BNB Chain has successfully burned over 1.8 million BNB tokens in a transaction completed on 19 April 2022.

Per data from Binance explorer, the transaction saw 1,830,382.48 BNB burned. The market value of the tokens at the time of the burn was over $772 million.

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 1,830,382 #BNB (772,363,806 USD) burned at #Binancehttps://t.co/x1VxRpqgt1

— Whale Alert (@whale_alert) April 19, 2022

Binance CEO Changpeng Zhao had earlier confirmed the removal of the over 1.8 million BNB. He also acknowledged the successful burn, stating that this activity is part of BNB’s whitepaper.

$741,840,738 worth of #BNB will be taken out of circulation soon.

Real time info: 👇https://t.co/BikWciOHY7#BNB is deflationary. If you don’t know what that means, you lack basic financial knowledge to get lucky in this world. Harsh but true. Time to learn.🙏

— CZ 🔶 Binance (@cz_binance) April 19, 2022

19th BNB Burn

This was BNB’s 19th burn (for Q1 2022) after Binance adopted an auto burn system that automatically triggers from an on-chain command.

The auto burn system allows for a planned removal of BNB from circulation and takes into account the coin’s price and total blocks generated in the given quarter on the Binance Smart Chain. For Q1 2022, the total number of blocks was 2581627, with the average price at $403.22.

During the 18th burn, over $729 million worth of BNB was removed from circulation.

The next burn is estimated to also see 1.8 million BNB (estimated at $769 million) taken out of circulation. According to data on the BNB Chain, the 20th burn is expected to occur at an average price of $424.59.

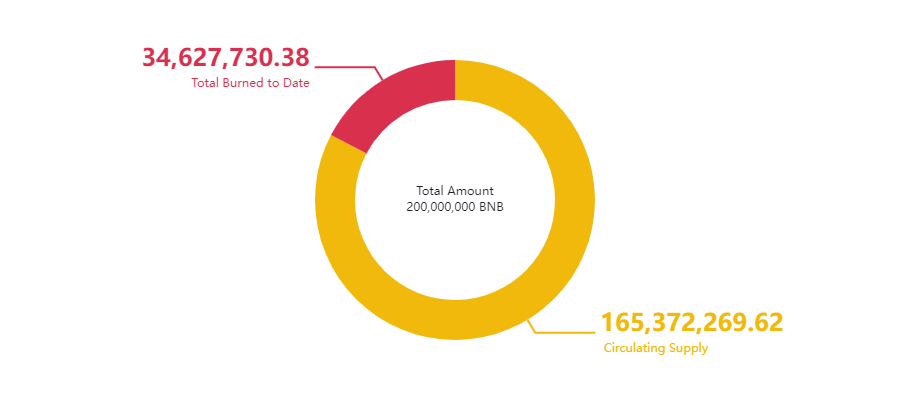

BNB Chain plans to reduce the total supply from 200,000,000 BNB tokens to 100,000,000. As of the latest burn, a total of over 34.6 million tokens have been destroyed. Data shows the circulating supply is currently just over 165.3 million.

BNB supply

BNB supply

BNB was trading at $420 at writing time, with the token’s value up by 4.4% in the past 24 hours. BNB/USD has added nearly 7% in the past week.

The post BNB Chain burns $772M worth of BNB appeared first on Coin Journal.