Binance will over the next three years be the exclusive crypto sponsor of four competitions organised by the Confederação Brasileira de Futebol (CBF)

Binance, the world’s largest crypto exchange platform by trading volume, has announced a new partnership with the Brazilian national football body, making the crypto provider the official crypto sponsor of four competitions overseen by the Confederação Brasileira de Futebol (CBF).

Changpeng Zhao, the CEO and founder of Binance said the collaboration will help drive crypto adoption in Brazil given the massive popularity that football enjoys in the country.

“Sport is an important driver for inclusion in society. With football being strongly linked to Brazilian identity and culture, our partnership with CBF is important to help expand crypto adoption and generate positive impact for our users, the crypto and blockchain community, and society as a whole in Brazil,” Zhao said.

Per a blog announcement Binance published on Monday, the three-year deal will see the crypto giant act as the exclusive crypto sponsor of the Brasileirão Assaí, Brasileirão Female Neoenergia, Brasileirão Female A-2 and Brasileirão Female A-3.

Under the terms of the deal, Binance will benefit from promotions and advertisement opportunities at the tournaments. The exchange, on the other hand, will help develop Fan Tokens and NFTs for the CBF.

The deal with CBF adds to Binance’s growing footprint in the Brazilian sporting space, with the exchange having signed deals with the Paulistão Sicredi and Santos Football Club.

On the international scene, Binance has partnerships with Portuguese soccer giants Porto and Italy’s Lazio. The exchange also sponsored the 2022 African Cup of Nations.

The post Binance signs sponsorship deal with Brazil’s CBF appeared first on Coin Journal.

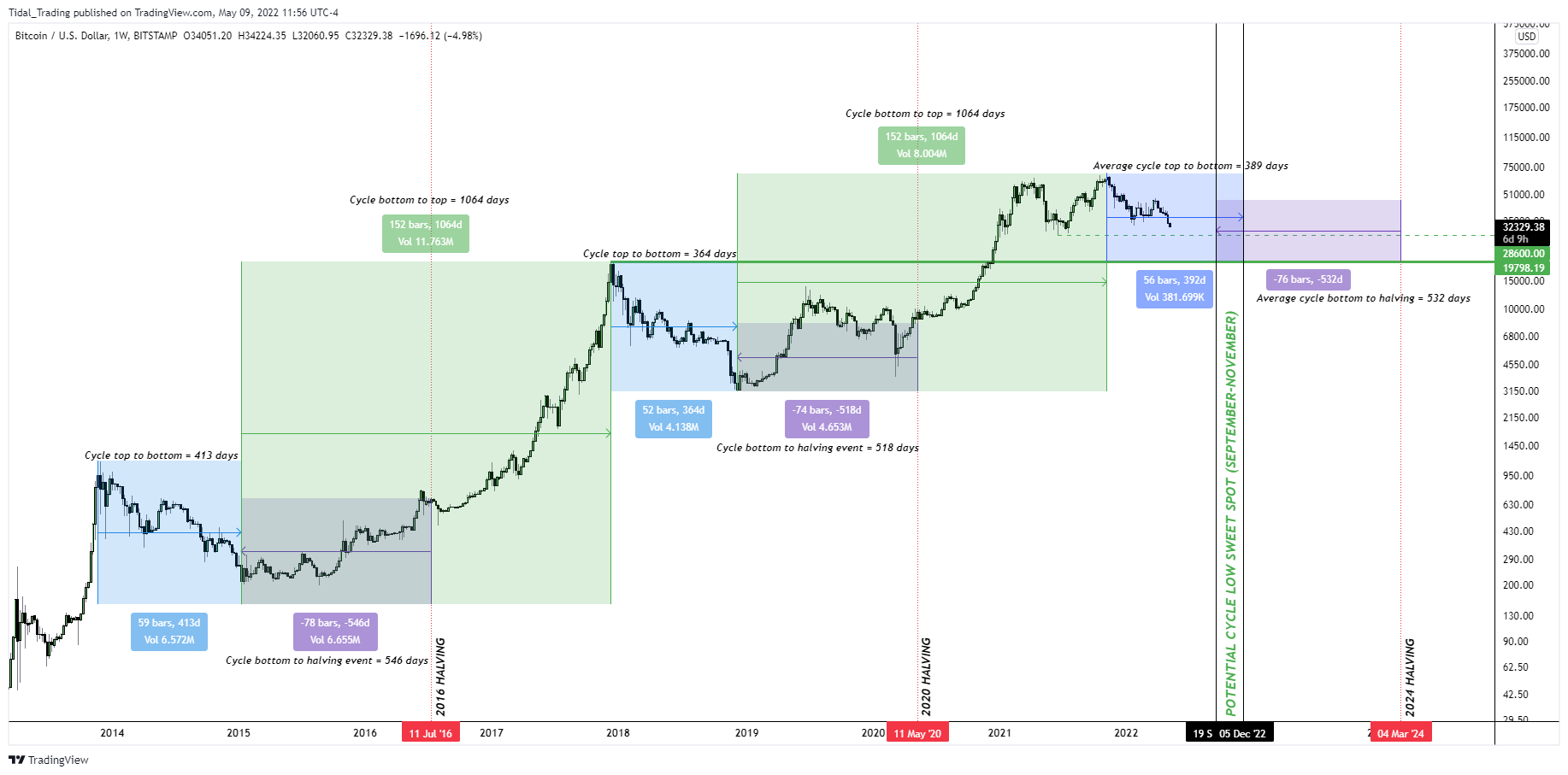

Chart showing historical price movement for BTC. Source:

Chart showing historical price movement for BTC. Source: