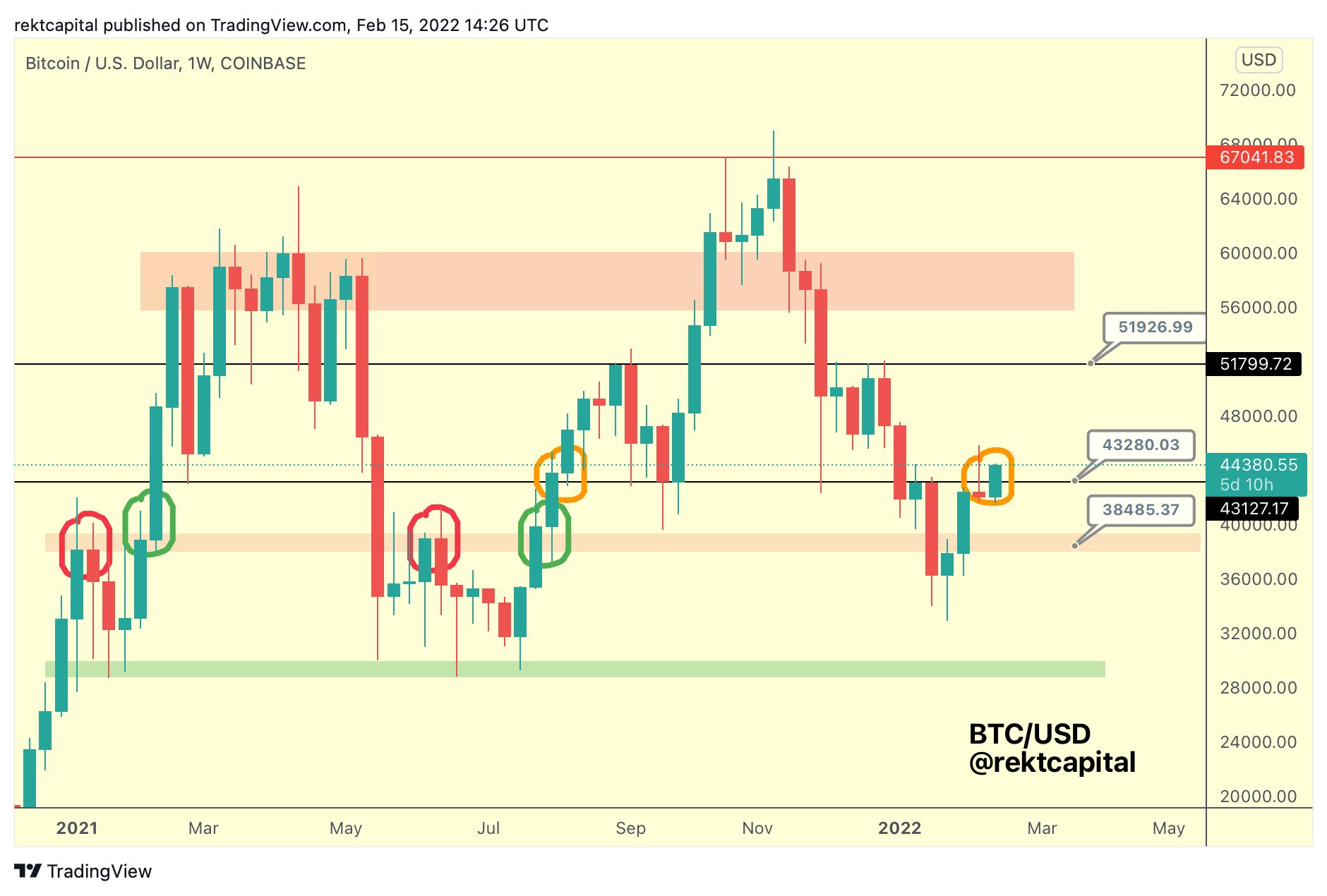

Weekly chart showing Bitcoin price breakout into the key bullish range of $43-$52k. Source:

Weekly chart showing Bitcoin price breakout into the key bullish range of $43-$52k. Source: