MicroStrategy hält derzeit insgesamt 125.051 BTC, die das Unternehmen für 3,78 Milliarden US-Dollar zu einem Durchschnittskurs von 30.200 US-Dollar pro Bitcoin erworben hat.

Krypto minen, NFT minten, Gold schürfen und Geld drucken

MicroStrategy hält derzeit insgesamt 125.051 BTC, die das Unternehmen für 3,78 Milliarden US-Dollar zu einem Durchschnittskurs von 30.200 US-Dollar pro Bitcoin erworben hat.

Auf der Suche nach einer dauerhaften Lösung für über 4 Million BTC-Nutzer, konzentriert sich die Regierung von El Salvador auf Stabilität und Betriebszeit der Chivo-Wallet, Skalierbarkeit und soziale Wirkung.

Vulcan Forged (PYR) price is skyrocketing. At the time of writing, had gone up 17.14% to trade at $13.80 up 17.14% with a daily high of $14.30 and a daily low of $11.84 in the last 24 hours.

PYR currently has a trading volume of $90,542,432, a market cap of $329,857,824, a circulating supply of 23,897,700 PYR coins, and a max. Supply of 50 million PYR coins.

In this article, we shall delve into what is making the PYR coin price rally.

Before we look into the current bullish, it’s important we first explain what Vulcan Forged is.

In a nutshell, Vulcan Forged is a blockchain NFT marketplace and game studio that is in the process of developing its metaverse ecosystem called VulcanVerse. PYR is its native utility token.

This week the PYR token has been on the top while a majority of the metaverse and NFTs related project tokens recover from the recent bear market.

There are three main reasons behind the current Vulcan Forged (PYR) price surge. These include the launching of the Elysium testnet, listing of 100 plots of land for sale within the VulcanVerse ecosystem, and launching of a PYR bridge between Polygon and Ethereum.

The high gas fees related to the Ethereum Network has pushed many projects to launch solutions aimed at lowering the cost of deploying metaverse and NFT related project. That is why Vulcan Forged decided to launch the Elysium blockchain that it refers to as the blockchain for Metaverse.

It’s 20:05 GMT, 28th January, 2022, The Year of the Vulcanite.

And Elysium Testnet just went live.$PYR pic.twitter.com/qqevQeC0TB

— Vulcan Forged (@VulcanForged) January 28, 2022

Elysium will become the first carbon-neutral blockchain in the world and it shall work in collaboration with the Netherlands-based decentralized carbon credit exchange Coorest. Coorest will be responsible for offsetting the CO2 emitted by the Elysium blockchain using tokenized trees and gas fees from transactions.

The environmentally-friendly approach has caught the attention of other protocols and other metaverse projects have started showing interest in Elysium.

The plots of land available for purchase have led to an increase in token price and demand since the traders need to accumulate PYR tokens to purchase the plots of lands.

The limited listing of 100 plots was the main contributor to last week’s bullish momentum.

12-24 hours left on the @VulcanVerse 100 plot sale.

Auction expiry dates cleverly designed for time zones.https://t.co/CjiW5HPVjY$PYR pic.twitter.com/tDRhQT5HjG

— Vulcan Forged (@VulcanForged) February 1, 2022

Apart from the plot holders earning 35 PYR coins per month in the next four years, the plots of land can also be used to earn through rent or gameplay.

The success of VulcanDex, a decentralized exchange protocol that operates on Ethereum and Polygon Networks, is also seen as a major contributor towards the current PYR bullish trend.

As of 29th January, VulcanDEX had a total value locked of more than $10 million and the protocol is in the process of integrating a cross-chain bridge between Polygon and Ethereum to enable the simple transfer of PYR tokens between them.

The post Here is why Vulcan Forged (PYR) price is skyrocketing appeared first on Coin Journal.

Es besteht kein Zweifel daran, dass die Leute wirklich Angst haben und das ist typisch für Kaufgelegenheiten“, so Willy Woo.

The analyst says February could see a green candle if $37,000 holds as key monthly support, which could potentially open the path to $50,000.

Bitcoin price has failed to break above $39,000 this week, having bounced near the level multiple times since the upside from lows of $33,000 last week.

BTC is currently 2% down and looking to retest the $38k support level, which if it fails to hold, could see the flagship cryptocurrency dip further.

