Yenwen Feng says Perpetual Protocol and True plan to increase the asset cap in the protocol-to-protocol lending portfolio from $5 million to $20 million if the initial trial succeeds.

Perpetual Protocol (PERP), an Ethereum-based decentralised derivatives exchange and TrustToken, the company behind digital asset lending platform TrueFi and popular stablecoin TrueUSD (TUSD) recently signed a deal that saw the latter launch a $100 million liquidity pool for market makers.

As part of the partnership, TrueFi unveiled a protocol-to-protocol lending portfolio on Perpetual Protocol, with a $5 million initial plough from the $100 million targeted by end of the year. With the funds, market makers on the PERP platform can now offer more liquidity, allowing the platform to scale its services to more professional and institutional investors.

Commenting on the critical role played by liquidity providers, Perpetual Protocol co-founder Yenwen Feng said:

“Committed market makers are crucial for any user-driven decentralized exchange, as they are the engine that keeps it going. By teaming up with TrustToken, we bring our market makers more liquidity to tap into as they support our own trading pairs. This grants liquidity providers more confidence through greater market stability and reduced slippage which ultimately results in a better trading experience for all of our users.”

Yenwen Feng on TrueFi partnership and 2022 outlook

After Perpetual and TrustToken announced their partnership, we wanted to know more about the $100 million liquidity pool and what the PERP team is looking forward to in 2022.

Feng elaborated on several points, including plans to increase the LP funds’ pool from $5 million to $20 million following an initial trial period. He explained the importance of providing support to market makers via a dedicated lending portfolio, with a note on why this could be crucial to the derivatives market.

Feng is also convinced layer 2 solutions will play a key role in the future of on-chain derivatives starting in the second half of 2022.

There’s more the Perpetual Protocol co-founder said.

CJ: When do the Perpetual Protocol (PERP) ecosystem market makers begin to tap into the huge liquidity?

Feng: After this initial trial we should be able to fine-tune the parameters of the program before opening it up to other market makers.

CJ: Briefly tells us about the $5 million lending ceiling and why start with only 5% of what could rise to $100 million by end of the year?

Feng: We wanted to start with a small enough amount to initially test the waters to see what kind of an impact it would have on the market-making activities on Perp. This approach is another route for us to bring more liquidity to the platform and if it goes well, we’ll increase it to $20 million for the next round and more in the future.

CJ: What’s your outlook on the crypto derivative markets, especially if we see a crypto winter in 2022? Any advice to investors?

Feng: New L1/L2 development: Rollup technologies and new L1 chains are launching this year. It should further increase the bandwidth and lower the gas fees. The landscape for L2s will become really competitive in the second half of 2022.

For example, zkSync recently launched their public testnet and the Optimism team are working on reducing the fees by 10x, so we’ll likely see a boost to trading volumes as on-chain derivatives become cheaper and more widely accessible.

Awareness of institutions: More and more institutional traders are testing out crypto trading and bringing in more markets.

CJ: What do you say about the 2022 crypto market outlook?

Feng: I feel that the bearish market will only be short-lived. In the 2018 bear market, people were leaving crypto and never came back. At that time, we were in the Binance Accelerator program and I think around half of the projects there at the time quit the crypto market completely.

However, the difference this time is that even if crypto market valuation drops, most people will remain in the space and there are many builders and new innovations.

There’s still a lot of appetite for cryptocurrency, such as in Silicon Valley, so I think by the second half of the year, the market will be in a much better position.

CJ: Any new projects and protocols that have looked at your partnership with TrustToken and as a result expressed intention to build on top of the Perpetual Protocol?

Feng: Market makers and online strategy providers are very interested in this partnership.

CJ: What compliance issues, if any, has the platform faced or had to address as a result of sealing a partnership with TrustToken?

Feng: TrueFi creates a great environment to help us navigate through the complexity of regulations. TrueFi is like a fund manager, where Perpetual Protocol is the lender and market makers are the borrowers. Because we are using their platform, we don’t have to be too preoccupied about regulations, as TrueFi handles those issues.

Also, once we grow more, we can utilize their platform to become the borrower.

The post Perpetual Protocol co-founder shares outlook on TrustToken and Perp’s DEX liquidity deal appeared first on Coin Journal.

Poking fun at myself a little here

Poking fun at myself a little here

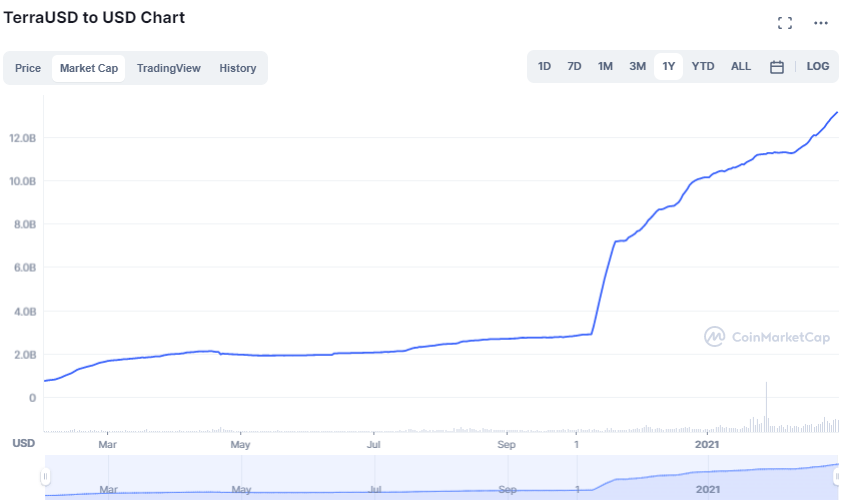

Via CoinMarketCap

Via CoinMarketCap UST market cap via CoinMarketCap

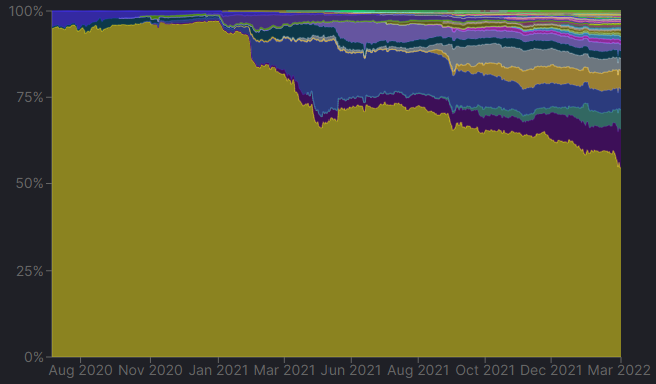

UST market cap via CoinMarketCap TVL on Luna (purple on graph) has been growing steadily, now representing 11.2% of total DeFi TVL

TVL on Luna (purple on graph) has been growing steadily, now representing 11.2% of total DeFi TVL