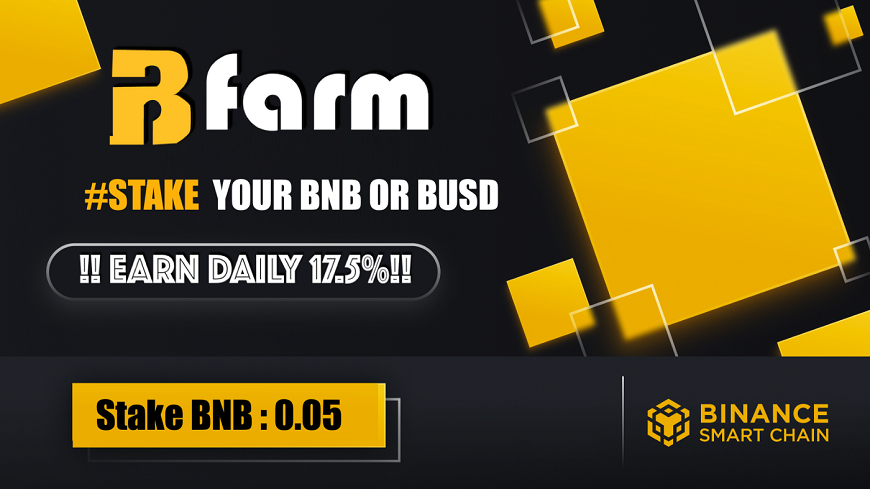

BFARM, a new yield farming platform built on Binance Smart Chain (BSC), has unveiled its new BNB and BUSD stake and earn feature as well as an extensive referral program. BFARM platform offer users steady and fixed daily income and the additional staking feature adds to its list of assets that can be staked by the users.

BFARM specifically allows users to maximize their income by leveraging and staking their native Binance tokens and earning quick staking yields on the BSC network.

Staking BNB and BUSD on BFARM

To stake BNB on BFARM, users require a minimum of 0.05 BNB coins. On the other hand, if a user wants to stake BUSD, they require a minimum of $10 worth of BUSD.

One can choose to stake the coins using the 8-days lockup with a 140% return, 16-days lockup with 188% return, or 25-days lockup with 242% return.

The 8-days lockup plan is designed for short-term investors who prefer quick returns on their crypto investments. The 16-days and 25-days lockup plans on the other hand are for long-term investors and they also have giveaway bonus instant credits.

The 16-days lockup plan has a 2% giveaway bonus instant credit while the 25-days lockup plan has a 3% giveaway bonus instant credit.

BFARM Referral program

BFARM has also unveiled an extensive referral program to provide its users with an opportunity to earn as the ecosystem expands. By inviting more people to the platform, users get to earn extra coins.

The referral program groups the referrals into five groups depending on the hierarchy of those referrals.

Level 1 referral earn 5%, level 2 referrals earn 3%, level 3 referrals earn 2%, level 4 referrals earn 0.5% and level 5 referrals earn 0.05%.

The post BFARM launches a BNB and BUSD stake & earn feature and an extensive referral program appeared first on Coin Journal.

Data Source: Tradingview

Data Source: Tradingview