- Donald Trump-backed crypto project uses dip to buy ETH.

- Arkham data shows World Liberty Financial bought $10 million of Ethereum’s ETH as prices plummeted.

World Liberty Financial, the crypto project backed by U.S President Donald Trump, has scooped another $10 million worth of Ethereum (ETH).

The World Liberty wallet has in recent weeks aggressively purchased various tokens, and on Jan. 27, added ETH worth $10 million.

Trump-backed World Liberty buys ETH

Per market intelligence and security platform Arkham, the Trump family crypto project acquired the 3,247 ETH via crypto platform Cow Protocol. The purchase, including the recent $47 million in ETH bought on Trump’s inauguration day, brings the total Ethereum holdings World Liberty Financial has amassed to 59,265 ETH.

Arkham data shows te value of these tokens currently stand at around $185 million at the time of writing.

DONALD TRUMP’S PROJECT WORLD LIBERTY FI JUST BOUGHT ETH pic.twitter.com/uggBxVJL3H

— Arkham (@arkham) January 27, 2025

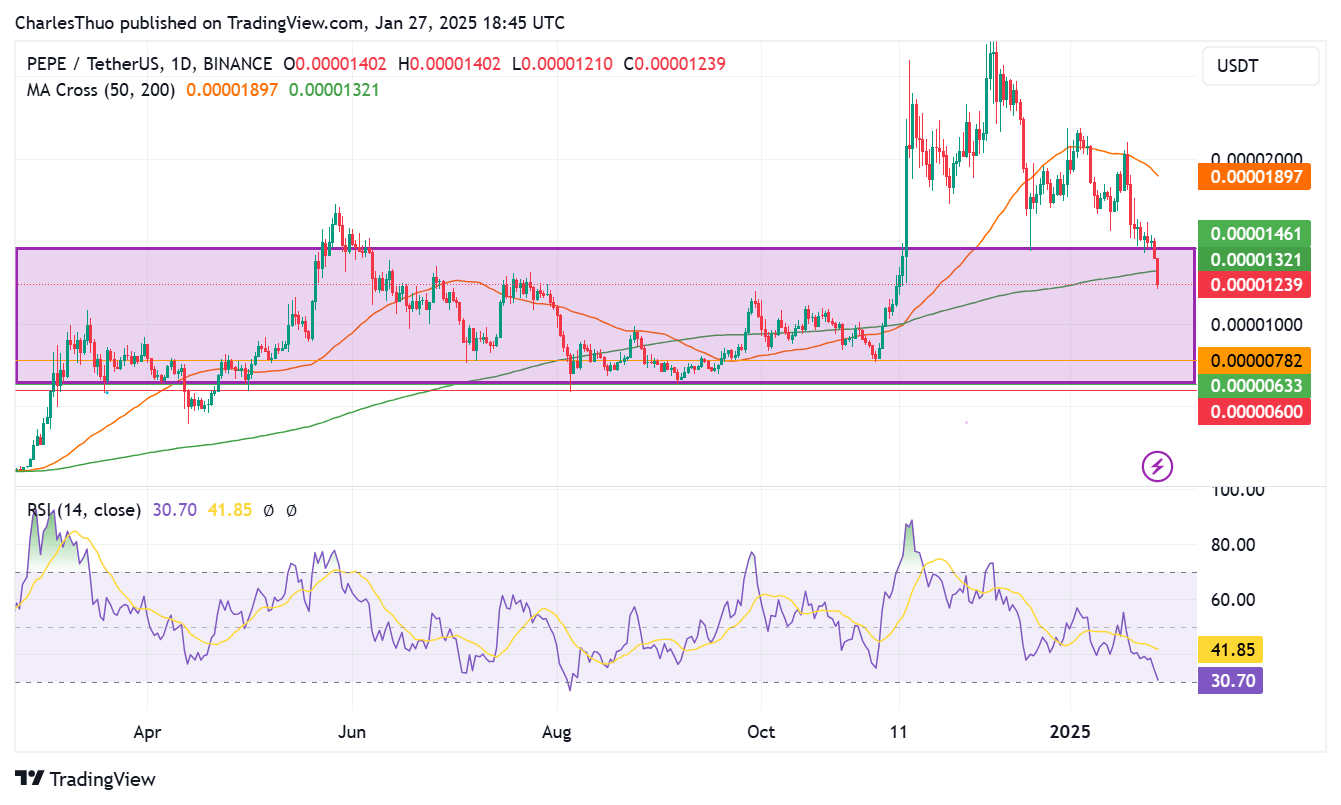

Notably, the purchase came as Ethereum and other cryptocurrencies mirrored Bitcoin’s sell-off on Monday. BTC dropped below $100k and touched lows near $97,900 as risk assets sold-off amid market’s negative reaction to the unveiling of China’s AI app DeepSeek.

The bloodbath that wiped off close to $1 billion in crypto positions as liquidations mounted in 24 hours had Ethereum’s price plummeting to near $3,000. World Liberty Financial exploited the dip as a buy opportunity.

MicroStrategy also bought more BTC, adding over $1 billion of the benchmark digital asset to its rapidly growing Bitcoin haul. The firm now holds 471,107 BTC purchased for $30.4 billion at the average price of $64,511 per BTC.

Overall, World Liberty holds cryptocurrencies worth over $381 million.

In addition to the $185 million in ETH, the platform also has over $65 million in Wrapped Bitcoin (WBTC), more than $60 million in Lido Staked ETH (STETH) and $33 million in USDC stablecoin. The project also holds USDT, LINK, AAVE and ENA among other tokens.

The post Trump family’s crypto project World Liberty buys $10m ETH appeared first on CoinJournal.