Axie Infinity (AXS), like most other metaverse and blockchain gaming tokens, has been falling sharply in the last few weeks or so. Nonetheless, we are starting to see some price consolidation. It seems the downtrend is stalling at least for now. But does this suggest a trend reversal is coming? We will analyze this below but first, some highlights:

-

Axie Infinity (AXS) is largely trading sideways at the moment, holding on to its strong support zone of $48.

-

At the time of writing, AXS was trading at $45, down around 5% in 24-hour intraday trading.

-

AXS has been in the bear market for most parts of January and price consolidation could be a sign a trend reversal is near.

Data Source: Tradingview.com

Data Source: Tradingview.com

Axie Infinity (AXS) – Price prediction and analysis

From our analysis, Axie Infinity (AXS) started its downward trend at the start of November 2021. There were a few rallies in between but the general trend has always been downwards.

The 2022 crypto crash did nothing to make the situation better. As most crypto assets fell, metaverse tokens like AXS were hit hard. But in recent days, the price action appears to have stalled.

AXS is finding strong support at $48, and if it can keep trading above this threshold in the coming days, then there could be a real trend reversal here. But if bulls are not able to hold the price at $48, then we are likely to see more weakness on AXS in the near term.

Why buying Axie Infinity (AXS) is still a good idea

Despite the bullish trend over the last few weeks, AXS still remains a very decent asset. Metaverse and blockchain tokens are expected to be big. While we expect more coins to come out, by virtue of being a pioneer, AXS stands a huge chance of delivering a lot of value for investors in the future.

The post Axie Infinity (AXS)’s downtrend is stalling – Is a trend reversal coming? appeared first on Coin Journal.

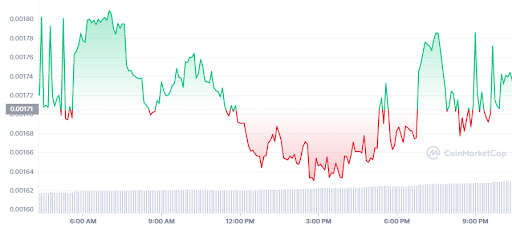

Data Source: Coinmarketcap.com

Data Source: Coinmarketcap.com

Data Source: Tradingview.com

Data Source: Tradingview.com

Data Source: Tradingview.com

Data Source: Tradingview.com

Data Source: Tradingview.com

Data Source: Tradingview.com