X2Y2 price has been soaring since February 16. It has risen by more than 200% in a little over two days.

At the time of writing, it was trading at $3.56 up 16.20% in the last 24 hours having hit a daily high of $4.17and a daily low of $2.64.

Though it is normal to see a new token rise immediately after launch, X2Y2’s surge has made headlines after jumping by over 200% in two days. Let’s take a deep dive into what is propelling the surge.

Why is the price of the X2Y2 token rising?

One of the factors being attributed to the current X2Y2 price surge is its launch on February 16. The X2Y2 Ethereum-based NFT trading platform team conducted a vampire attack, a tactical move that projects use to distribute free tokens to incentivize users of OpenSea to start using their product. LooksRare also used the same move.

In its case, LooksRare dropped tokens for OpenSea users who had traded over 3 ETH on OpenSea and also rewarded its active users. While the method attracted some traffic for LooksRare, it also led to some suspected cases of wash trading on the platform.

X2Y2 airdropped 120 million tokens, which is 12% of its 1 billion token supply to 861,417 wallets had traded on OpenSea between mid-June and mid-December 2021. Token distribution was proportional to their trading activity on OpenSea. In reciprocation, the Airdrop claimers were to list their OpenSea-listed NFTs on X2Y2 at the same price they list on OpenSea.

Although OpenSea is the leading NFT trading hub although it does not have a cryptocurrency token of its own, other alternatives are rapidly cropping up and trying to offer a better user experience as they aim at snatching the OpenSea users base. And one of the ways competitors are doing so is through Airdrops like what X2Y2 did.

X2Y2 tokenomics

X2Y2 tokenomics design was almost similar to that of the LooksRare (LOOKS) token, only that X2Y2 will pay token stakers and also an additional platform cut-off fee paid in WETH rather than rewarding users for trading.

Staking X2Y2 tokens currently is over 8000% per annual yield. In addition, the platform also rewards staking NFTs.

Listing an NFT on X2Y2 is also counted as an NFT staking and makes the users eligible for free rewards.

The post X2Y2 token price jumps over 200% in two days: what is causing the new token to rally? appeared first on Coin Journal.

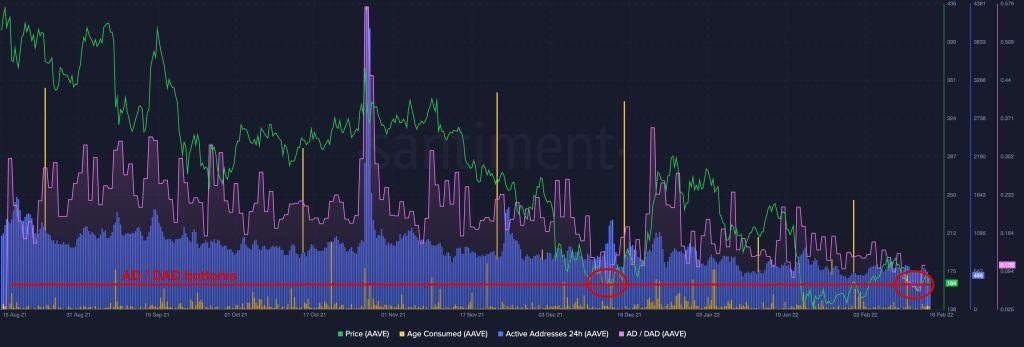

AAVE chart showing the AD/DAD ratio. Source: Santiment.

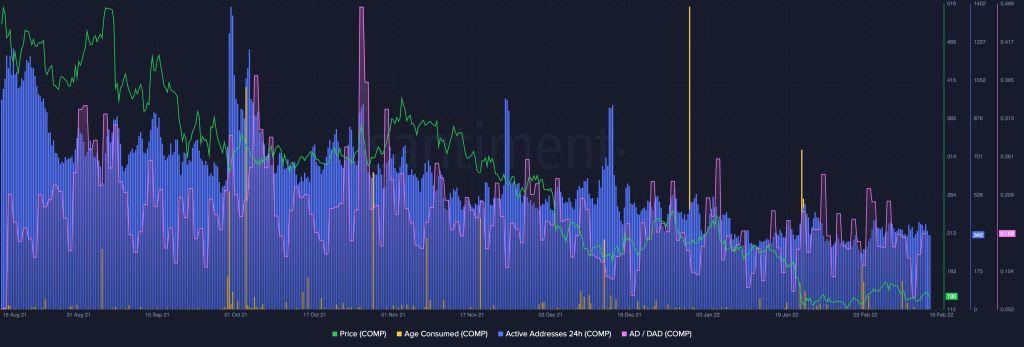

AAVE chart showing the AD/DAD ratio. Source: Santiment. Compound chart showing the dip in the active deposits to daily active addresses. Source: Santiment

Compound chart showing the dip in the active deposits to daily active addresses. Source: Santiment