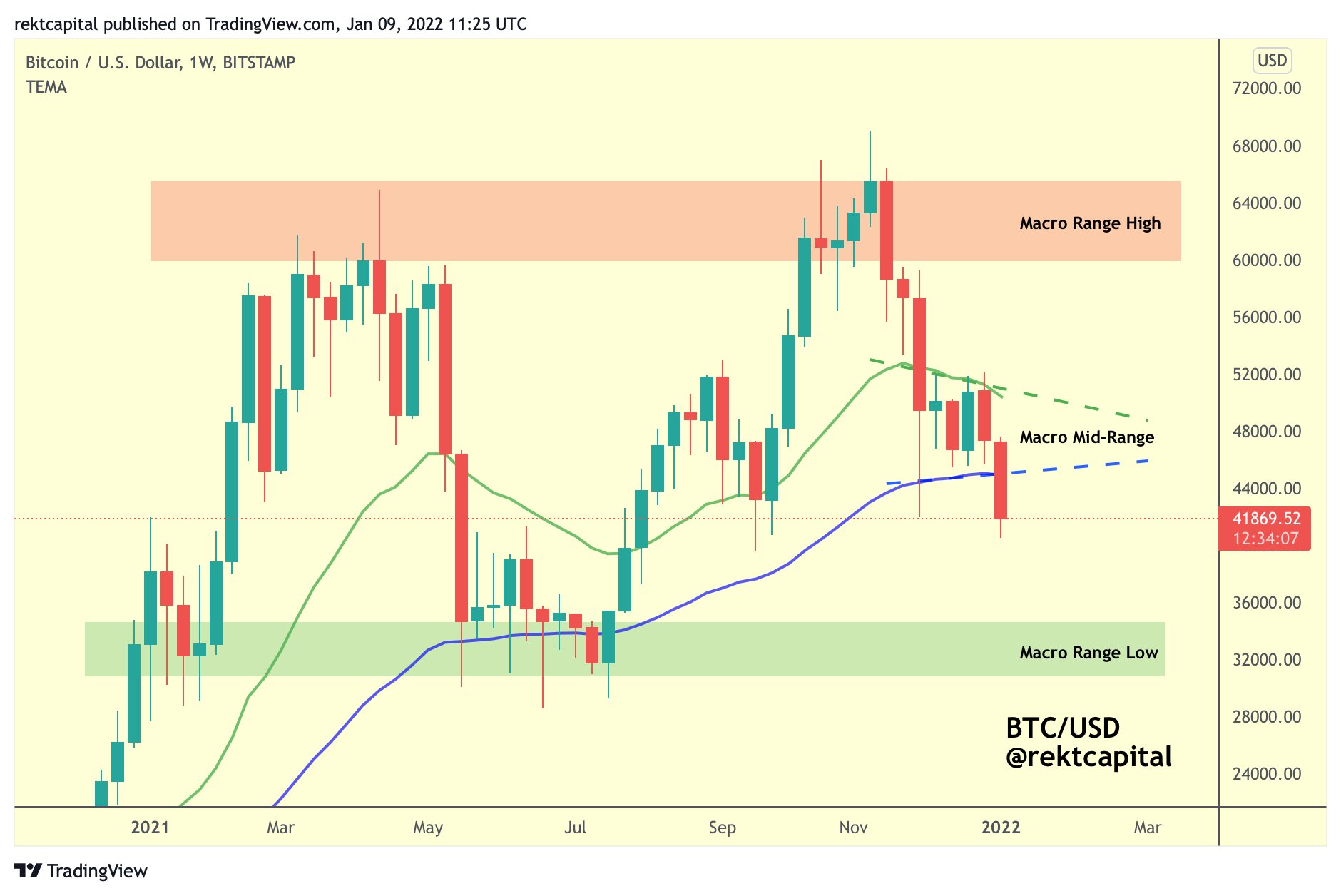

Pseudonymous crypto trader and analyst Rekt Capital says the declines keep Bitcoin in a consolidation phase, with support and resistance at two exponential moving averages (EMAs) on the weekly chart.

According to him, Bitcoin price has dipped below the two EMAs which macro-wise, represent the mid-range area.

“Since BTC lost its Mid-Range area as support… [It] has revisited the Macro Range Low area (green).Macro-wise however, BTC is still just consolidating between $28000-$68000 (green-red),” he noted in a tweet shared on Wednesday.

Chart showing BTC price below the two EMAs. Source: Rekt Capital on Twitter.

Chart showing BTC price below the two EMAs. Source: Rekt Capital on Twitter.

The analyst says Bitcoin is thus set to trade within the lower half of its range low-range highs of $28K-$68K. The benchmark crypto will stay within this “macro range for the next weeks,” Rekt added.

He highlights the $43-$48K range as a critical barrier below which BTC price is likely to hover until bulls reclaim the two EMAs. If this scenario plays out, he believes fresh momentum will see Bitcoin break back into the upper half the $28k-$68k.

Weeks ago, #BTC lost its Mid-Range as support

Which means BTC will occupy the lower half of the $28K-$68K macro range for the next weeks

BTC will stay below $43-$48K until BTC is able reclaim these two EMAs to confirm a return into the upper half of the range#Crypto #Bitcoin https://t.co/2Gs7jL6cvo pic.twitter.com/6m1SWgtSZG

— Rekt Capital (@rektcapital) February 2, 2022

Looking at monthly support, the analyst notes Bitcoin has had three successive negative closes so far. It includes January that saw BTC/USD slip over 20%.

According to Rekt, Bitcoin is likely to see a reversal in February. His outlook is that the monthly candle shows a retest and bounce off a key level at $37,000.

Beyond the green Monthly support level, #BTC has only ever seen a 3-month downtrend, at most

The last time $BTC experienced a 3-month downtrend beyond the green level…

BTC enjoyed a green Monthly candle

Could BTC be setting itself up for a green February?#Crypto #Bitcoin pic.twitter.com/MJQXv4QC0q

— Rekt Capital (@rektcapital) February 2, 2022

“The last time BTC successfully turned this level into support was in August 2021 [and] that retest preceded a move to $50,000,” he added.

The last time Bitcoin rebounded off lows of $30k was in July 2021, with an uptick to highs above $52k followed by a retest of $40k and another bounce all the way to its all-time high in November.

The post Rekt Capital: Bitcoin’s dip below mid-range support highlights $43-$48K as a key barrier appeared first on Coin Journal.