- Key resistance zone flagged between $86,549 and $88,244.

- MicroStrategy buys 6,556 BTC worth $555.8 million.

- $90,000 is seen as a psychological and technical barrier.

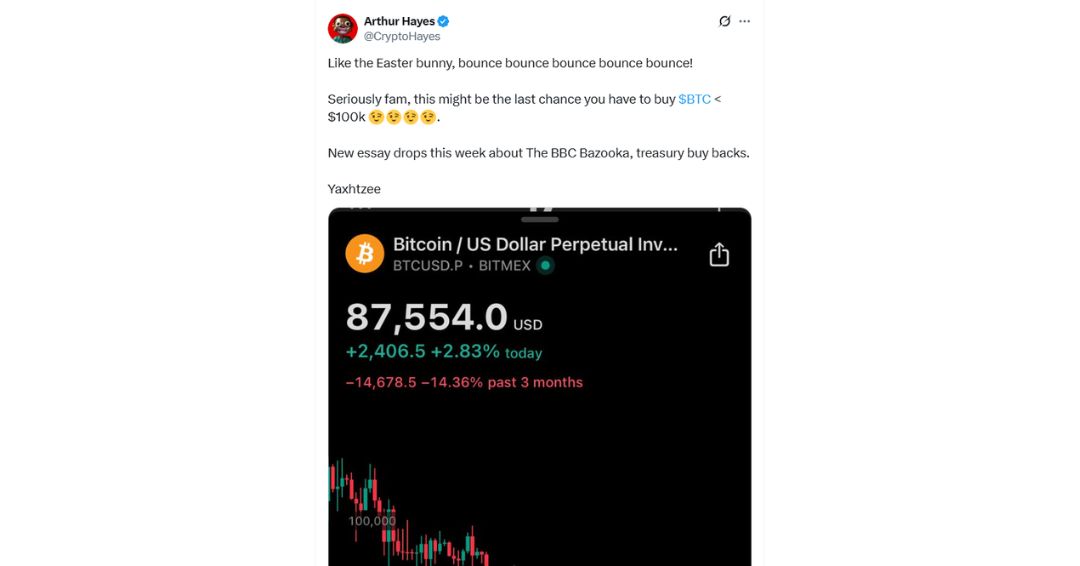

Bitcoin has surged back to near $89,000, inching closer to its all-time high and setting the stage for what could be a significant breakout.

According to crypto analyst Michael van de Poppe, the flagship cryptocurrency is now approaching a crucial resistance band between $86,549 and $88,244.

This level has historically been difficult to breach, often leading to temporary corrections.

However, the current market sentiment, combined with macroeconomic cues like a potential US-China deal, is fuelling speculation about a fresh rally past $90,000.

In a tweet posted earlier this month, van de Poppe shared a technical chart highlighting Bitcoin’s rebound and its current position near a historical resistance level.

He suggested that Bitcoin may first dip to retest support at $80,982 before making another attempt at a breakout.

A further decline to $76,604 is also possible if current support fails to hold, marking a retest of a previous support level that could now act as resistance.

Bitcoin gains 1.5% as whale accumulation boosts sentiment

Bitcoin’s rise above $88,500 has been aided by strong accumulation from institutional players.

Notably, US-based corporate holder MicroStrategy recently acquired 6,556 BTC at a total cost of around $555.8 million.

The purchase comes amid growing interest in Bitcoin as a hedge against inflation and geopolitical risks, and appears to have given the market a confidence boost.

According to CoinMarketCap, Bitcoin gained 1.5% in the past 24 hours, adding to its 4.7% weekly gain.

The surge has also lifted overall crypto market capitalisation past $2.7 trillion.

Source: CoinMarketCap

Van de Poppe noted that despite nearing overbought territory, the market may remain bullish if Bitcoin consolidates above $88,000.

A sustained rally past $90,000 could open up a move towards new highs, while failure to maintain support around $80,000 could send prices lower.

Analyst warns of pullback to $76,604 if support fails

Technical indicators show that Bitcoin’s RSI is approaching critical levels, suggesting a temporary correction could occur.

Still, many traders are watching the $90,000 resistance level as the next major milestone.

If Bitcoin manages to flip $90,000 into support, it could mark a psychological and technical breakthrough.

Historically, this kind of pattern has led to rapid price discovery.

However, if momentum fades, the cryptocurrency may struggle to hold onto gains and revisit lower support zones.

Van de Poppe outlined that a correction to $76,604 would still be within healthy limits and could act as a springboard for a future rally.

The price level was previously a key support and remains one to watch in the near term.

Macro trends could support the Bitcoin push

On the macroeconomic front, van de Poppe hinted at the potential impact of global events.

In particular, signs of de-escalation between the US and China could reduce market anxiety, prompting increased risk appetite among investors.

Geopolitical calm, combined with institutional accumulation and favourable regulatory signals, may set the stage for Bitcoin to finally break through its upper resistance.

However, short-term volatility should not be ruled out, especially as the asset hovers near historically reactive zones.

As of 14 April, Bitcoin is trading just above $88,606.

All eyes are now on whether the world’s largest cryptocurrency can consolidate its gains and surge through $90,000 in the coming sessions.

The post BTC nears resistance zone as analysts flag potential pullback to $76,600 appeared first on CoinJournal.