Market’s speculation of the US Federal Reserve’s interest rate hikes continues to hinder Bitcoin, according to Marcus Sotiriou of GlobalBlock.

Bitcoin continues to hold above $43,000 after a recent uptick in prices. However, the bellwether cryptocurrency “remains hesitant,” to make a major move upwards, suggests an analyst with UK-based digital asset platform GlobalBlock.

And he points to market concerns over higher interest rates as one of the factors to put a dampener on the flagship cryptocurrency’s chances of further gains.

In a note shared with CoinJournal in which he comments on various Bitcoin-related news events this week, Marcus Sotiriou points to data showing Bitcoin’s latest upside to have been fueled by an uptick in the futures market. He notes that the recent rally had its legs propped by the derivatives markets while spot sold-off.

The aggregated Cumulative Volume Data (CVD) for spot and the futures market shows that the latter has posted a significant surge in recent weeks while spot volumes continued to stagnate.

“This suggests that this price rise was driven by speculation or hedging, rather than genuine demand,” he noted.

As the broader market watches out for the language in the US Federal Reserve’s minutes from the January 25th-26th policy meeting, Sotiriou says the contents could provide an “insight” into the Fed’s thinking on interest rates.

While he thinks the market is unlikely to be “shocked” by today’s FOMC minutes given investors have already priced in the March rate hike, concerns remain around just how aggressive the Fed will be going.

Despite these concerns, Sotiriou says increased investment into the crypto sector by major financial institutions is a positive indicator of a possible rebound.

Such companies include Singapore’s DBS that plans to launch a crypto trading service for retailers by the end of 2022, and Fidelity, which just launched an exchange-traded product (ETP) in Europe.

Bitcoin currently trades around $43,630, nearly 1% lower in the past 24 hours. The cryptocurrency looks to be mirroring the US stock market, which has the S&P 500 and Nasdaq down by 0.76% and 1.31% respectively.

The post Higher interest rate concerns put a dampener on Bitcoin, says analyst appeared first on Coin Journal.

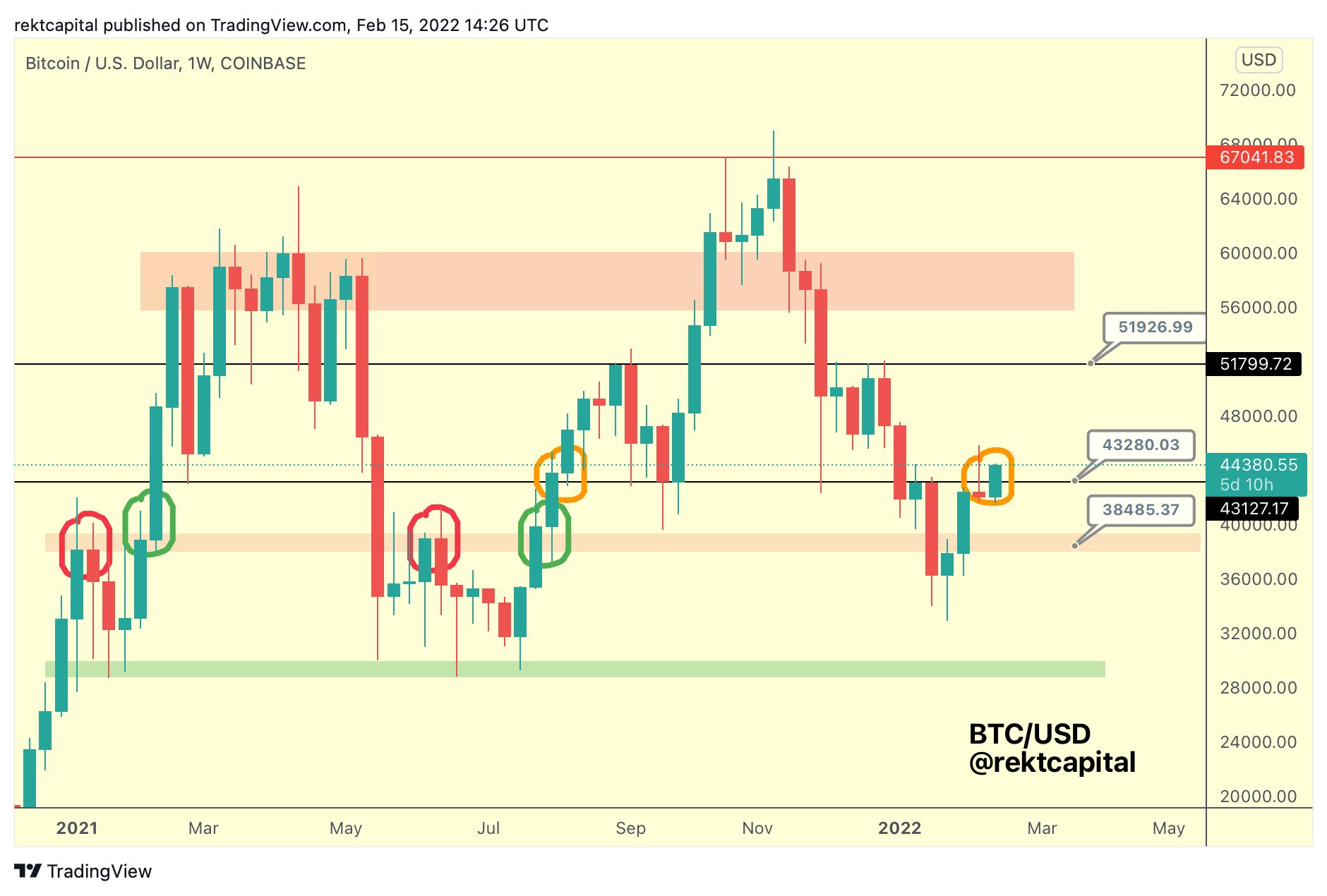

Weekly chart showing Bitcoin price breakout into the key bullish range of $43-$52k. Source:

Weekly chart showing Bitcoin price breakout into the key bullish range of $43-$52k. Source: