Shiba Inu price has been disappointing lately. It has crashed by more than 75% from its all-time high, giving it a market capitalization of more than $12 billion. As a result, it is the 15th biggest cryptocurrency in the world. A common question among traders is whether Shiba Inu is a good investment. In this article, we will explain why we believe that SHIB is a good investment.

Read more about how to buy Shiba Inu.

SHIB is an ERC-20 token

Shiba Inu is known for its association with Dogecoin. Indeed, the coin was created in a bid to become a better alternative to Dogecoin. However, the two coins are radically different. For one, DOGE is built from scratch using proof-of-work technology. Its foundation is similar to that of Bitcoin, which means that anyone can mine it.

However, Shiba Inu is an Ethereum Request for Comments (ERC-20) token. An ERC is the smart contract standard for building on Ethereum. As a result, Shiba Inu does not have its underlying technology, meaning that it uses the one provided by Ethereum.

This is a good thing considering that Ethereum is now in an upgrade period where its developers are transitioning it from a proof-of-work to a proof-of-stake platform. The Merge of the Beacon Chain and the current Ethereum will happen in the third quarter of 2022. Therefore, this merge will make Shiba Inu faster and more user-friendly.

Shiba Inu is not just a meme coin

One of the top concerns that many people have about Shiba Inu is that it is a network without any utility value. While this was the case when it was started, things have changed dramatically in the past few months. Its developers have increased its utility as they seek to make it a more useful platform.

One of the most useful products is known as ShibaSwap. This is a Decentralized Finance (DeFi) platform that makes it possible for people to swap tokens, buy and sell non-fungible tokens, and even invest to gain returns.

ShibaSwap is a relatively young product that has a total value locked (TVL) of over $70 million. Therefore, there is a likelihood that the Shiba Inu price will keep growing as this ecosystem grows. There is a possibility that it will grow because of how popular Shiba Inu is among traders.

Therefore, we believe that Dogecoin and Shiba Inu have a similar relationship like that of Ethereum and Binance. While Bitcoin is mostly used for payments, Ethereum has additional utility value.

It is possible to stake Shiba Inu

Staking is a process where an investor is able to earn a return for simply depositing their coins in an exchange. Because of how it is built, it is not possible to stake Dogecoin. But it is possible to earn a return by staking Shiba Inu.

One of the easiest methods of earning these returns is using Shiba Swap. To do this, just visit the website and then select bury. The idea is that when you bury your SHIB, you will earn proportionally to your contribution to the pool.

After staking, you will receive xSHIB which represents your share of the return. These rewards are then distributed every week. At the time of writing, the APY for staking Shiba Inu is 5.50%, which is a reasonable amount.

Read more about the best cryptocurrency exchanges.

Shiba Inu is known for its comebacks

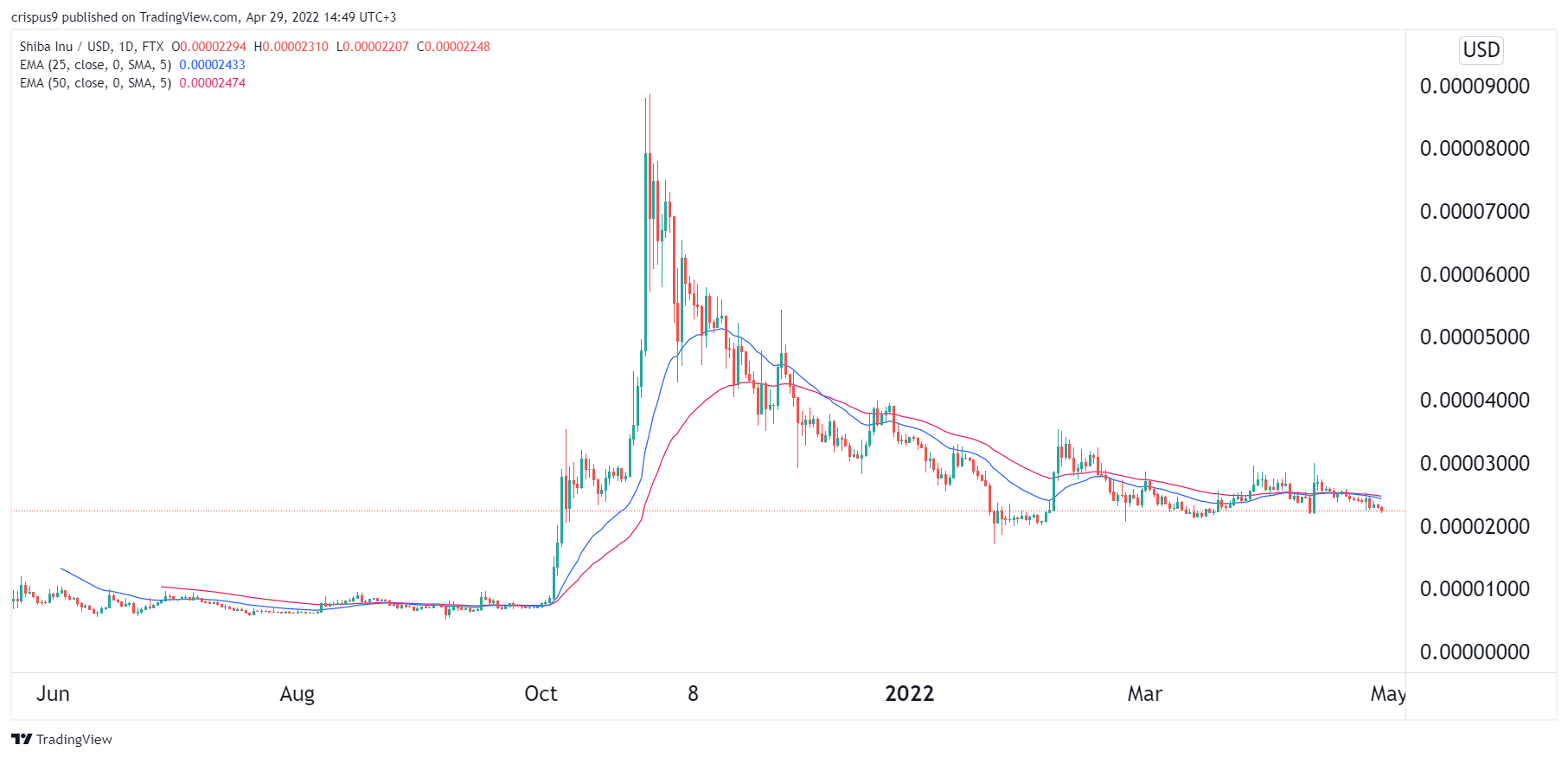

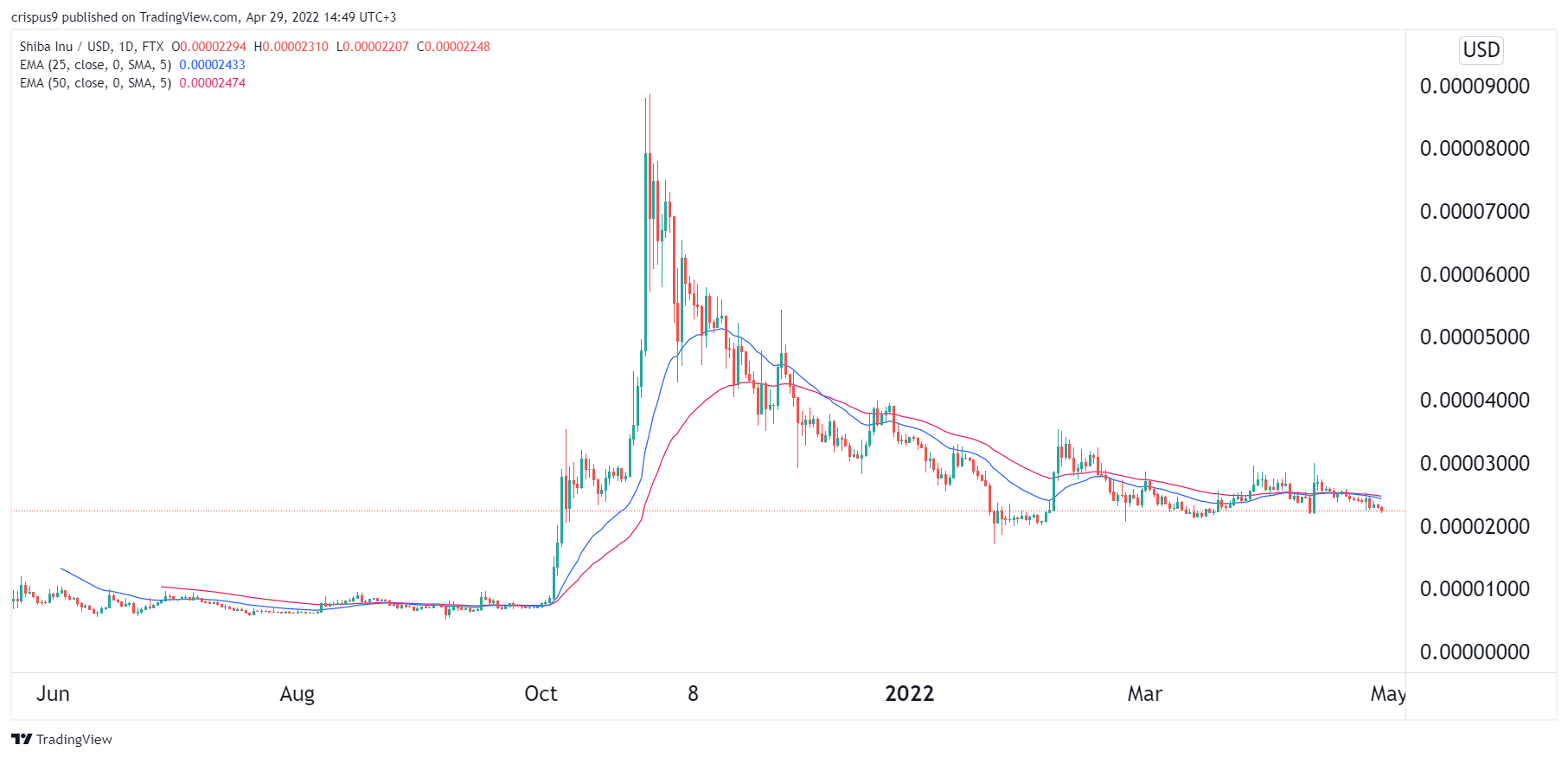

Another reason why we believe that Shiba Inu is a good investment is that the coin is known for its comebacks. When Shiba Inu was started, its price initially jumped to a high of $0.000040. At the time, most people were equating it to Dogecoin, which was then having its best time ever.

However, these gains were short-lived as the coin crashed by more than 90% and reached an all-time low of $0.0000055. At the time, most people, including myself, believed that the coin had collapsed. This changed in October 2021 when the coin rallied to an all-time high of $0.000090. This means that the coin can always make a comeback.

History is full of coins that dropped sharply and then bounced back. For example, in 2020, Bitcoin crashed from over $13,000 to $3,500 when the Covid-19 pandemic started. While most people expected its price to keep crashing, it bounced back and reached an all-time high of nearly $70,000.

Shiba Inu crash is not isolated

Further, Shiba Inu is a good investment because its current crash is not an isolated case. For one, most coins have been in a downward trend for months as worries about the hawkish Federal Reserve continue. Notably, other assets like stocks have also crashed hard, with the Nasdaq 100 falling by more than 10% from its YTD high.

Therefore, this is a good thing because, historically, sharp downward trends don’t last forever. I expect that Shiba Inu and other coins will rebound when the sell-off in stocks ends. Further, SHIB has an excellent risk-reward ratio because of how cheaply it trades.

The post Is Shiba Inu a Good Investment? 5 Reasons We Think It Is appeared first on Coin Journal.