With the majority of the altcoins seeing significant price gain lately, there is one by the name of STEPN (GMT) that has broken the ranks by rallying by over 320% in the past fourteen days.

At the time of writing, it was trading at $2.31 after a slight retracement from a daily high of $2.46 but still in the green with a 12.30% rise over the past 24 hours.

This article reflects on the factors behind the current STEPN price rise.

What STEPN?

STEPN is a Web3 lifestyle app launched on the Solana blockchain with fun features as well as a gaming design. It has two tokens; Green Metaverse Tokens (GMT), which is its governance token, and Green Satoshi Token (GST), which is used as the game token.

To earn GST tokens, users are given NFT sneakers with a built-in swap function to jog, walk or run outdoor, users are rewarded for running or walking. GST earnings are then stored in an in-app wallet and can be used to mint new sneakers or to upgrade game level.

Why is STEPN (GMT) price surging?

There are three main factors being attributed to the current surge in GMT price. These include the recent announcement about Nike and Adidas sportswear by a STEPN representative, STEPN’s partnership with Binance, and STEPN’s plan to apply a move-to-earn method.

-

Announcement about Nike and Adidas sportswear

During an interview, one of the STEPN representatives whose identity was not disclosed said that they have an upcoming announcement regarding big sportswear companies like Nike and Adidas.

In a recent interview, an unnamed STEPN (GMT) crypto platform representative says they have an upcoming announcement relating to sportswear giants Adidas and Nike.

“Big sports brands like Nike and Adidas are known for shaping the market regarding walking and running. Do you see these players as a threat in the future? You will see we have an announcement about this very soon.”

-

STEPN partnership with Binance

In a tweet earlier this week, STEPN gave a hint that it was planning an undisclosed partnership with a crypto exchange, Binance.

A beginning of many possibilities! pic.twitter.com/jfYPB7Pwe0

— STEPN | Public Beta Phase III (@Stepnofficial) March 28, 2022

-

Move-to-earn method

In addition, during a Solar Eco Fund interview, they said that to remain competitive, they will apply the move-to-earn crypto project to maintain a high return on investment (ROI) on GMT tokens.

“People are chasing high sustainable ROI, we believe we will be on the top of the list by providing long-lasting use cases and burning scenarios of GMT to maintain the high demand of GMT.”

Besides, STEPN is planning to convert the STEPN app to an NFT marketplace and a social platform.

The post Why has STEPN (GMT) price risen by more than 320% in two weeks? appeared first on Coin Journal.

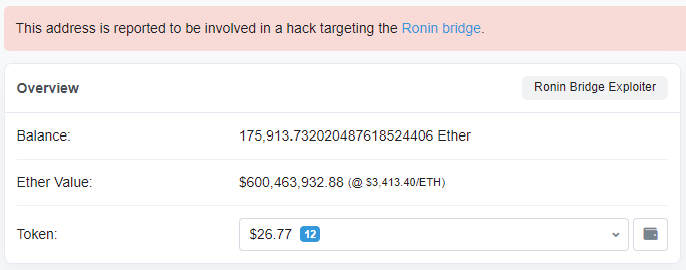

Ethscan shows the location of the funds

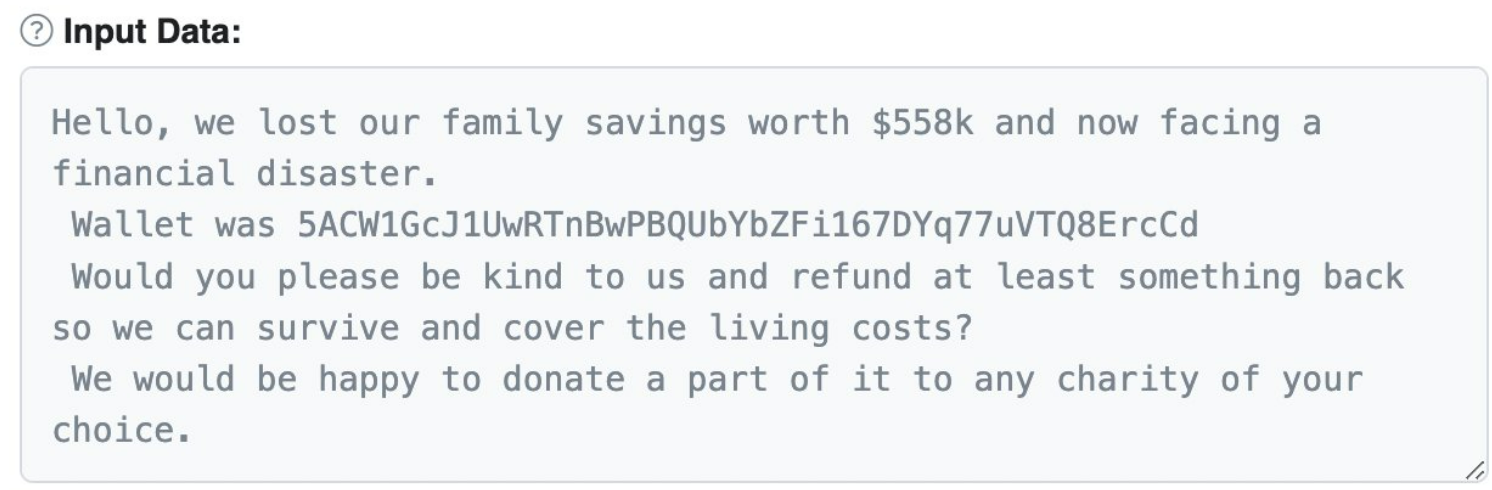

Ethscan shows the location of the funds A victim cries out to the hacker on ethscan

A victim cries out to the hacker on ethscan