Altcoins had a strong performance in March as the overall cryptocurrency industry recovered. This performance happened even as the crisis in Ukraine escalated and the Fed started its hiking policy for the first time since 2018. Here are some of the best coins to invest in April.

1. Ethereum (ETH)

Ethereum performed well in March as the network’s merge happened in the Kiln network. This is an important step as the network moves from to a proof-of-stake platform. It also did great as activity in its network rose as evidenced by the rising total value locked (TVL) in DeFi and NFT industry.

Therefore, there is a likelihood that Ethereum price will keep doing well in April as investors continue focusing on the merge process. Some analysts expect that it will leave the kiln testnet in April while others see it taking some time.

On the 4H chart, it appears like ETH formed a top at around $3,488 in March. This signals that it will likely drop to the support at $3,046 and then resume rising.

2. Terra (LUNA)

LUNA had a strong month in March as its price jumped to an all-time high. Analysts cited the strong performance of the Terra USD coin and its top DeFi platforms like Anchor Protocol and Lido as the reason for this performance.

Terra is a good cryptocurrency to invest in April after the developers raised billions from investors and as more developers embrace the network. They also announced that they will spend $10 billion buy Bitcoin. At the same time, the daily chart shows that it managed to cross the key resistance at $106 in March. This was its previous all-time high. Therefore, a retest of its all-time high will lead to more gains.

