-

Der Wert von Ethereum ist in den letzten 24 Stunden um 5 % gestiegen.

-

Auch der Wert von Solana stieg innerhalb der letzten 24 Stunden um 8 %.

-

Avalanche verzeichnete mit einem Plus von 12 % die höchsten Zuwächse innerhalb der letzten 24 Stunden.

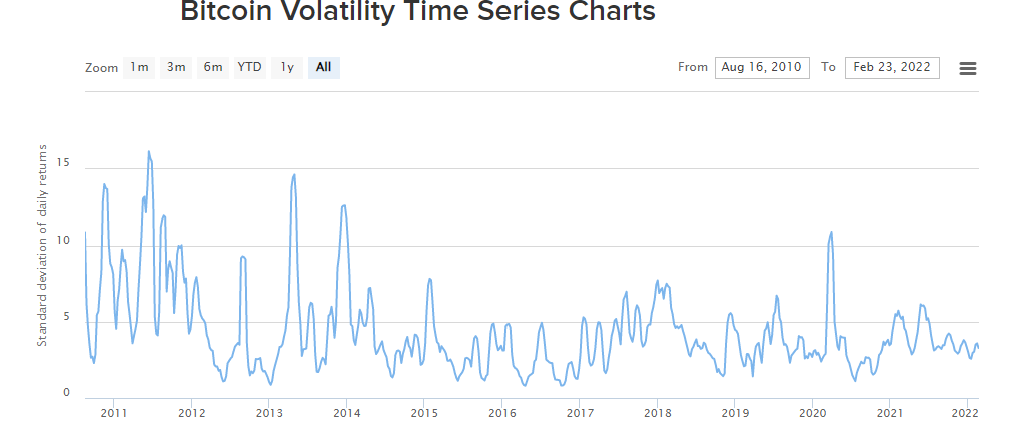

HODLen als Strategie ist bei Kryptowährungs-Enthusiasten beliebt geworden, da es einen langfristigen Ansatz in Bezug auf Kryptowährungs-Investitionen beschreibt.

Die Hauptstrategie, die hier umgesetzt wird, besteht darin, dass Anleger trotz der Kursrückgänge im Wesentlichen an ihren Kryptowährungsinvestitionen festhalten, mit dem letztendlichen Ziel, und hoffen, dass der Token wieder an Wert gewinnt.

Sollten Sie Ethereum (ETH) kaufen?

Am 23. Februar 2022 hatte Ethereum (ETH) einen Wert von 2.722,04 USD.

In Bezug auf den Allzeithochwert des Tokens hatte Ethereum (ETH) am 10. November 2021 einen Wert von 4.878,26 USD. Hier können wir sehen, dass der Token bei seinem ATH um 2.156,22 USD oder um 79 % höher war als heute.

Wenn wir uns die Performance des letzten Monats ansehen, hatte Ethereum (ETH) seinen höchsten Wert am 4. Januar, als es einen Wert von 3.874,34 USD erreichte.

Sein niedrigster Wert war am 24. Januar, als der Wert des Tokens auf 2.199,92 USD sank. Dies gibt uns einen Hinweis darauf, dass der Token in dieser Zeitspanne um 1.674,42 USD oder um 43 % an Wert verloren hat.

Vor diesem Hintergrund kann Ethereum (ETH) bis Ende März 2022 3.000 USD erreichen, was es zu einem soliden Token zum Kaufen und HODL macht.

Sollten Sie Solana (SOL) kaufen?

Am 23. Februar 2022 hatte Solana (SOL) einen Wert von 91,67 USD.

Beim Überschreiten des Allzeithochs des Tokens hatte Solana (SOL) am 6. November 2021 einen Wert von 259,96 USD. Dies bedeutet, dass der Token bei seinem ATH um 168,29 USD oder um 183 % höher war als heute.

Im Laufe des Vormonats hatte Solana (SOL) seinen höchsten Wert am 2. Januar, als es einen Wert von 178,74 USD erreichte.

Sein niedrigster Wert war am 24. Januar, als der Token einen Wertverlust von 82,71 USD verzeichnete. Dies bedeutete einen Wertverlust in dieser Zeitspanne von 96,03 USD oder 53 %.

Vor diesem Hintergrund ist SOL ein Token, das es wert ist, gekauft geHODLed zu werden, da er bis Ende März 2022 100 USD erreichen kann.

Sollten Sie Avalanche (AVAX) kaufen?

Am 23. Februar 2022 hatte Avalanche (AVAX) einen Wert von 81,35 USD.

In Bezug auf den Allzeithochwert des Tokens hatte Avalanche (AVAX) am 21. November 2021 einen Wert von 144,96 USD. Hier können wir sehen, dass der Token bei seinem ATH um 63,61 SD oder um 78 % höher war als heute.

In Bezug auf die Leistung im Januar hatte Avalanche (AVAX) seinen höchsten Wert am 2. Januar, als der Token einen Wert von 117,18 USD erreichte.

Der niedrigste Wert des Tokens war am 22. Januar, als er auf 55,84 USD fiel. Dies bedeutete einen Wertverlust von 61,34 USD oder 52 %.

Mit 81,35 USD ist AVAX ein solider Token zum Kaufen und HODLen, da er bis Ende März 2022 90 USD erreichen kann.

The post ETH, SOL und AVAX sind derzeit die besten Token zum HODLen appeared first on BitcoinMag.de.

Chart showing XTZ price in a rising parallel channel on the weekly timeframe. Source:

Chart showing XTZ price in a rising parallel channel on the weekly timeframe. Source: