- Dogecoin (DOGE) price is up 3% in 24 hours.

- Bitcoin has broken above $88k and could target 100k.

- Analysts see a bullish flip for crypto despite macroeconomic conditions.

Dogecoin price outlook is bullish as Bitcoin targets $100k, with key indicators and expert insights supporting this

While the cryptocurrency market remains largely negative, there’s a new buzz amid upward movement for Bitcoin (BTC).

Meanwhile, the lack of momentum for altcoins means most tokens still nurse huge losses since flipping negative amid a cool down in Trump-driven euphoria.

But despite the tariffs turbulence and broader risk asset market jitters, is Dogecoin price poised for a major spike?

Analysts say major altcoins, including Ethereum (ETH) and Solana (SOL), could post notable gains amid Bitcoin’s surge.

Dogecoin price gains in the past 24 hours

Dogecoin has surged 5.8% in the past 24 hours, trading at $0.82 as of 11:13 AM EAT.

The meme coin’s rally comes amid heightened volatility in the broader crypto market, with DOGE capitalizing on renewed retail interest and Bitcoin’s upward momentum. Trading volume has spiked 12% to $2.4 billion, reflecting strong buying pressure. DOGE has broken above a key recent price level. It’s likely a bullish signal that suggests potential for further upside if Bitcoin continues to surge.

However, there’s prevailing resistance levels that remain key hurdles for bulls in the near term.

Bitcoin eyes on $100k

Bitcoin is trading at $88,465, up 1.7% today. This 24-hour surge comes amid a 3.5% spike as the benchmark digital asset looks to break out.

The flagship cryptocurrency has been buoyed by expectations of increased liquidity from potential U.S. Treasury buybacks and a dovish Federal Reserve policy shift.

Analysts are closely monitoring BTC’s ability to break above $90k, which could pave the way for a test of the six-figure mark.

If there’s sustained move above $100,000 could trigger a broader altcoin rally, with meme coins like Dogecoin likely to benefit from speculative flows. Conversely, a rejection at this level might see BTC retest support near $80k.

What are analysts saying about BTC?

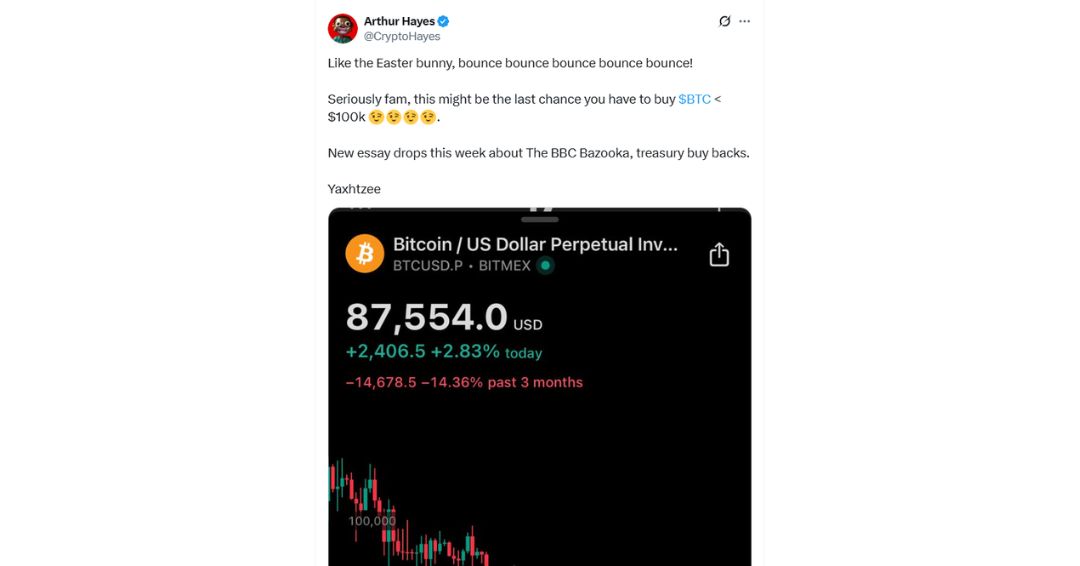

Arthur Hayes, co-founder of BitMEX, has been vocal about Bitcoin’s bullish outlook, predicting a potential surge to $250,000 by year-end if the Federal Reserve resumes quantitative easing (QE).

Hayes says US Treasury buybacks could inject significant liquidity into risk assets, with Bitcoin poised to benefit.

He stated, “This might be the last chance to buy Bitcoin below $100,000,” citing global liquidity trends as a key driver. QCP Capital, a leading crypto trading firm, shares a cautiously optimistic view.

The QCP analysis noted that Bitcoin’s momentum is supported by strong institutional demand and a favorable macroeconomic environment.

However, they warned that a failure to break $100,000 could lead to profit-taking, with $90,000 as a critical support level.

QCP’s analysis highlights the importance of sustained volume and bullish sentiment to maintain BTC’s upward trajectory.

Dogecoin price prediction

Dogecoin’s technical indicators suggest a mixed but cautiously bullish outlook.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) both suggest a potential bullish flip.

The latter has the MACD line moving above the signal line, reinforcing the potential for positive momentum.

Furthermore, the histogram is expanding, hinting at a possible surge amid Bitcoin breaking higher.

Analysts predict Dogecoin could target $0.3, the upper Bollinger Band, if meme coin flows resume.

Historically, DOGE has closely followed BTC’s price movements, and a BTC bull run could drive speculative interest in Dogecoin.

On the downside, failure to hold the $0.15 support level might see DOGE retreat to $0.10.

Macroeconomic factors, including U.S. policy shifts and global liquidity, will play a crucial role in shaping DOGE’s trajectory.

The post Dogecoin price outlook as Bitcoin approaches $100K appeared first on CoinJournal.