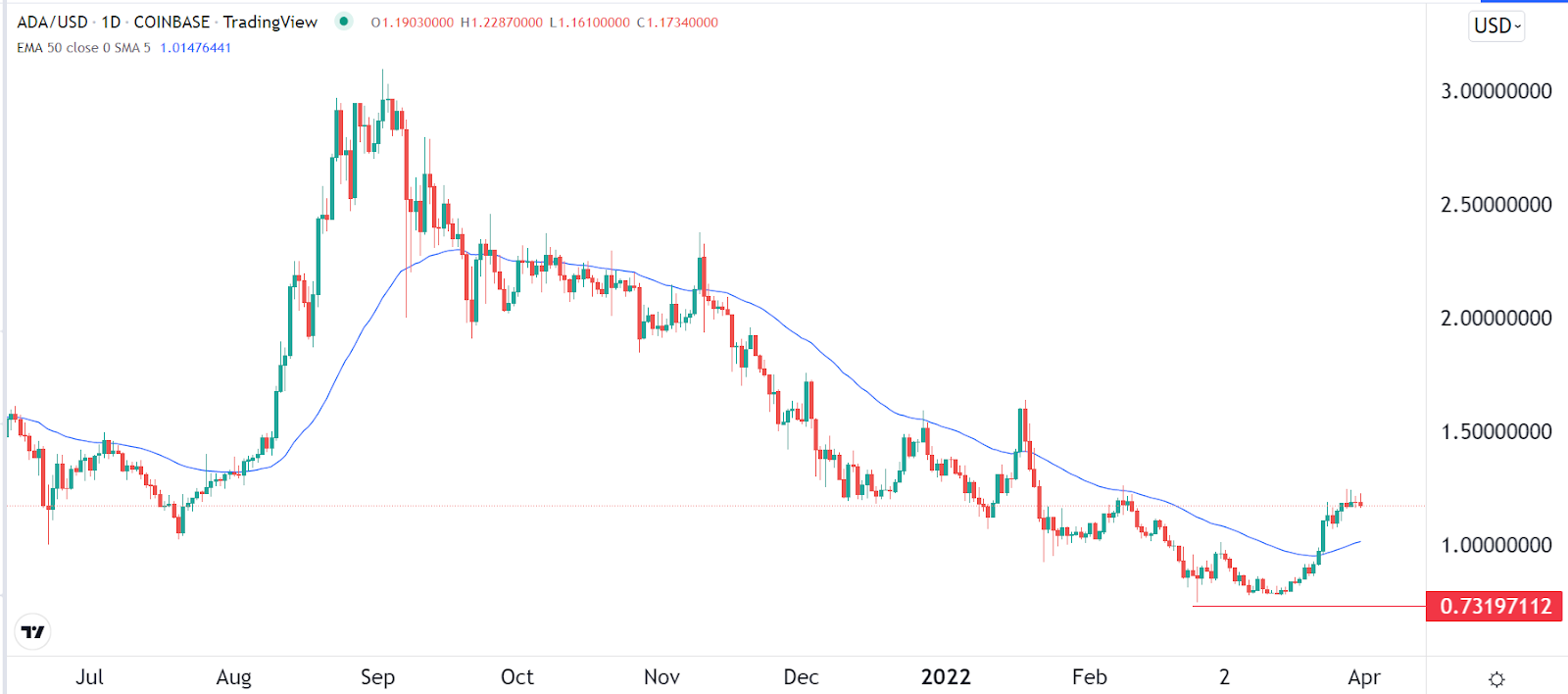

3. Cardano (ADA)

Cardano has been in a strong bearish trend in the past few months. At its lowest level this year, its long-term investors had lost over $65 billion from its all-time high. It managed to stage a strong recovery in March as the total value locked (TVL) of its network rose sharply to over $300 million. The resurgence was mostly because of MinSwap. The coin also rose as investors went bargain hunting.

Ada price found a strong support at $0.7320 in March. It has also moved above the 50-day moving average, signaling that the coin will likely keep rising in April. The key reference level to watch will be at $1.50.

