Bitcoin mining has picked up again in China, a new report suggests.

According to a study by Cambridge University, Bitcoin mining activity in China has slowly surged to currently account for 21% of the total global hashrate.

The report released on Tuesday comes nearly a year after a massive Chinese crackdown on crypto mining and trading drove miners out of the country. As the exodus of miners found its way into the US and other countries, the overall hashrate securing the Bitcoin network from within China fell dramatically.

Per the report, miners have launched “covert mining operations”, the result of which is the uptick in the hashrate from virtually zero to nearly a quarter of global output.

“In China, following a sudden uptick in covert mining operations after the June 2021 government-mandated ban on Bitcoin mining, the country has re-emerged as a major mining hub,” the Cambridge Centre for Alternative Finance (CCAF) noted in its research report.

But while there’s a re-emergence of activity in the Chinese market, bringing it to second globally, the majority of computational power currently securing the Bitcoin network is in the United States.

Cheap electricity and favorable outlook across several jurisdictions mean 40% of hashrate is from US-based miners, a scenario likely to see the US top remain top of the list.

China’s 21.11% of global hashrate puts it ahead of Kazakhstan which accounts for 13.22%, Canada with 6.48%, and Russia with 4.66%.

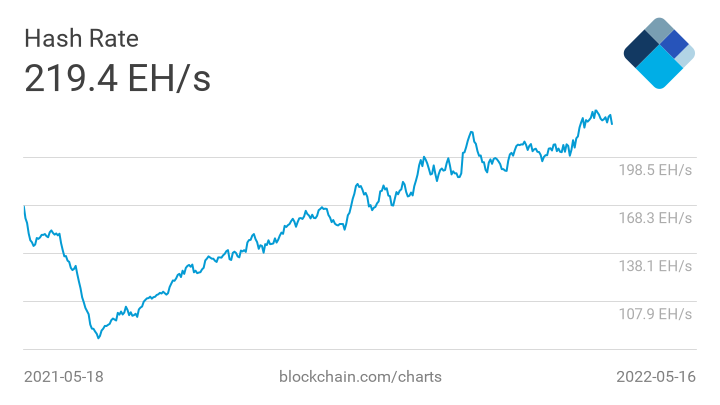

According to data from Blockchain.com, the Bitcoin hashrate has steadily risen since the lows reached in early July 2021. The 7-day average chart shows the total network hashrate stands at 219.4 EH/s (exahashes per second).

Bitcoin currently trades around $30,030 as bulls continue to battle massive bearish pressure.

The post China returns as second-largest Bitcoin mining hub: report appeared first on Coin Journal.