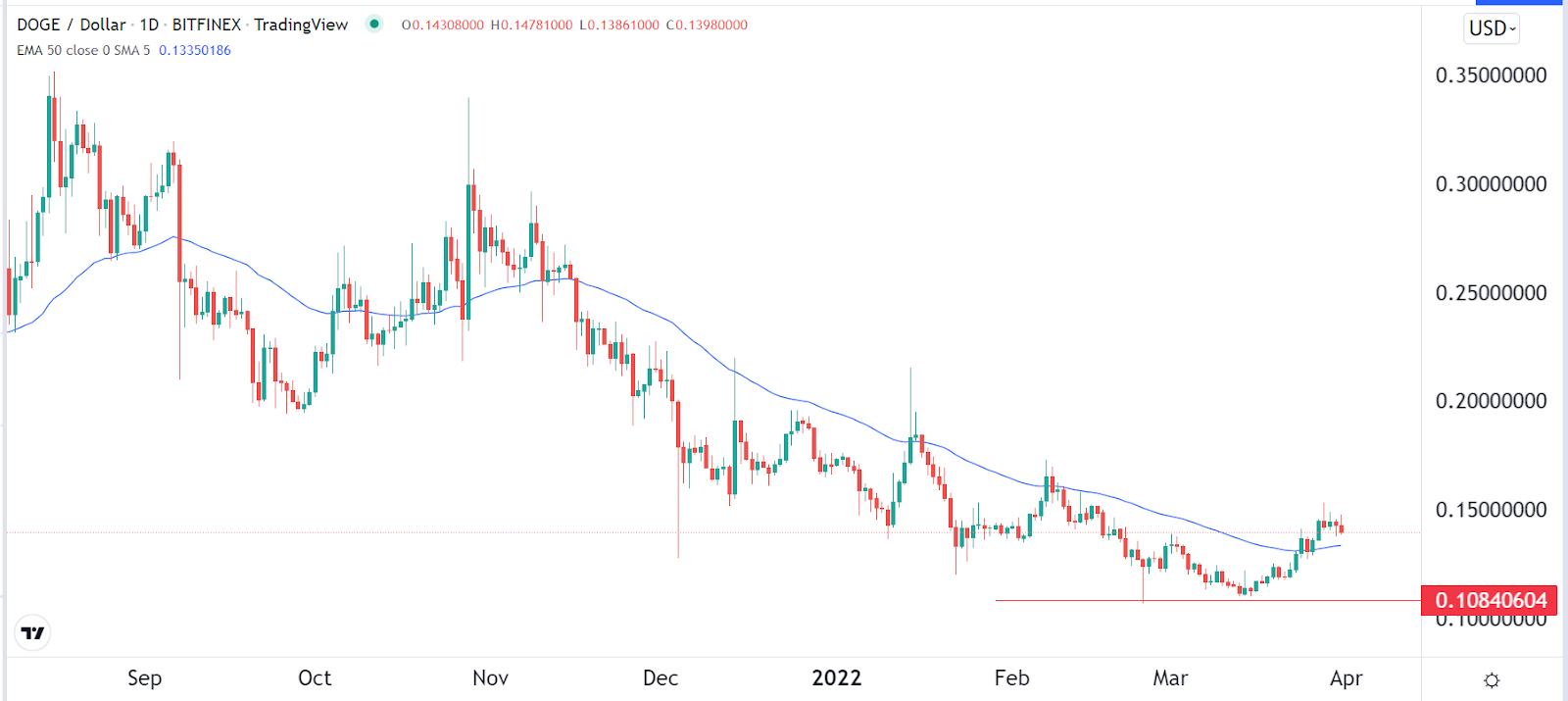

4. Dogecoin (DOGE)

Dogecoin has been a forgotten cryptocurrency in the past few months. It crashed to a low of $0.1084, which was about 81% below the highest point in 2021 and 61% lower than the highest level in October. It has fallen because of the overall lack of a bullish catalyst.

While technicals seem bearish, there is a possibility that the coin will rebound in April as investors go bargain hunting. Also, recently, most meme stocks have gone parabolic, meaning that meme coins could also rise. Most importantly, it has formed a strong support at $0.8400.

5. Waves (WAVES)

Waves is a blockchain project that aims to become a better platform than Ethereum. It has been used to build some of the most popular platforms like Neutrino and Waves Exchange. Waves price went parabolic in March and soared from less than $15 to over $60.

This performance happened as more developers moved to the network and its total value locked rose to an all-time high of over $4.6 billion. The main drivers were Neutrino, Vires Finance, and Waves Exchange soared.

Waves will likely have a pullback in April as it moves to a distribution phase. While this decline will happen, the bullish trend will likely continue later during the month.

6. Hedera Hashgraph (HBAR)

Hedera Hashgraph is a smart contract platform that is at least 10 times faster than alternatives. It is also widely used to build decentralized applications by companies like Avery Dennison and ServiceNow.

HBAR’s price has been in a strong bearish trend in the past few months. It moved from a high of $0.58 to a low of $0.188. It found a strong support at $0.188 in March and then managed to move above the 50-day moving average while the Relative Strength Index (RSI) has pointed upwards.

HBAR has lagged its peer coins like Near Protocol and Algorand and there is a likelihood that it will keep rising as investors continue bargain hunting.

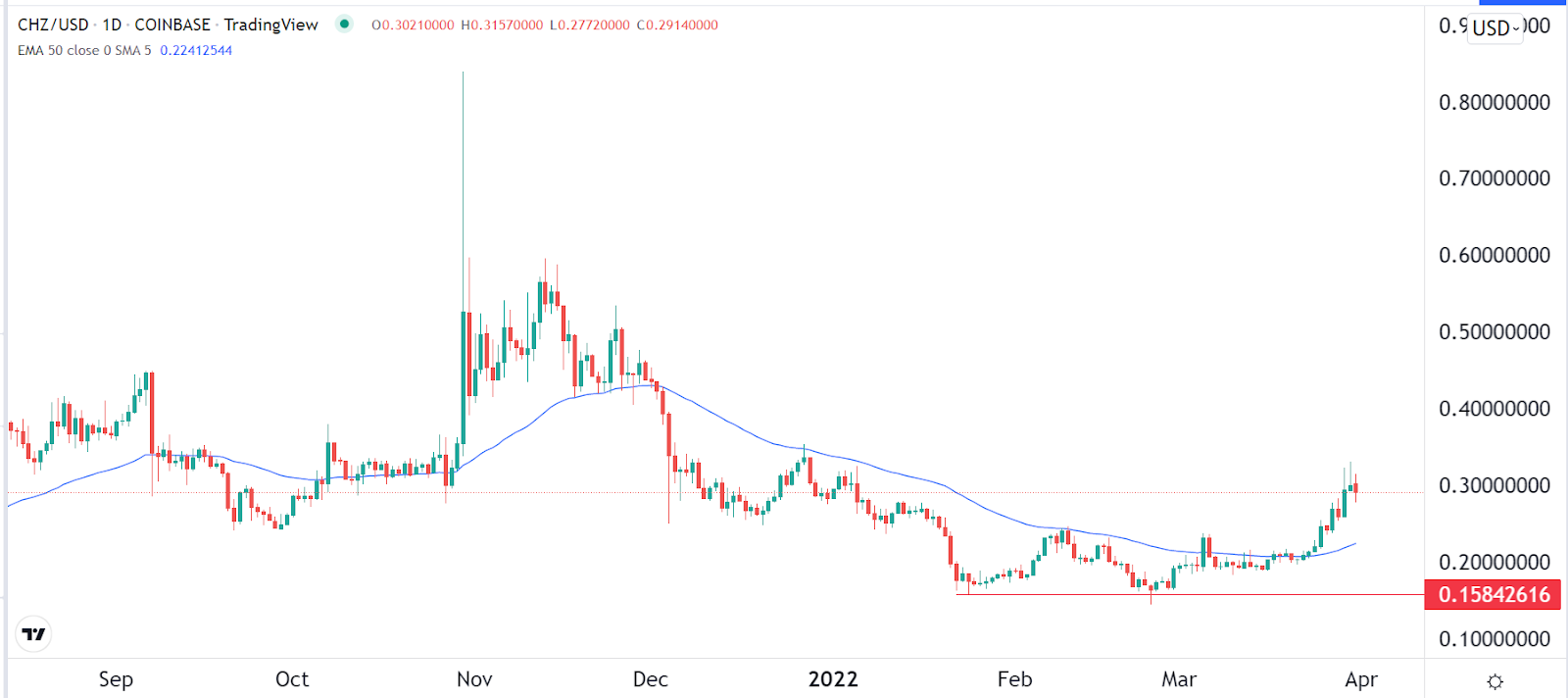

7. Chiliz (CHZ)

Chiliz is another cryptocurrency to invest in April. It is a leading blockchain project that focuses on the relatively new industry known as fan token offerings (FTO). In the past few months, it has signed some of the biggest teams like Manchester City and Manchester United.

Like all other cryptocurrencies, its price declined in the past few months as the value of fan tokens plummeted. But there are signs that the sector is gaining traction as its market cap soared to over $3 billion. Chiliz also announced a new partnership with Lionel Messi.

CHZ found a strong support at $0.1584 in March and has moved above the 25-day MA. It will likely keep rising in April.

8. STEPN (GMT)

STEPN was one of the breakout stars in March as it went parabolic and moved into top 100 of the biggest cryptocurrencies in the world. It is a platform that seeks to disrupt the fitness industry by paying people to run, walk, and jog. To participate, people need to first purchase an NFT sneaker and install an app with tracking features. They will then receive a GMT token whenever they workout. While GMT price jumped in Match, there is a possibility it will continue rising in April as the fear of missing out sets in.

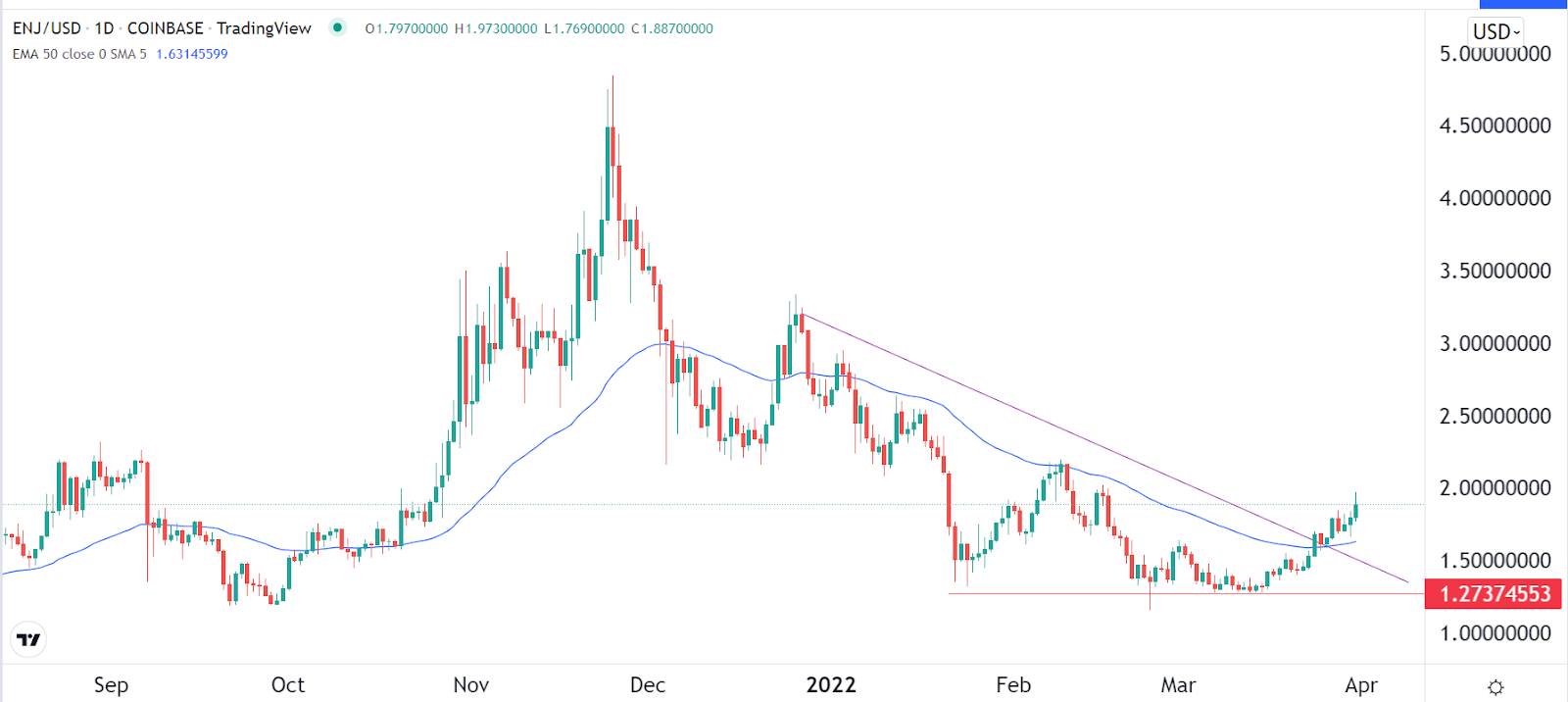

9. Enjin Coin (ENJ)

Enjin is a blockchain project that has been around for more than a decade. It has created a platform that allows people to create and market their non-fungible tokens (NFT). Enjin found a floor at around $1.27 in March and then started a bullish trend. It moved above the 25-day moving average and rose above the descending trendline. The coin will likely do well as its Efinity network gets more integrated to Enjin.

10. VeChain (VET)

VeChain was once one of the hottest cryptocurrencies. At its peak, it was among the top 15 of the biggest cryptocurrencies in the world. It then made a strong drop and moved to position 45. This changed in March as demand for VeChain started rising. It rose above the 23.6% Fibonacci retracement level and the 50-day moving average. Therefore, there is a possibility that it will continue finding buyers in April.

The post 10 Best Altcoins to Invest in April appeared first on Coin Journal.